Back

How do I record my UK Corporation Tax?

The option to calculate the Corporation Tax is currently not supported in the UK edition of Zoho Books. You have to calculate it manually over your profit.

However, once you have calculated your Corporation Tax you can record both the tax owed and the payment for the same in Zoho Books by following the steps below:

Create an Other Current Liability account called “Corporation Tax Account”. You can use it to record the liability as a Journal entry and the payment as an Expense.

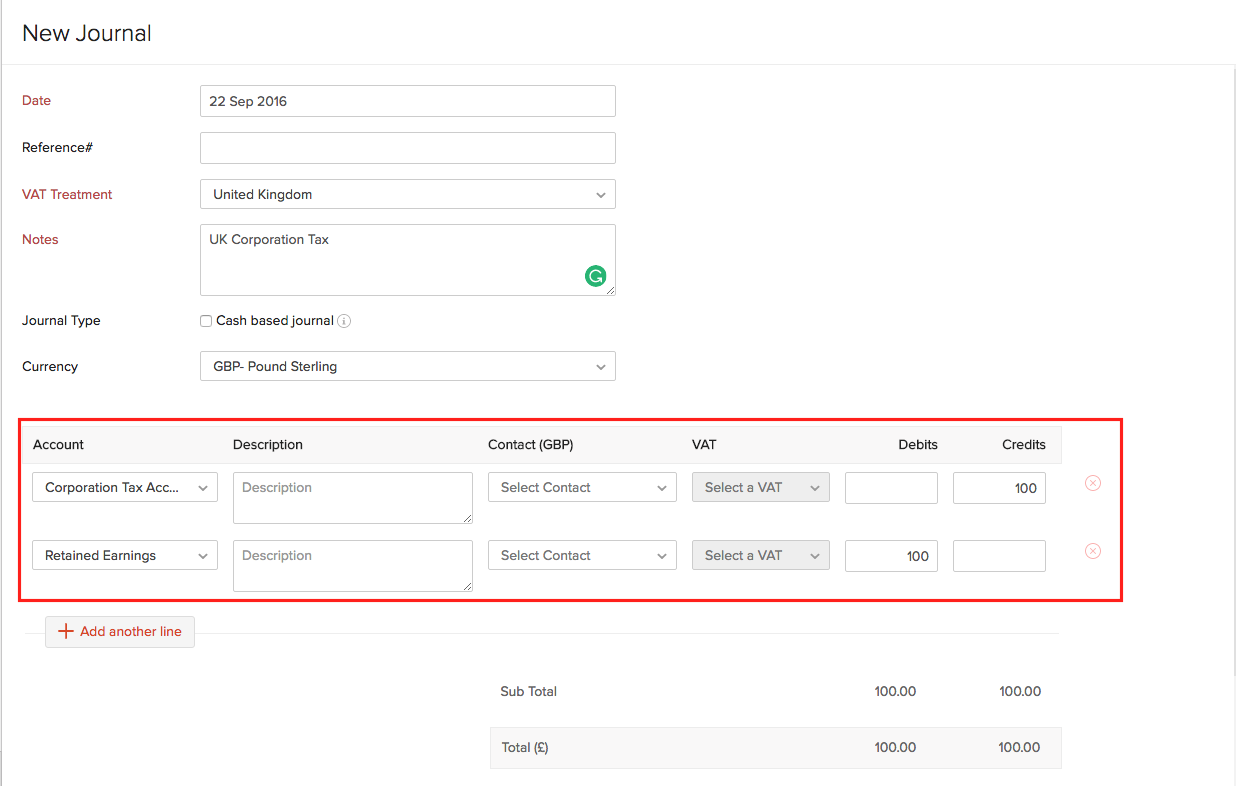

- To record the Corporation Tax Liability, create a Manual Journal to debit Retained Earning and credit Corporation Tax Account.

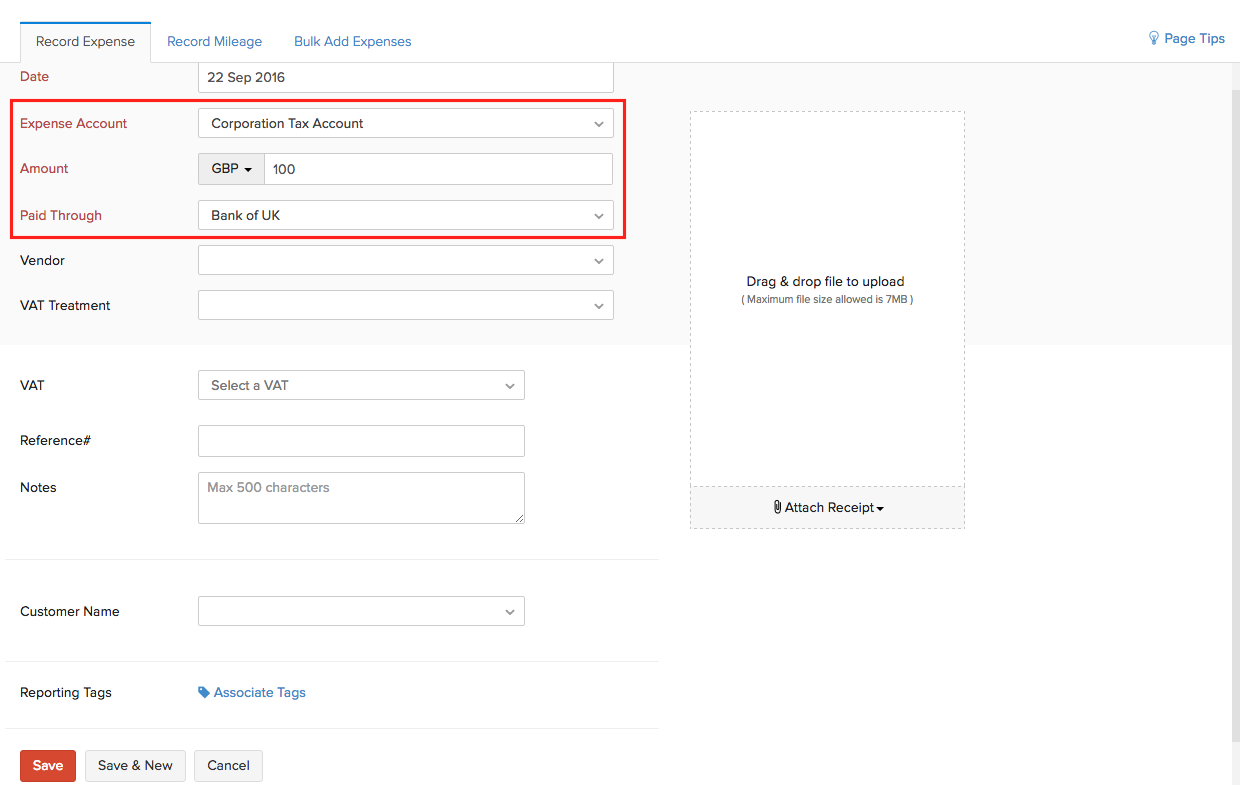

- After you make the tax payment, create an expense for the payment with the Expense account as Corporation Tax Account and Paid through as the appropriate Bank account.