- HOME

- Accounting Principles

- A comprehensive overview of the finalization of accounts

A comprehensive overview of the finalization of accounts

Every business, irrespective of its size, should adhere to proper accounting practices from the beginning of the financial year, as it is critical to have clean books, remain compliant, and avoid unnecessary hassle for their accountants at the end of the year.

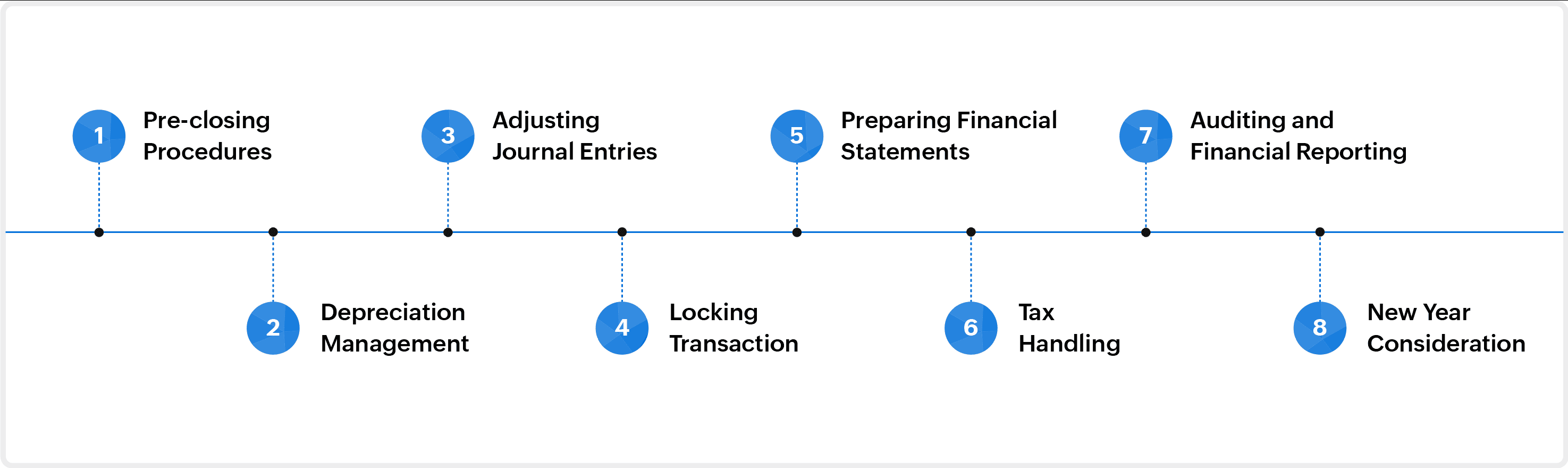

Finalization of accounts is a year-end accounting process, practiced to close the books for one year and set the stage for the next. While the process of finalizing accounts might be complicated, a disciplined accounting routine can streamline it. This process involves a pre-closing checklist and best practices, year-end GST and TDS closures, and laying the foundation for the new fiscal year. To make things easier, adopting a comprehensive, modern accounting solution can help. This guide aims to explain the finalization of accounts in detail so you know how to approach the process.

Why is it important?

The steps involved in finalization of accounts ensure that the financial records of the business are accurate. It provides an overview about the business's financial situation and clarity on specific aspects of the business, which will enable stakeholders to make informed decisions. It also helps businesses avoid penalties by ensuring adherence to relevant tax and accounting standards.

Steps involved in finalization of accounts

1. Pre-closing procedures

This is the primary step in the finalization of accounts, where you have to make sure all the transactions and accounts relevant to the particular financial year are recorded and balanced, respectively. There will be numerous transactions recorded by the business from the beginning of the financial year. There are high chances that some of the transactions are missed or recorded incorrectly. Reviewing these transactions and reconciling various accounts becomes vital to have an error-free accounting record.

Reviewing and verifying transactions

In this step, each transaction is cross-checked with relevant receipts, invoices, and other documents. Any inconsistencies in details like date or value of a transaction are rectified, and the correct details are recorded in the books.

Reconciling accounts

Reconciliation, in accounting, is the process of comparing two records, usually one being internal and the other being external, to find any inconsistencies among them. For example, in bank reconciliation, the business's cash account is cross-checked with its bank statement. Any kind of discrepancies among the documents are identified and corrected. Below are the major reconciliations carried out during finalization of accounts.

Reconciliation | Documents reconciled |

Bank and credit card reconciliation | Cash book vs. Bank statement/Credit card statements |

Seller reconciliation | Accounts payable data on the general ledger vs. Seller statements (invoices and receipts) |

Client reconciliation | Accounts receivable data on the general ledger vs. Invoices issued to the clients |

Inventory reconciliation | Physical inventory vs. Record of inventory |

2. Depreciation management

Depreciation is the reduction in the value of fixed assets owing to wear and tear over a period of time. Every year, during the finalization of accounts, depreciation should be computed and applied appropriately so the books reflect the accurate value of fixed assets.

For efficient depreciation management, a "fixed asset register" should be maintained properly. The register contains details like asset type, purchase date, price, useful life, and residual value.

Depreciation is calculated based on one of the following methods:

Depreciation methods | Formula |

Straight line method | (Cost of asset - Scrap value)/Number of useful years |

Write-down value method | Book value at the start of the year * (Percentage of depreciation/100) |

Any assets disposed of during the financial year should be removed from the books after adjusting depreciation. Any gain or loss incurred due to asset disposal should be treated appropriately

3. Adjusting journal entries

Adjustment entries

Certain journal entries are carried out after reconciliation and depreciation management to make sure the business accounts are balanced. Some of the adjustments are:

Adjustments | Explanation | Example |

Accrued expense | Expense incurred but not paid | Credit purchases |

Accrued revenue | Revenue earned but not received | Credit sales |

Prepaid expense | Expense paid but not incurred | Advance rent |

Unearned revenue | Revenue received but not earned | Advance received on goods/services which are not delivered/rendered |

Depreciation/Amortization | Non-cash expense | Depreciation computed for fixed assets |

Provisional entries

Apart from the above, journal entries have to be made for certain provisions, which are mostly estimates. Some of the provisional entries are:

Provisional entries | Explanation |

Bad debt entries | Entries are made as:

|

Inventory | Entries are made as:

|

4. Locking transactions

Once the adjustments in the journal have been made, transaction locking is done to prevent any modifications to the books. This is done because any modifications after the final journal adjustments might result in inconsistencies between the business records and financial statements. This will create unnecessary confusion during the audit and filing process. Businesses these days use accounting software to carry out the transaction locking process, where access to create, edit, or delete any record is denied for a particular period of time.

5. Preparing financial statements

After locking transactions, balances from the different accounts are used to prepare financial statements. Financial statements are the documents that are prepared and reported by the business so stakeholders can have a clear picture of the financial condition of the business. There are different types of financial statements to understand the different financial aspects of a business. Some of the common financial statements are:

Financial statements | Purpose |

Balance sheet | To know the financial position of the company on a particular date |

Profit and loss statement | To know the financial performance of the company for a particular period |

Cash flow statement | To know the liquidity condition of the company for a particular period |

6. Tax handling

Tax reconciliation

Tax reconciliation is carried out to ensure the tax data in the business records match the auto-generated records with the respective tax authorities. The auto-generated tax data is nothing but the tax details of the business available with the government based on the details provided by the other parties.

For example, a customer who has deducted tax for payments made to the business might have filed those details with the government from their side. Based on the input provided by them, the government would have compiled and generated a tax document. This auto-generated document will be reconciled with the books of the business to identify any discrepancies. Some of the important auto-generated documents that are used for reconciliations are:

Form 26 AS - Available in the Income Tax portal/TRACES, it provides a summary of TDS, TCS, and advance tax payments.

AIS - Available in the Income Tax portal, it provides detailed information about the financial transactions of a business.

GSTR 2A - Available in the GST portal, it provides detailed information about tax data related to the purchases of a business.

GSTR 2B - Available in the GST portal, it provides information about input tax credit.

Tax adjustment entries

After tax reconciliation, final tax adjustment entries are made in the books so they reflect accurate tax liability and other tax data. Some of the common tax adjustment entries are:

Final tax liability

Advance tax adjustments

TDS adjustments

Deferred tax asset/liability

Finalization of financial statements

Financial statements will be finalized after appropriate final tax adjustments are made in the books. These finalized financial statements will now reflect the appropriate tax-adjusted figures of the financial year.

7. Audit and financial reporting

Once the financial statements are finalized, financial statements and tax reports are subjected to internal and external audits.

Followed by the audit, financial statements will be filed with the Registrar of Companies (ROC) through the MCA portal.

Various tax returns will be filed with the respective tax authorities after the tax audit. Some of the important tax returns filed by the business are:

ITR (Income Tax Return)

ITR 5: Partnerships, BOIs, LLPs, and AOPs.

ITR 6: Companies.

GST returns

GSTR-1: Businesses dealing with outward supplies.

GSTR-3B: A summary return filed by a business that contains details about sales, ITC, Tax liability, and the like.

TDS returns

Form 24Q: Filed for tax deducted on salaries.

Form 26Q: Filed for tax deducted on non-salary payments.

8. New year consideration

The last step in finalizing accounts is preparing for a smooth transition to the next financial year. Here are some of the major steps to take to lay the foundation for the next year's accounting.

The closing balances of various accounts are transferred to the opening balances of the next financial year.

The opening balances of the new financial year are reviewed and ensured that they match with the closing balances of the previous year.

Budgets are prepared in accordance with the goals of the new financial year.

A compliance calendar is set up to ensure adherence to various regulatory requirements.

A plan is prepared to address any new regulatory changes introduced for the new financial year.

A word from Zoho Books!

Finalization of accounts is a comprehensive and complex process as businesses need to comply with various regulations. Compliance is vital as it upholds the integrity of the accounting process. By adhering to disciplined accounting practices, like proper record maintenance and reconciliations at regular intervals, the challenges associated with finalization of accounts can be handled efficiently. Also, choosing the right accounting software as your accounting partner, the entire accounting process can be streamlined, which will simplify the year-end accounting.

If you're interested in easing your finalization of accounts, check out Zoho Books, a powerful accounting platform preferred by businesses and accountants worldwide, and explore how it can help transform your year-end accounting process.