Optimize cash flow and ensure compliance

Zoho Billing enables enterprises to streamline revenue processes, ensure accurate revenue recognition, and secure payment transactions to maintain financial compliance and reduce cash flow bottlenecks.

Schedule a discovery callTailored to optimize cash flow and protect financial transactions

Support multi-channel payments

Accept credit cards, ACH, wire transfers, and digital wallets to enable seamless transactions. Provide customers with flexible payment options while ensuring secure, compliant processing across global markets.

Secure hosted payment pages

Provide customers with PCI-compliant payment pages that safeguard sensitive data and reduce fraud risks while ensuring a smooth checkout experience.

Automate payment matching

Gain real-time visibility into payment activity, instantly identify outstanding invoices, and enhance collections efficiency to optimize and maintain a healthy cash flow.

Maintain compliance with revenue standards

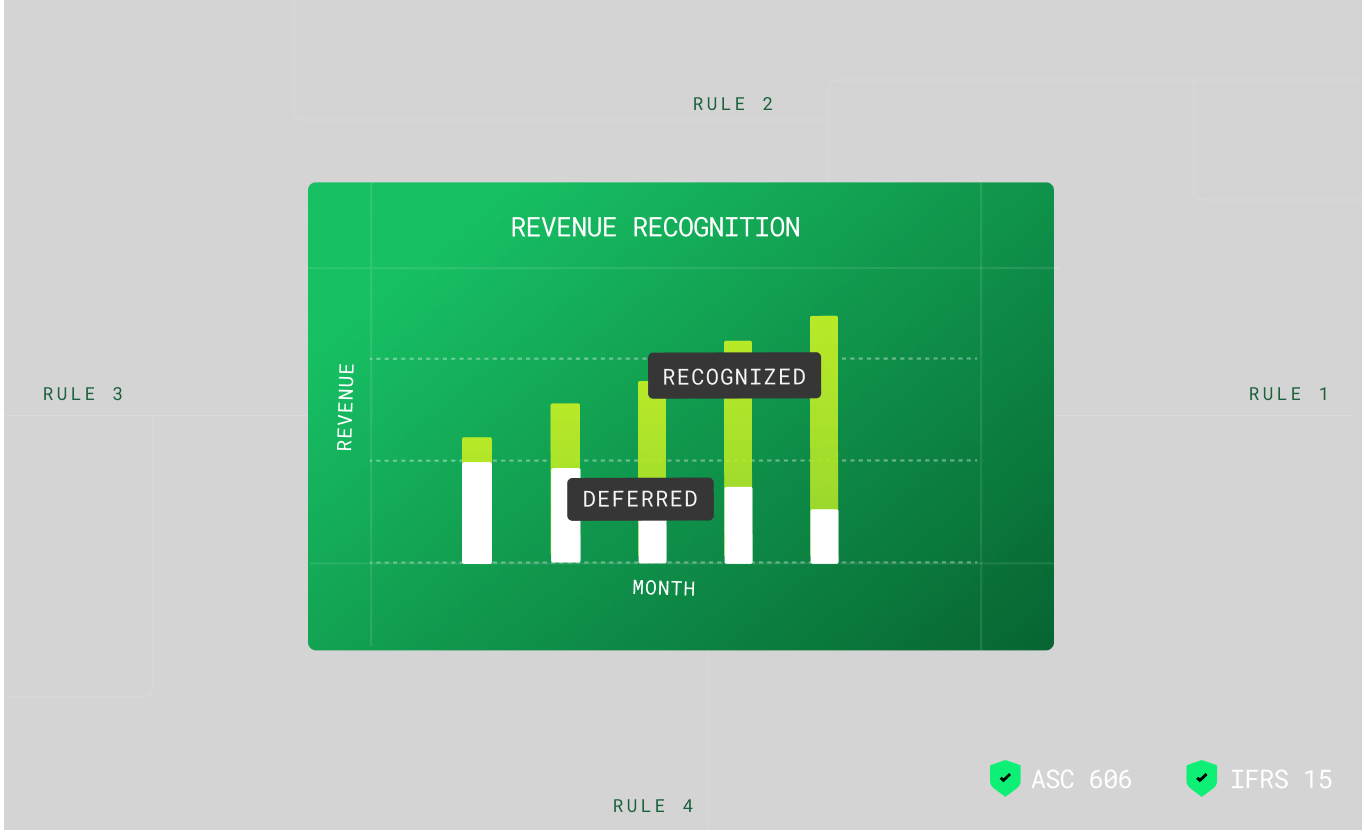

Automate revenue recognition to align with global standards, including ASC 606 and IFRS 15, ensuring accurate reporting and maintaining audit-ready financial records.

Automated revenue recognition

Ensure accurate revenue attribution across hybrid pricing models and contract structures using predefined rules that adapt to varied billing scenarios.

Real-time revenue insights

Track deferred and recognized revenue, forecast trends, and assess financial performance across teams, customer bases, and global markets for strategic planning.

Optimize collections and reduce revenue leaks

Dunning and payment recovery

Minimize overdue payments with automated dunning workflows that send reminders and retries at the right time. Adapt retry mechanisms based on customer behavior to maximize collections and reduce churn.

Adaptive revenue adjustments

Ensure that amendments to contracts, billing cycles, and refunds are accurately tracked and recorded to prevent revenue leaks while avoiding adverse downstream impacts on financial reporting.

Transparent payment reconciliation

Maintain financial accuracy by tracking and resolving transaction mismatches in real time across multiple payment channels. Gain full visibility into financial transactions, ensuring fraud detection and revenue protection.