- HOME

- Compliance

- Madhya Pradesh professional tax: Rules, slab, and payment methods

Madhya Pradesh professional tax: Rules, slab, and payment methods

State governments in India levy a professional tax on people who earn a regular income from different professions, trades, or jobs. The purpose of this tax is to generate revenue for the state and fund the development of its infrastructure. In Madhya Pradesh, the collection of tax from professionals is regulated by the Madhya Pradesh Professional Tax Act, 1995, also called the Madhya Pradesh Vritti Kar Adhiniyam, 1995.

This article will provide detailed information on the applicability, regulations, deduction cycle, and payment options for professional tax in Madhya Pradesh.

Professional tax rules in Madhya Pradesh

The Madhya Pradesh Professional Tax Act was established in 1995, introducing professional tax in the state. In 2010, the act underwent amendments, making it mandatory for salaried individuals, working professionals, and businesses in Madhya Pradesh to pay professional tax if their income exceeds the threshold limit set by the state government. The tax amount is determined by the individual's income, with a maximum annual limit of ₹2,500.

Employers in Madhya Pradesh must register their organization under the act and calculate their employees' tax due based on the applicable rates. They should deduct the appropriate amount from their employees' salaries and remit it to the state's Department of Commercial Tax.

Self-employed individuals are personally responsible for registering under the act, accurately determining their tax obligations, and making timely payments to the government.

Applicability of professional tax in Madhya Pradesh

The following individuals and entities are liable to pay professional tax in Madhya Pradesh.

- Employees: All salaried individuals, including those working in the private sector, or employed by the central government, state government, or by the railways department.

- Entities: Hindu Undivided Families, firms, companies, or other corporate bodies engaged in any type of profession or trade within the state.

- Self-employed individuals: Freelancers and other individuals involved in any type of profession, trade, orcalling, excluding those who earn income on a casual basis.

- Employers: Business owners, head of the office or establishment, or the manager who is responsible for the disbursement of salaries to the employees in an organization. They must deduct the correct tax amounts from their employees' salaries and submit them on their behalf

Individuals exempt from professional tax

The following individuals are not required to pay professional tax in Madhya Pradesh.

- Members of the armed forces—Army, Navy, and Air Force

- Individuals aged 65 years and above

- Individuals with permanent disabilities

- Parents or guardians of children with disabilities

Registering businesses for professional tax in Madhya Pradesh

Employers in Madhya Pradesh, as well as self-employed individuals, must acquire a registration certificate from the Department of Commercial Tax. The registration process can be done online or offline and requires submission of specific documents.

Documents required for registering

Business owners who are registered with the Madhya Pradesh VAT Act, 2002 only need their VAT registration certificate. However, for those without VAT registration, the following documents must be provided at the time of registration:

- Identity proof, such as Aadhar card, or PAN card.

- Address proof, such as property tax receipt, or rental agreement.

- Lease deed for the rented business premises.

- Partnership deed, or memorandum of association, if applicable.

- Registration certificate of the establishment with the Director of Company Affairs, or under the Co-operative Society Act.

Professional tax offline registration process

- Download Form 1, Application for Registration for Employers, and Form 2, Certificate of Registration for Employers, and fill in all the necessary fields.

- Submit both forms to the assessing authority in person at the Department of Commercial Tax.

After reviewing the application, the assessing authority will send the registration certificate and your login credentials to your email address.

Professional tax online registration process

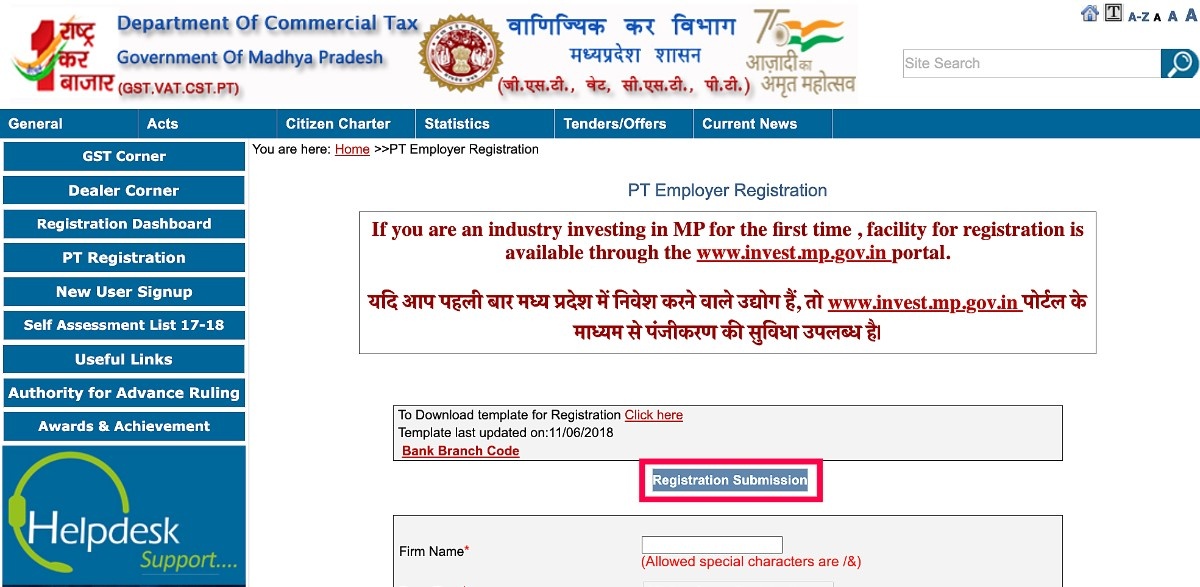

- Visit the official website for the state's Department of Commercial Tax.

- Navigate to the PT Registration section on the homepage and select PT Employer Registration from the dropdown.

- On the subsequent PT Employer Registration page, download the Professional Tax Registration Template.

- Open the downloaded form on your device and fill in the form with the necessary details.

- Once done, go to the official website, select PT Employer Registration from the PT Registration section, and hit the Registration Submission button on the new page.

- Upload the completed PT Registration form on the page and update your business details.

- Double check all the provided information and click Upload.

- The system will generate an acknowledgment letter and send an SMS to your mobile number.

- You can track the progress of your application on the portal using the provided acknowledgment number.

Once your professional tax registration is approved by the assessing authority, you will receive an SMS notification along with your registration number and login credentials.

Source: https://mptax.mp.gov.in/mpvatweb/download/home/MPCTD_Registration_Checklist&_Rates.pdf

Madhya Pradesh professional tax slab rates

For salaried individuals

| Monthly gross salary | Monthly tax amount |

| Up to ₹ 18,750 | Nil |

| From ₹ 18,751 to ₹ 25,000 | ₹ 125 |

| From ₹ 25,001 to ₹ 33,333 | ₹ 166 and ₹ 174* |

| Above ₹ 33,334 | ₹ 208 and ₹ 212** |

*For employees with a monthly income between ₹ 25,001 and ₹ 33,333, a tax of ₹ 166 should be deducted for the first 11 months, and ₹ 174 should be deducted in the final month.

**For employees earning more than ₹ 33,334 per month, a tax of ₹ 208 should be deducted for the first 11 months, and ₹ 212 for the last month.

For self-employed individuals and businesses

| Tax assess category | Yearly tax amount |

| Individuals or businesses registered under the Madhya Pradesh VAT Act, 2002, or the Madhya Pradesh Goods and Services Act, 2017, whose annual turnover: | |

| Nil |

| ₹ 2,500 |

| Individuals or businesses engaged in the sale or supply of goods and services, but not registered under the Madhya Pradesh VAT, or the GST Act, whose annual turnover: | |

| Nil |

| ₹ 2,500 |

Source: https://mptax.mp.gov.in/mpvatweb/download/act/pdf/PT-Amendment-Act-2018.pdf

Madhya Pradesh professional tax payment process

After calculating the professional tax amount for you and your employees, make sure to deduct that exact sum and submit it promptly to the government. Professional tax in Madhya Pradesh can be paid online through the Department of Commercial Tax's website.

- Go to the official website and navigate to the Tax Payment button on the homepage.

- Select Registered Dealers from the Tax Payment dropdown.

- Log in to your account using your email address and password. You will be taken to the Tax Payment page.

- Under the Tax Type option, select Professional Tax and select the appropriate period for which you are paying the tax.

- Verify your employee details and the total tax amount due.

- Choose your preferred payment method and enter your bank details in their respective fields.

- Click Confirm to initiate the payment process.

- On the payment gateway page, enter the OTP sent to your mobile number, and complete the payment process.

- Upon successful payment, a confirmation receipt will be auto-generated. Save the receipt for any future reference.

Last date to pay professional tax in Madhya Pradesh

Employers are required to deduct professional tax from their employees' salaries monthly and submit it within 10 days after the end of the respective month.

| Professional tax deduction cycle for employees | |

| Professional tax deducted month | Last date to pay professional tax |

| January | 10th of February |

| February | 10th of March |

| March | 10th of April |

| April | 10th of May |

| May | 10th of June |

| June | 10th of July |

| July | 10th of August |

| August | 10th of September |

| September | 10th of October |

| October | 10th of November |

| November | 10th of December |

| December | 10th of January of the following year |

For self-employed individuals and businesses, the deduction cycle depends on the date of their registration under the act.

| Professional tax deduction cycle for businesses and self-employed individuals | |

| Date of registration | Last date to pay professional tax |

| Before the start of a financial year or on or before the 31st of August | Before the 30th of September |

| After the 31st of August of a financial year | Within 30 days from the date of registration |

Late payment penalty

If a registered person fails to make the tax payment before the due date, the Professional Tax Assessing Authority can impose a penalty. The penalty will be 2% per month of the unpaid tax amount, up to a maximum of two-thirds of the total tax due.

Compliance forms for professional tax in Madhya Pradesh

| Form | Description |

| Form 1 | Application for registration for employers |

| Form 2 | Certificate of registration for employers |

| Form 3 | Application for certificate of registration for self-employed persons |

| Form 4 | Certificate of registration for self-employed persons |

| Form 5 | Certificate to be furnished by person to his employer |

| Form 6 | Certificate to be furnished by a person who is simultaneously engaged in employment of more than one employer |

| Form 7 | Return for employer |

| Form 9 | Return for self-employed persons |

| Form 10 | Payment challan |

References