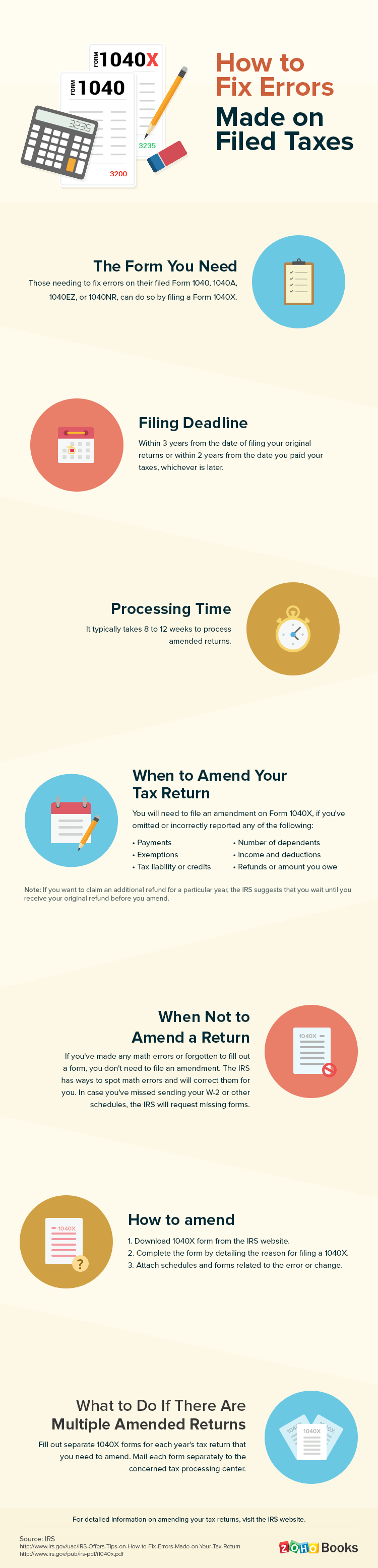

Congratulations! You've crossed the finish line. Meeting the tax deadline is no small feat, and all the time spent working through your 1040s, 1099s, and W-2s probably feels like a distant memory now.

But then it hits you: you've made a mistake! Perhaps you've miscounted your dependents, overlooked a tax deduction, or received a late 1099. Now what? Don’t worry, there’s a way forward!

Stay calm and read on because we’ve put together an infographic with a quick rundown on how to amend your tax returns.