- HOME

- Compliance

- Telangana professional tax: Tax slab, payment, registration, and more

Telangana professional tax: Tax slab, payment, registration, and more

Professional tax in Telangana is collected by the Commercial Taxes Department under the state government. It applies to individuals earning an income—whether employed in the government, private sector, or self-employed in any profession. Much like income tax collected by the central government, professional tax is mandatory.

This guide covers the rules, deduction cycle, applicability, registration, payment methods, slab rates, and exemptions for professional tax in Telangana.

Professional tax in Telangana

Under the Telangana Professional Tax Act, 1987, every earning individual, including salaried employees, self-employed persons, and professionals—is required to pay professional tax.

For salaried individuals, employers are responsible for deducting professional tax from salaries and depositing it with the state government. Self-employed individuals, on the other hand, must pay the tax directly, based on slab rates.

The professional tax amount ranges from ₹ 110 to ₹ 2,500 annually, depending on income levels.

Applicability of professional tax in Telangana

The following individuals and entities are liable to pay professional tax in Telangana:

- Employees: All salaried individuals working in the private sector, central or state government, local bodies, or government-controlled organizations operating within the state.

- Self-employed individuals: Professionals such as doctors, lawyers, chartered accountants, and other freelancers who are engaged in any profession, trade, or calling within Telangana and earn above the taxable threshold.

- Entities: Hindu Undivided Families (HUFs), associations, clubs, and firms carrying out business or professional activities within the state.

- Companies and co-operative societies: Registered companies and co-operative bodies involved in trade, business, or professional services.

- Employer: The employer or head of an establishment is responsible for deducting professional tax from employees' salaries as per applicable slabs and remitting it to the Telangana Commercial Taxes Department within the due date.

Professional tax registration process in Telangana

Employers in Telangana must register online using Form I on the official Telangana Commercial Taxes Department website. To complete the registration, ensure the following documents are ready:

- PAN card and Aadhaar card

- Articles and Memorandum of Association

- Address proof and ID with photo

- Photos and details of directors/partners

- Number of employees

- Bank details and cancelled cheque

- Rental agreement or ownership proof

- Board resolution for authorised signatory

Step-by-step professional tax registration process in Telangana

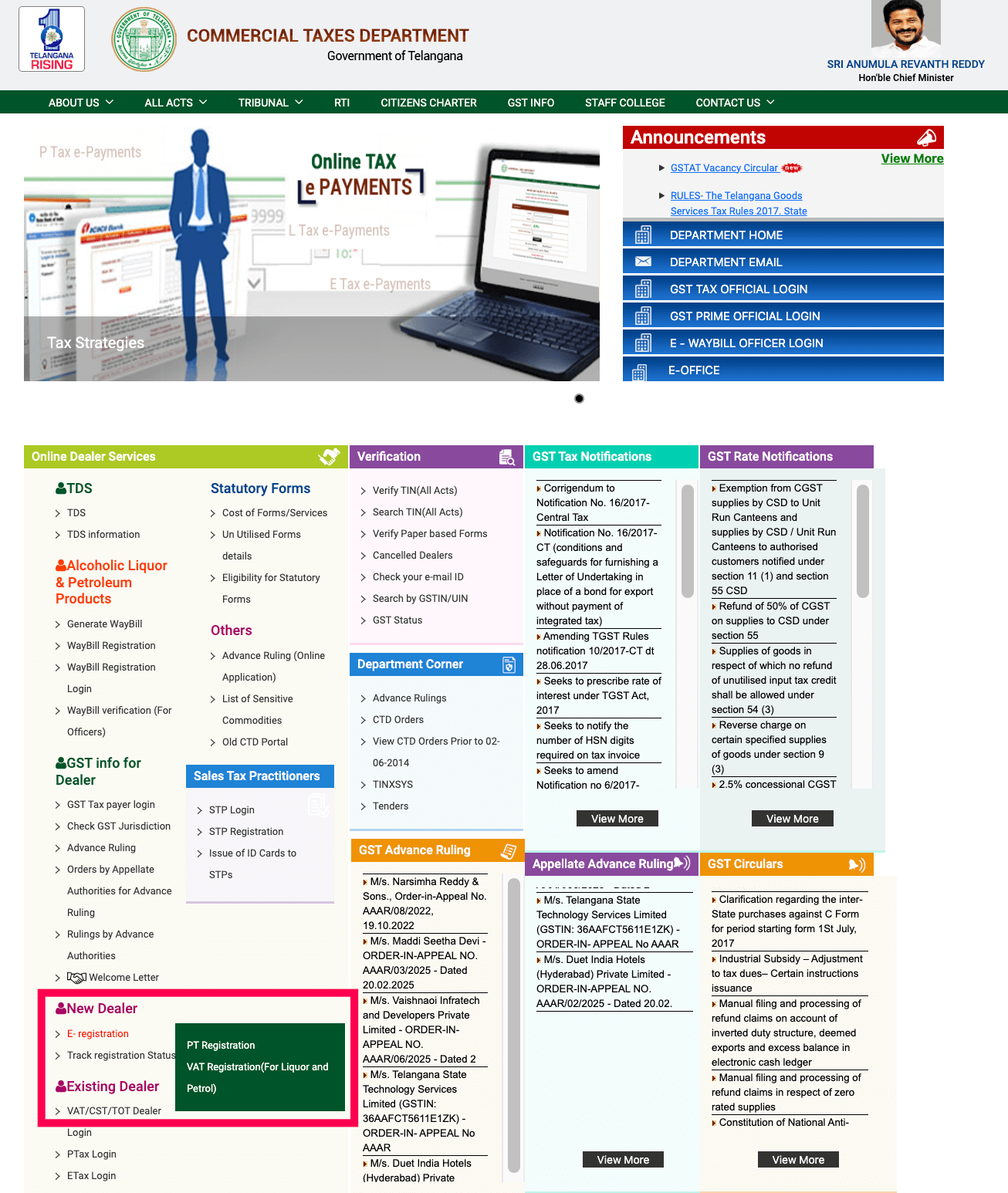

- Visit the official Telangana Commercial Tax portal.

- Scroll and go to the New Dealer section. Click on ‘E-Registration’ > ‘PT (Professional Tax) Registration’.

- Click on ‘New user sign up’ and enter your email ID and mobile number.

- Once done, log in with a valid email address and manually enter orgnisation details, such as:

- Business information

- Owner/managing partner details

- Authorised signatory details

- Tax Information Number (TIN)

- Additional locations/branches, if any

- Go through the form and click ‘Finish’ to complete the registration.

- A reference number will be generated for tracking. A tax assessing authority will review your application and generate the professional tax certificate for your business upon successful registration.

Telangana professional tax slab rates for salaried employees

Employers must calculate and deduct professional tax every month based on employee salary slabs:

| Monthly gross salary | Monthly tax amount |

| Up to ₹ 15,000 | Nil |

| From ₹ 15,000 to ₹ 20,000 | ₹ 150 |

| Above ₹ 20,000 | ₹ 200 |

Professional tax rates for all categories of profession in Telangana

Telangana has separate slab rates for different professional categories (like doctors, lawyers, chartered accountants, etc.). Here is a table outlining the tax rates for professionals:

| Category of profession | Tax rate per annum |

| Legal practitioners, chartered accountants, medical professionals, architects, brokers, auctioneers, engineers, plumbers, electricians, and tax consultants who have been in the service for: | |

| Up to 5 years | Nil |

| More than 5 years | ₹ 2,500 |

| Contractors and dealers whose annual gross turnover is: | |

| Below ₹ 10 lakhs | Nil |

| From ₹ 10 lakhs to ₹ 50 lakhs | ₹ 1,250 |

| Above ₹ 50 lakhs | ₹ 2,500 |

| Holders of transport vehicle permits under the Motor Vehicles Act: | |

| Less than 3 transport vehicles | Nil |

| 3 or more transport vehicles | ₹ 2,500 |

| Co-operative Societies registered under the Telangana Co-operative Societies Act: | |

| Village and mandal level societies | Nil |

| District-level societies | ₹ 1,250 |

| State-level societies | ₹ 2,500 |

| Members of Stock-Exchange recognised under the Security Contracts (Regulation) Act, 1956 | ₹ 2,500 |

| Directors of companies registered under the Companies Act, 1956 | ₹ 2,500 |

| Banking Companies as defined in the Banking Regulations Act, 1949 | ₹ 2,500 |

For detailed rates, refer to the official government document: https://www.tgct.gov.in/tgportal/AllActs/APPT/APPTSchedule.aspx

Telangana professional tax payment steps

- Visit the Telangana Commercial Tax payment portal.

- Choose the type of tax.

- Enter your TIN/GRN, firm name, purpose, and payment type:

- Monthly for employees

- Annually for employers

- Provide the period, amount, and date of payment.

- Click ‘Submit’ and confirm details.

- Choose ‘Make payment’ and complete the transaction using your preferred bank.

- Save the payment receipt for future references.

Telangana professional tax due date

In Telangana, professional tax must be paid by the 10th of each month, if applicable. Failure to meet this deadline may result in a penalty imposed by the state government.

If you hold an enrolment certificate, the tax must be paid before 30th June, provided you were enrolled before the start of the financial year. For those enrolled after 31st May, the payment is due within one month from the date of enrolment.

Professional tax late payment penalty in Telangana

In Telangana, if an individual fails to pay the tax within the time mentioned in the notice of demand, without a valid reason, the assessing authority can impose a penalty. This penalty will range from a minimum of 25% to a maximum of 50% of the unpaid tax amount. Before imposing the penalty, the authority will provide the person with a chance to explain their case.

Additionally, if an enrolled person does not pay the tax as required under this Act, they will have to pay interest. The interest is calculated at ₹1.25 per month on the outstanding tax amount.

Professional tax exemption in Telangana

Certain individuals and groups are exempt from paying professional tax in the state. These exemptions include:

- Individuals with disabilities: Persons with physical or mental disabilities are exempt from professional tax.

- Senior citizens: Individuals aged 65 years and above are not required to pay professional tax.

- Parents of mentally or physically challenged children: Parents or guardians of children with mental or physical disabilities are exempt.

- Badli workers in the textile industry: Temporary workers in the textile sector, known as Badli workers, are exempt from this tax.

- Women working under specific government schemes: Women employed as agents under the Mahila Pradhan Kshetriya Bachat Yojna or those associated with the Directorate of Small Savings are exempt.

- Military personnel: Individuals serving in the Army, Navy, or Air Force are not liable to pay professional tax.

Compliance forms for Telangana professional tax

| Form | Description |

| Form I | Application for registration |

| Form II | Application for certificate of enrolment/ |

| Form III | Certificate to be furnished by a person to his employer |

| Form IV | Certificate to be furnished by a person who is simultaneously engaged in employment of more than one employer |

| Form V | Returns of tax payable by employer |

| Form VI | Paying in slip for making payment to the collecting agents |

| Form VII | Receipt for the amount of tax, interest, and penalty |

| Form XII | Appeal/revision application against an order of assessment appeal/ penalty/ interest |

| Form XV | Claim for refund |

Frequently asked questions

How to pay professional tax online in Telangana?

You can pay professional tax in Telangana either online or offline. For online payments, go to the official website of the Telangana Commercial Taxes Department, click on E-payment (all Acts)’, enter your TIN/GRN, and follow the steps to complete the payment. Alternatively, visit your nearest district sales tax office to make the payment offline.

What is the professional tax rate in Telangana?

The amount of professional tax in Telangana varies based on your income. If your monthly income is:

- Up to ₹15,000 - No tax

- ₹15,001 to ₹20,000 - ₹150 per month

- Above ₹20,000 - ₹200 per month

Reference