Back

How to handle VAT which are a part of written-off invoices?

If you have already paid VAT to HMRC but have not received the payment from the customer, you can reclaim it back.

When you write off a transaction the entire (tax+taxable) amount will be debited to Bad Debt.

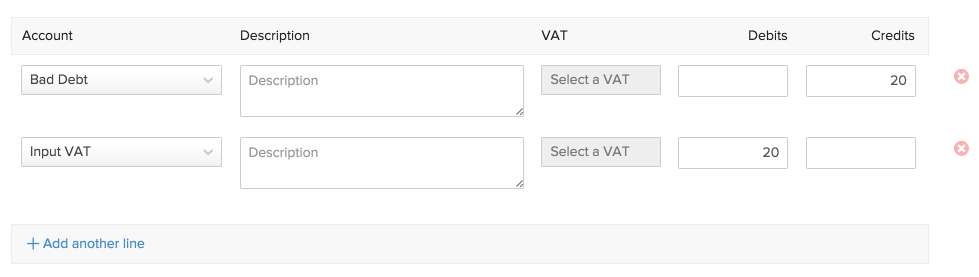

You can raise a journal entry for the same as follows -

The number “20” is an example for an amount that you wish to reclaim.

This will debit input VAT, and you will be able to reclaim this from HMRC.