- HOME

- Expense Management

- How to create an effective travel and expense policy [Free downloadable template]

How to create an effective travel and expense policy [Free downloadable template]

Introduction

Every organization with traveling employees has faced the complexity, confusion, and challenge that comes with managing multiple employees traveling for work and expecting reimbursements. Companies streamline this process with the help of a workflow supported by a detailed guideline document called a Travel and Expense Policy.

A formal policy helps employers control spend while helping employees make frugal decisions for business expenses that ensure budgetary compliance. The guidelines also help ease the reimbursement process for employees and ensure reimbursement accuracy.

This guide will take you through what a travel and expense policy is. It also has an editable free travel and expense policy template that you can download, customize, and use per your organization's rules and guidelines.

What is a travel and expense policy?

A travel and expense policy is a detailed guideline document that covers the dos and don'ts related to business travel bookings and employee expenses for the company.

Let's take an example of a company where the sales team travels to meet with clients, showcase the product, and close deals. If every employee books their own travel and accommodation as per their preference, it becomes difficult for businesses to keep track of the expenses and control them. A travel and expense policy allows employees to check for restrictions and allowances for their travel booking and make choices that abide by the company's budgetary requirements for smoother reimbursement processing.

It balances the need to control company costs with providing employees with clear instructions and support for their travel-related activities, thereby streamlining expense management and fostering trust within the organization.

Why does your business need a travel and expense policy?

This balance between employee satisfaction and cost control is not an easy task. In an ideal world, employees would be able to book business class tickets of their preferred flights, stay at a luxury accommodation, and travel with a limo and a driver to client visits—all within their company's expense budget. But sadly, we do not live in this imaginary world. Lack of a travel and expense policy allows too many variables to affect these decisions made by multiple employees—from overspending to unreliable vendor bookings. A detailed guideline, on the other hand, allows for faster bookings, smoother reimbursements, cost control, and regulatory compliance.

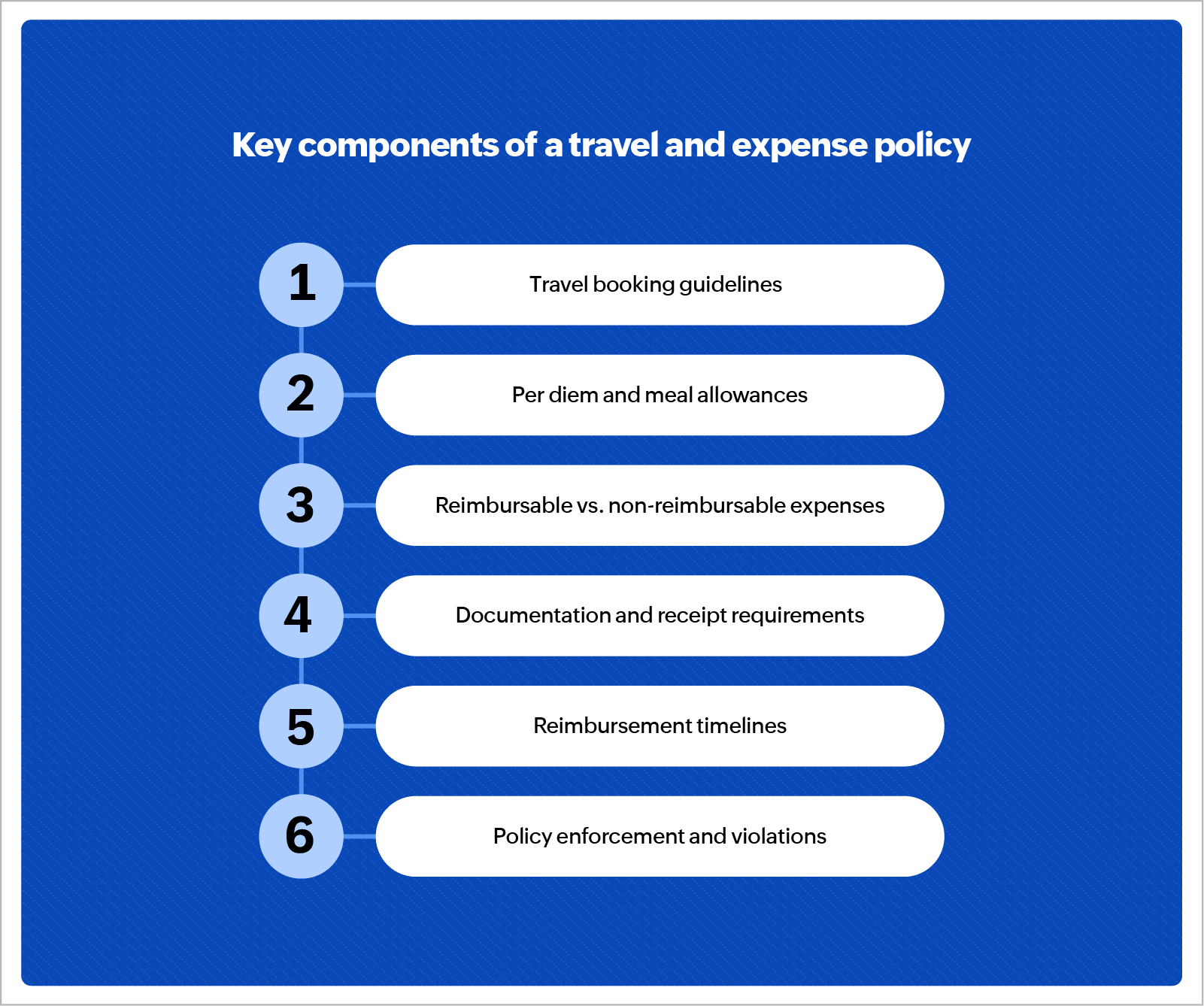

Key components of a travel and expense policy

Travel and expense policies are built by organizations based on travel booking patterns, employee requirements, and company affordability. An organization such as a regional retail chain would have supervisors driving to different locations frequently, only requiring mileage reimbursement guidelines and rules. On the other hand, national manufacturing companies often find their employees traveling domestically across the country to build customer relations and improve sales.

For global organizations, this requirement is at an international level. Every business must, thus, build a policy that addresses their specific use cases and requirements.

Here are a few key components that most businesses can build into their policy.

Travel booking guidelines

These comprehensive guidelines can cover every section of the travel itinerary, like the preferred vendors, the amount limits, booking preferences, exceptions, and more. While some companies allow employees to upgrade airline seats, others might choose to subscribe for added fringe benefits. This section covers all available booking options related to:

- Airline bookings

- Hotel

- Transportation

Per diem and meal allowances

Per diem and meal allowances across the globe are often regulated by the government. Depending on the rates and allowances that must be paid to traveling employees as per these regulations, this section of the policy highlights the amount that employees can expect based on their travel duration, reasons, and destinations. This allows employees to plan their travel meals, set their expectations, and request reimbursements correctly.

Reimbursable vs. non-reimbursable expenses

The policy must clearly state reimbursable and non-reimbursable expenses. In cases where expenses include part reimbursable and part non-reimbursable amounts, the calculation approach must be mentioned within the policy guidelines. It becomes easier if businesses list expense categories, define what is included in them, and mention whether each is reimbursable or not.

For personal expenses, since organizations do not reimburse for the same, the category must be specifically mentioned and its applicable rules highlighted.

Documentation and receipt requirements

Whether it's regulatory requirements or company policies, employees are required to collect and maintain certain documents, such as receipts, card statements, and more, that help businesses conduct a fair audit for every employee expense incurred. The policy must list the documents, their format (whether digital or physical), how to save the same, and the duration for which each should be maintained.

Reimbursement timelines

Another important point to note that employees must be aware of and the employer must adhere to are the reimbursement timelines. For employees spending on behalf of the company, the expense is over and above their personal expenses. These are expenses that businesses must undertake, but in order to promote and facilitate freedom and flexibility, the spend is incurred by the employee. From the time the expense is incurred to the time the reimbursement is credited to the employee, the company owes the employee the amount. Thus, a shorter reimbursement time is favorable to both the company and the employee.

Communicating these timelines helps employees plan around their expenses and also reduce follow ups and reminders to administrators, easing the reimbursement process for them all.

Policy enforcement and violations

Clear enforcement protocols are essential to ensure consistent compliance with the travel and expense policy. This section outlines the consequences of non-compliance and the steps to be taken if the rules are violated. It details what constitutes a policy violation—such as submitting false receipts, exceeding spending limits, or booking outside approved channels—and defines the disciplinary actions that may follow, ranging from reimbursement denial to formal HR involvement.

Transparent enforcement builds accountability and fairness while reinforcing the importance of policy adherence. It also ensures that all employees, regardless of role or seniority, are held to the same standards.

Best practices for implementing your policy

Involve key stakeholders

Successful implementation of a travel and expense policy requires input and alignment from all relevant stakeholders. This includes finance, HR, travel managers, department heads, and frequent travelers. Involving them early in the process helps ensure the policy is practical, comprehensive, and aligned with company goals. Their feedback can identify potential roadblocks, streamline workflows, and improve adoption rates across teams. Collaboration also fosters a sense of ownership, increasing the likelihood of long-term compliance and support.

Keep it simple, concise, and exhaustive

A well-crafted travel and expense policy should be easy to understand, quick to navigate, and thorough enough to cover all use cases. Avoid jargon and lengthy explanations—clarity and simplicity help employees comprehend better without confusion. At the same time, ensure the policy is comprehensive, addressing key areas such as booking procedures, reimbursement timelines, allowable expenses, and escalation processes. A policy that strikes this balance reduces misinterpretations, minimizes violations, and improves overall compliance.

Communicate clearly to employees

Even the most well-written policy is ineffective if employees aren’t aware of it or can’t easily access it. Clearly communicate the policy through multiple channels—email announcements, onboarding sessions, shared folders, expense software, and company-wide meetings. Make it available in easily accessible formats, such as PDFs or intranet pages, and ensure it’s mobile-friendly for employees on the go. Regular reminders and updates help reinforce the policy and keep everyone informed about any changes.

Use automation tools or expense management software

Workflow automation tools and expense management software are invaluable when it comes to effective creation and implementation of a travel and expense policy. Software applications, like Zoho Expense, are equipped with features that allow businesses to configure all their company policy rules to control expenses at the time of report submission. This reduces the time of approvals and reimbursements. Continuous audits help maintain compliance and remove potential fraud and inefficiencies from the process. Absolute compliance, accuracy, and control help achieve cost control and savings goals while aligning to business needs.

Review and update periodically

A travel and expense policy should evolve with the changing needs of your business, industry standards, and employee behavior. Regular reviews—annually or bi-annually—help identify outdated procedures, emerging compliance requirements, and areas of confusion or misuse. Involving key stakeholders during the review process ensures the policy remains relevant and practical. Timely updates not only improve policy effectiveness but also demonstrate the organization’s commitment to fairness and adaptability.

Travel and expense policy template [Free download]

Download the editable free template to build a comprehensive travel and expense policy for your organization. The template covers all necessary components, details for each of the components, and placeholders that can be simply swapped as per your business requirements to build a strong and effective business travel and expense policy that is ready to be implemented.

For businesses that rely on automation software such as Zoho Expense, the detailed policy can be configured as well as uploaded as a document for employees to refer to for future use.

Some common mistakes to avoid

Many organizations tend to make some common mistakes when setting up their business travel and employee expense policies. Here are a few that you can avoid while building your own.

Very vague or highly detailed rules and guidelines

Striking the right balance in policy language is crucial. Rules that are too vague create confusion and leave room for inconsistent interpretations, while overly detailed policies can restrict the policies from supporting exceptional situations leading to non-compliance. Avoid ambiguity, but also resist the urge to micromanage every possible scenario. Aim for clear, practical guidelines that cover common situations while allowing flexibility for exceptions when necessary. A well-balanced policy fosters understanding, accountability, and ease of adherence.

Lack of employee feedback consideration

Overlooking employee feedback during the creation or revision of a travel and expense policy can lead to impractical rules and low adoption. Employees are the end users of the policy, and their first-hand experiences can highlight gaps, inefficiencies, or pain points that might otherwise go unnoticed. Failing to involve them may result in resistance, frequent policy violations, or workarounds. Regularly soliciting and incorporating employee input ensures the policy remains user-friendly, relevant, and widely accepted. Most travel and expense software possess the capability to collect employee feedback after every trip or report processed and build reports that can give clear insights. Check out Zoho Expense's feedback and reporting capabilities to understand this better.

Lack of regular updates

A travel and expense policy that isn’t reviewed and updated regularly can quickly become outdated and ineffective. Changes in business operations, tax laws, per diem regulations, travel costs, or technology can render existing guidelines obsolete or non-compliant. Failing to update the policy can also lead to missed cost-saving opportunities. Regular reviews ensure the policy stays aligned with current needs, industry standards, and employee expectations.

Manual tracking and enforcement

Relying on manual processes to track expenses and enforce policy compliance is time-consuming, error-prone, and inefficient. It increases the risk of missed violations, delayed reimbursements, and inconsistent enforcement across departments. As businesses scale, these issues only compound. Automating expense tracking and policy enforcement through a travel and expense management tool such as Zoho Expense not only improves accuracy and visibility but also saves valuable time for both employees and finance teams.

Zoho Expense allows businesses to not only automate the entire process, ensuring higher accuracy, it also helps administrators manage complex workflows, advances, corporate card expenses, travel desk administration, and much more. Click here for a 14-day free trial.

Conclusion

A detailed travel and expense policy helps organizations across all industries and sizes streamline their business travel management processes and simplify expense reporting and reimbursement processes. The travel and expense policy template acts as your go-to document for every complication, confusion, and escalation of any sort. It helps businesses stay compliant and maintain budgets. It's time for you to build a comprehensive travel and expense policy for your business. Download the free editable travel and expense policy template today to get started.

FAQs

What should be included in a travel and expense policy?

The company's guidelines, rules, limits, processes, workflows, and requirements must be captured in the travel and expense policy document.

How do I create a travel and expense policy?

Map the existing process for raising travel requests, submitting expense reports, and processing reimbursements to understand the business' inherent policy. Build rules, limits, approval workflows, exceptions, and more based on this observation. Refer to policy documents used by those in the industry, free templates shared by resource pages across software vendors, and community pages to choose and modify the content for the final policy document. Simplify the process by editing existing free downloadable templates and automating the process by configuring the policy on your travel and expense software.

Are meals reimbursable under a travel and expense policy?

Yes, meals and incidentals is one of the most common expense categories in a travel and expense policy that is reimbursable. This category may fall under the per diem allowance category and covers all meals, tips, and food-related expenses incurred by the travelers.

- Dhwani

Dhwani Parekh is a seasoned FinTech content writer with more than 7 years of experience in SaaS marketing. As a contributing expert at Academy by Zoho Expense, she focuses on uncovering trends that empower businesses to streamline their financial operations, especially business travel and expense management. With deep industry knowledge and a pulse on the rapidly evolving landscape of business spend, Dhwani’s content adds tremendous value to Academy by Zoho Expense.