VAT201 Return

The VAT201 Return report is a comprehensive summary of your VAT returns. This report contains a list of VAT return files which are generated for a specific time period.

The VAT201 returns generated in Zoho Books follow the standards and specifications mentioned by the SARS (South Africa Revenue Service).

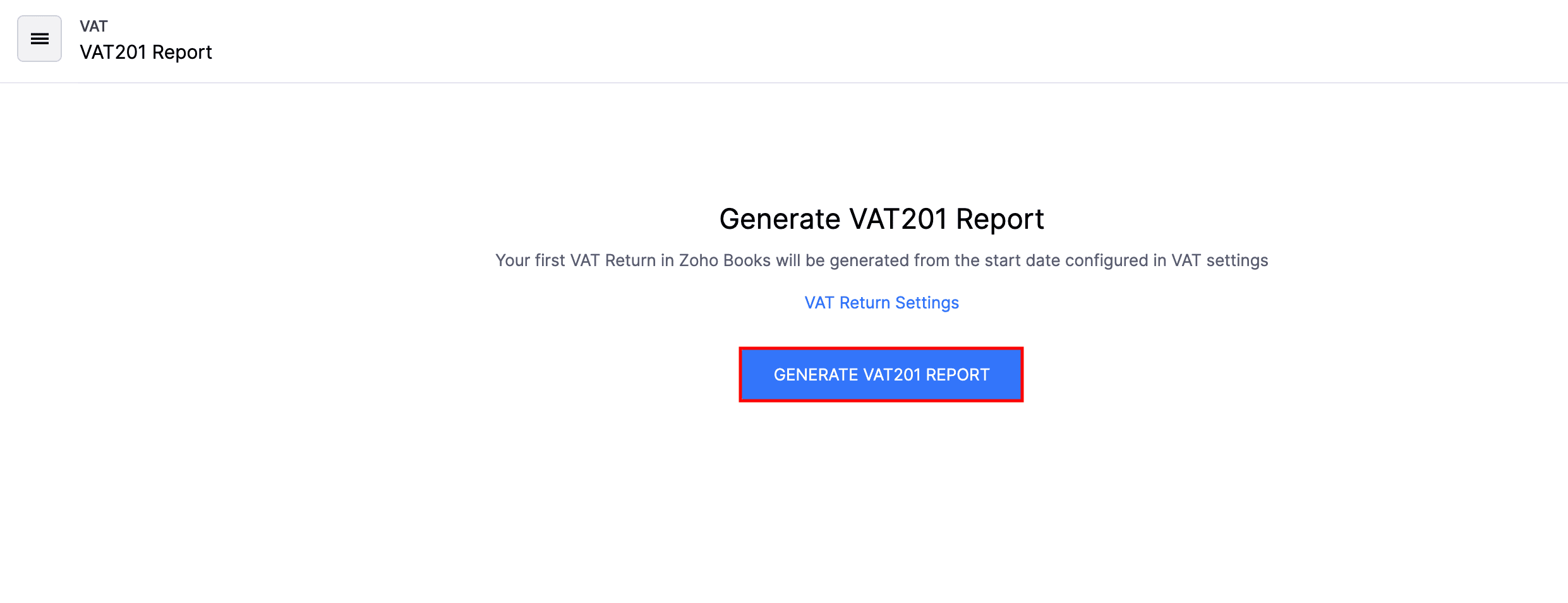

Generate VAT Return

-

Go to Reports on the left sidebar.

-

Navigate to VAT and click VAT201 Report.

-

Click Generate VAT201 report.

VAT201 Return will be generated.

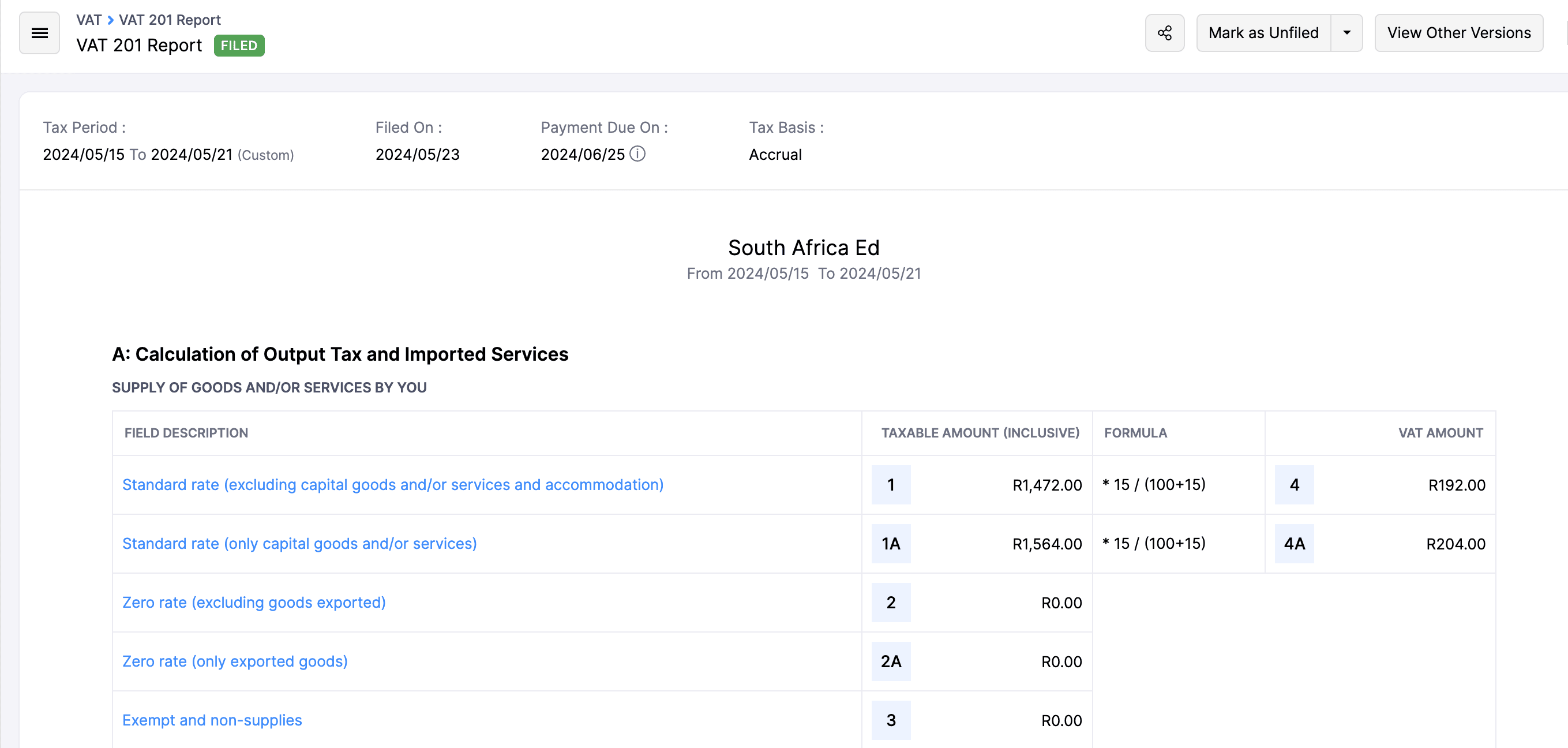

View VAT201 Return

To view the VAT201 return file:

- Go to Reports on the left sidebar.

- Navigate to VAT and click VAT201 Report.

- Click any report that you’ve generated to view the report.

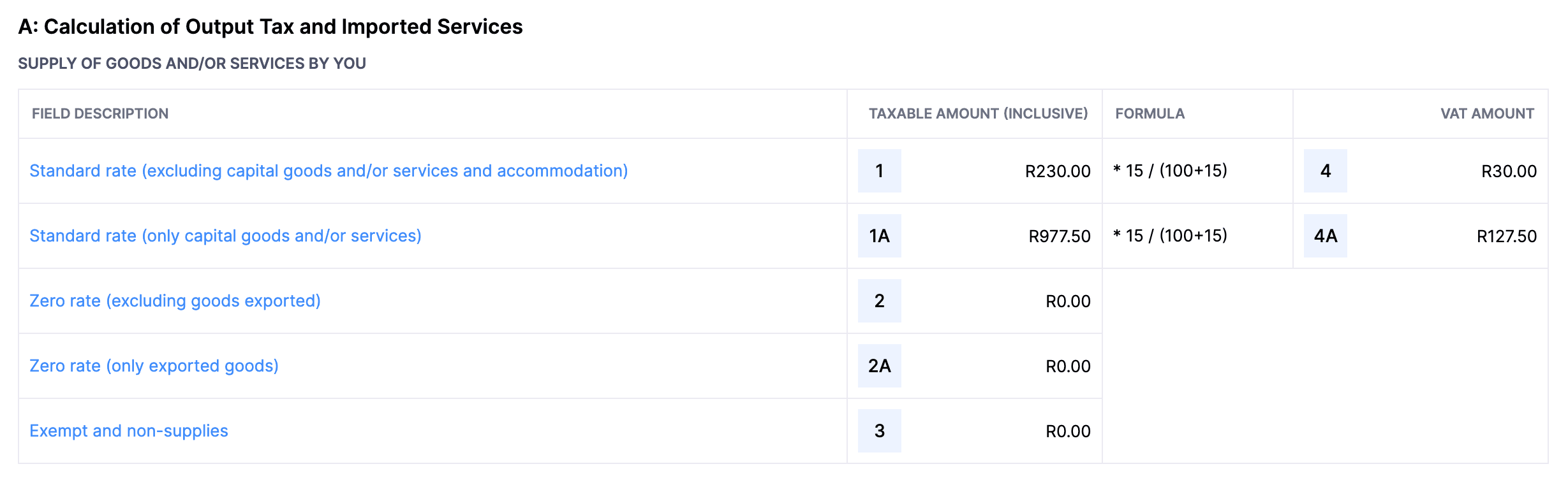

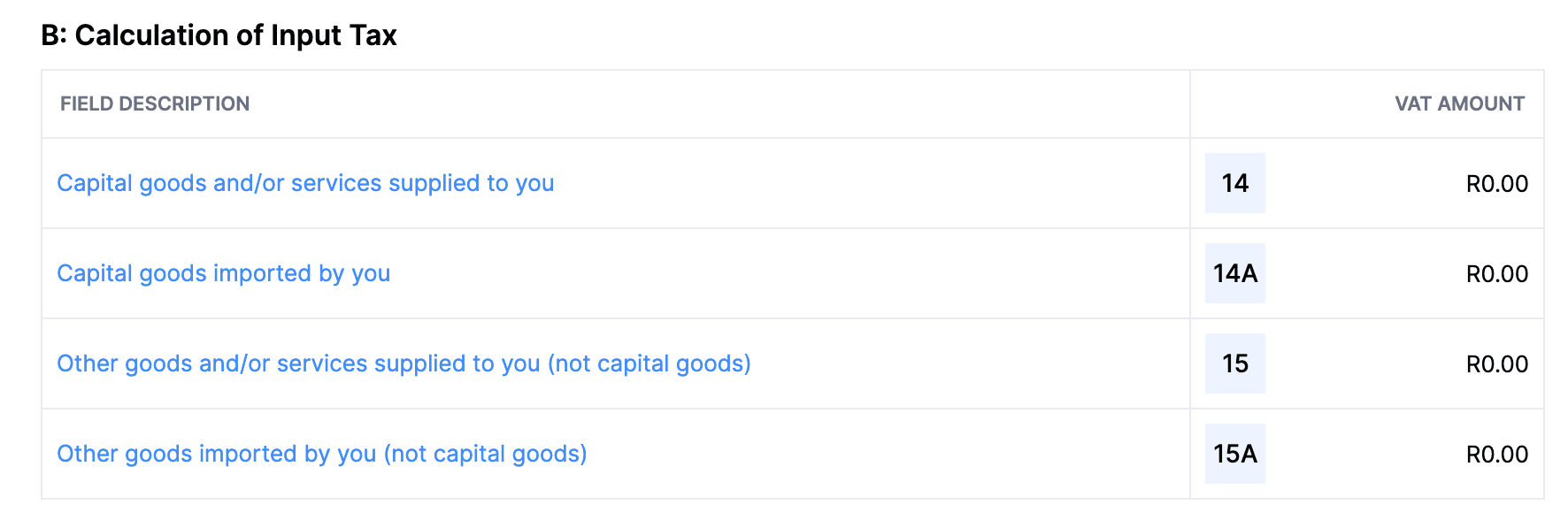

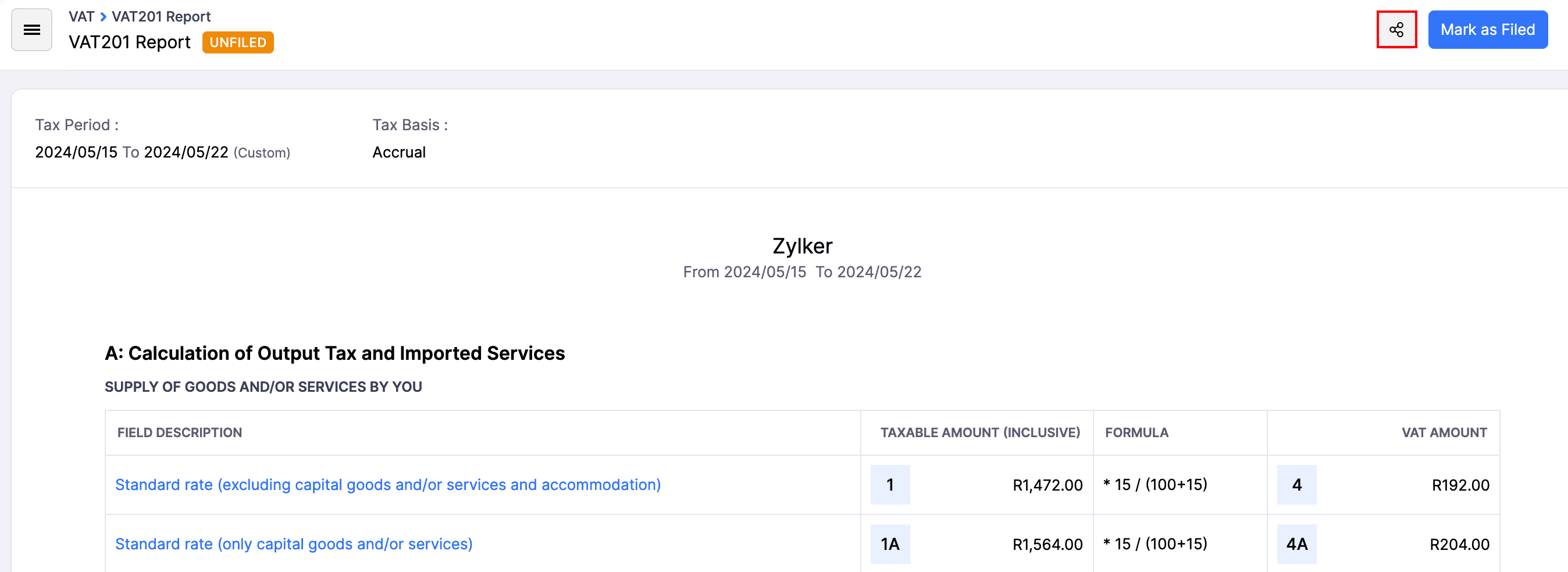

The VAT201 return file consists of the following sections:

Calculation of Output Tax and Imported Services

Calculation of Input Tax

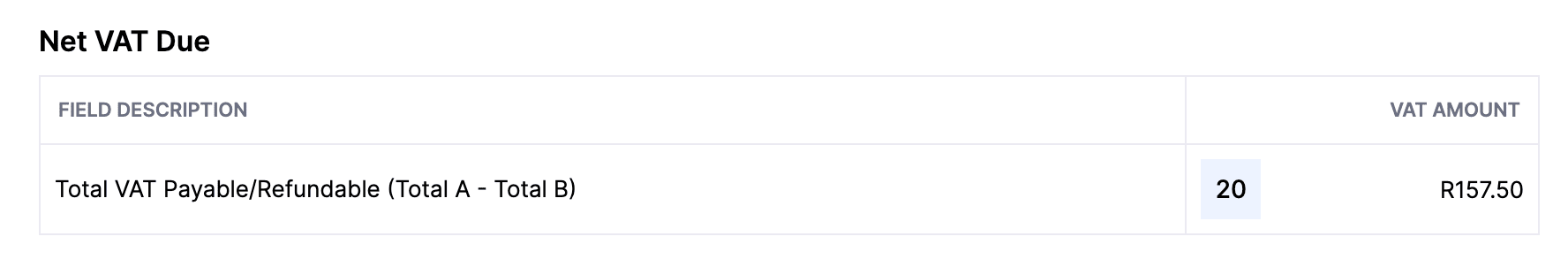

Net VAT Due

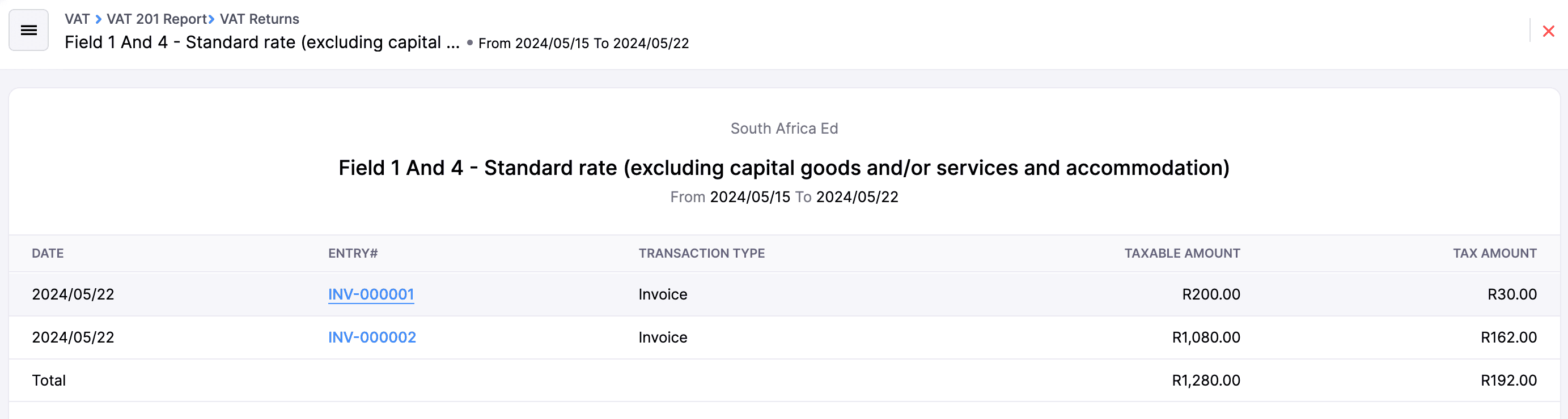

If you click the particular transaction, you will be redirected to the transaction page.

Share VAT201 Return Report

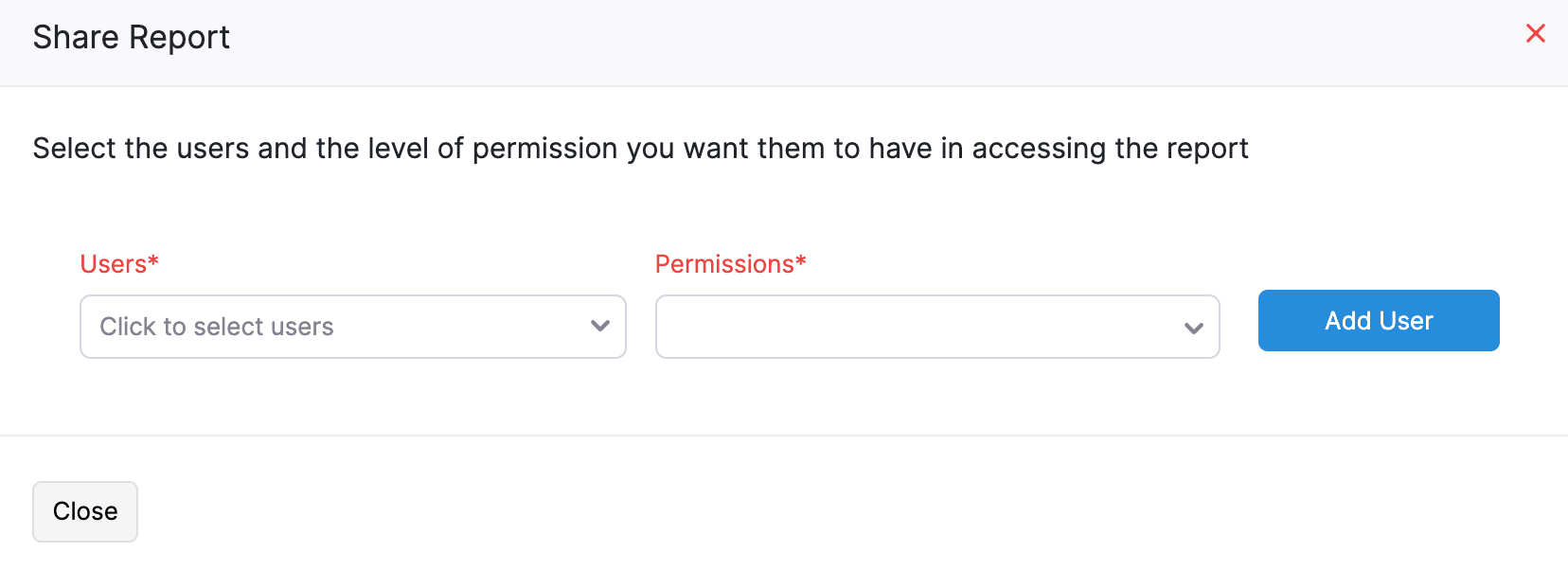

To share the VAT201 Return report with the other users in your organisation:

-

Click the Share icon at the top-right corner. The Share Report pop-up will appear.

-

Select the Users and the Permission from the dropdowns.

-

Click Add User.

Mark VAT201 Return as Filed

To file VAT201 return in Zoho Books:

- Go to Reports in the left side bar.

- Navigate to VAT and click VAT201 Report.

- Select a VAT201 return that you’ve generated.

- Click Mark as Filed in the top-right corner.

- Click OK in the following File VAT Return pop-up to confirm.

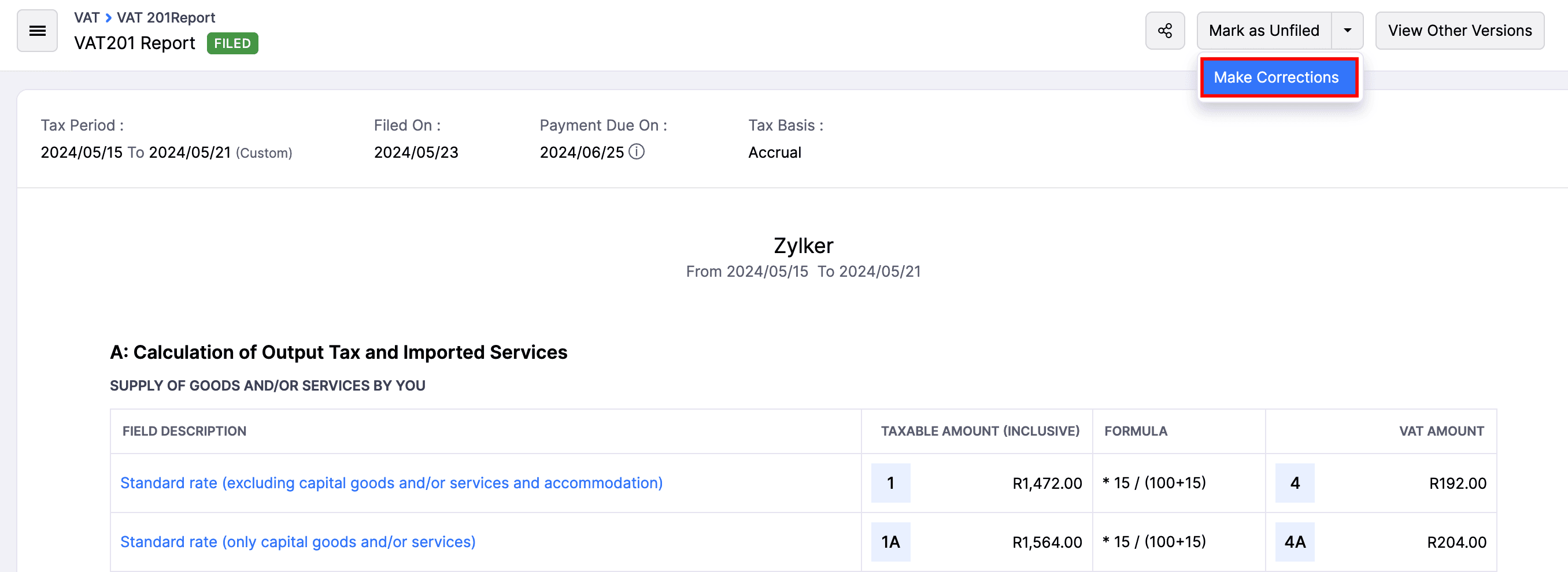

Make Corrections on VAT201 Return Report

If you’ve created any sales transactions after filing VAT, you can make corrections in the recent VAT return file to update the latest sales transactions.

To do so:

-

Go to Reports in the left side bar.

-

Navigate to VAT and click VAT201 Report.

-

Select the filed VAT201 return for which you like to make the corrections.

-

Click the drop-down next to Mark as Unfiled and select Make Corrections.

-

Click Make Corrections in the following pop-up to confirm. The VAT Return will automatically be unfiled, and you can update it with the latest sales transactions and file it again.

Mark VAT201 Return as Unfiled

If you want to update the filed VAT201 return file with the latest purchase and the sales transactions, you can unfile the VAT201 return file.

To do so:

- Go to Reports in the left side bar.

- Navigate to VAT and click VAT201 Report.

- Select a VAT201 return that you want to unfile.

- Click Mark as Unfiled in the top-right corner.

- Click OK in the following pop-up to confirm.

You can then file the VAT201 return again once you’ve updated the transactions.

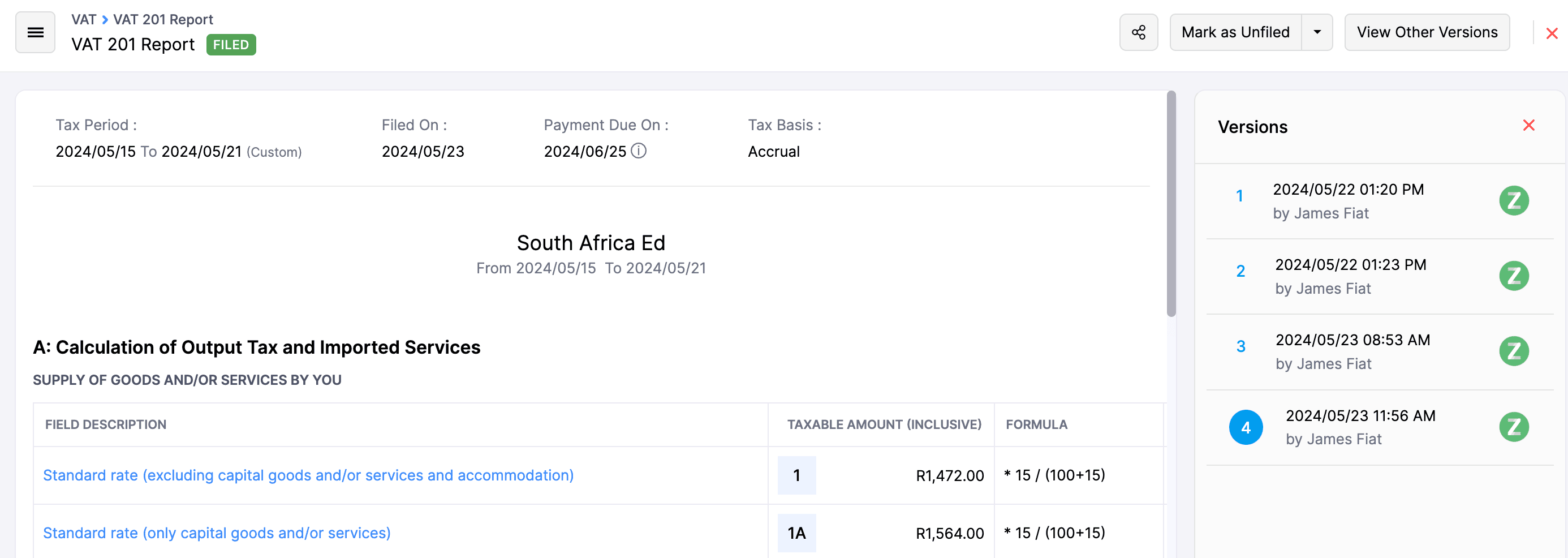

View Other Versions of VAT201 Return

You can view the other versions of VAT201 returns that you’ve filed. To do this,

-

Go to Reports in the left side bar.

-

Navigate to VAT and click VAT201 Report.

-

Select a VAT201 return.

-

Click View Other Versions in the top-right corner.

The other versions of the VAT201 return will be displayed on the right side bar.