Currency Adjustments

There is always a little amount of risk involved while transacting with customers dealing in foreign currencies. The risk is due to the fluctuation of exchange rates on a daily basis. Most of the times it is a profitable transaction, except for a few unlikely days of bad exchange rates.

In Zoho Books you can have an insight on the profit or loss incurred due to the change in exchange rates and also apply the changes to open transactions.

Let’s consider a scenario:

- You raise an invoice for your customer handling AUD currency on November 3rd. The invoice is still in the Open status.

- On November 5th, the exchange rates change and you are worried about how it will affect your business.

- In this case, you need to adjust the base currency rate with the foreign currency rate and have an insight about the profit or loss.

- You can change the rate for the open transactions with foreign currency.

ON THIS PAGE

Adjusting Base Currency

To adjust the base currency in Zoho Books:

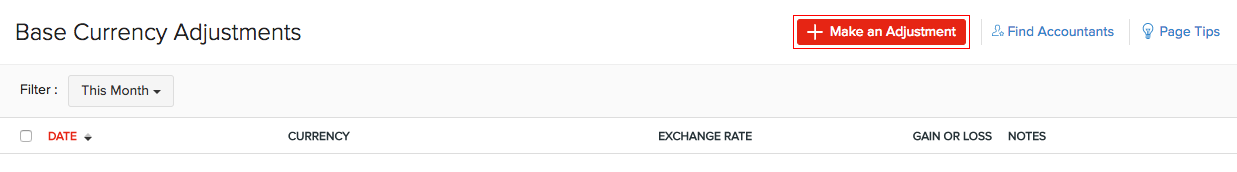

- Go to the Accountant module on the left sidebar.

- Select Currency Adjustments.

- Click the + Make an Adjustment button in the top right corner of the page.

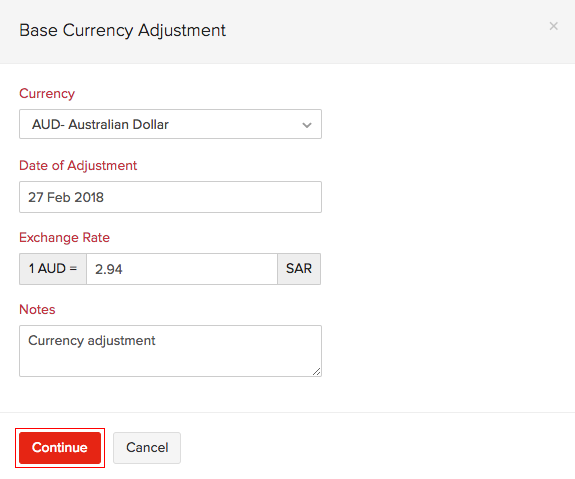

- Fill in the Base Currency Adjustment page.

| Fields | Description |

|---|---|

| Currency | Currency for which the adjustment is made. |

| Date of Adjustment | Date on which the adjustment is made. |

| Exchange Rate | Exchange rate of the foreign currency with respect to the base currency of your organization. |

| Notes | Fill in the reason the adjustment is being made (mandatory). |

- Click Continue.

Note:

It is recommended to have an accountant or a bookkeeper to have the adjustments made according to the date.

Open transactions are mandatory to make base currency adjustments.

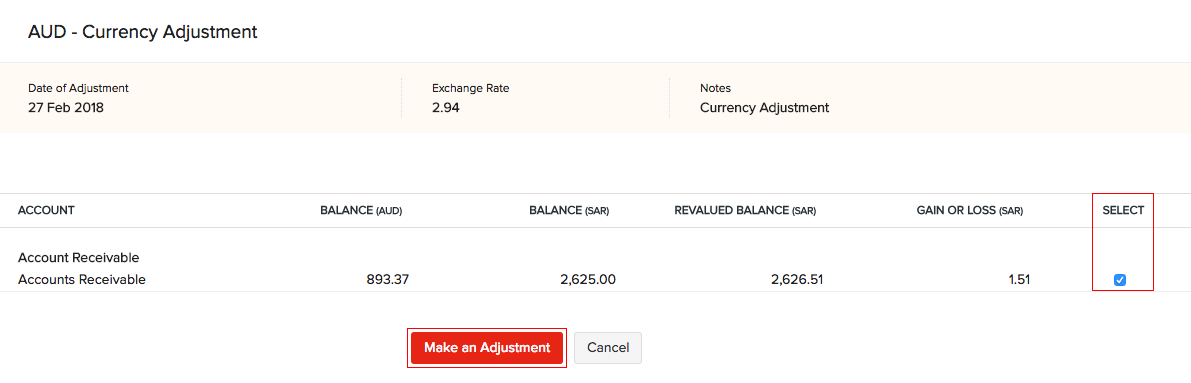

- Once the details are filled, you will be navigated to confirm the adjustment.

| Fields | Description |

|---|---|

| Account | The account which is affected due to change in exchange rates. |

| Balance (FCY) | This represents the foreign currency amount. |

| Balance (BCY) | This represent the your organization’s currency (SAR) amount. |

| Revalued Balance (BCY) | The total amount in BCY after the new exchange rate is adjusted and revalued. |

| Gain or Loss (BCY) | This column shows whether you have made profit due to the change or incurred a loss. An amount with a negative sign will depict the loss incurred. |

FCY: Foreign Currency

BCY: Base Currency

- If you wish to adjust the new exchange rate, check the box under the Select and click Make an Adjustment.

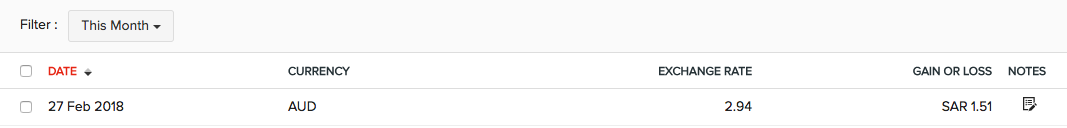

The adjustment will be shown in the following page.

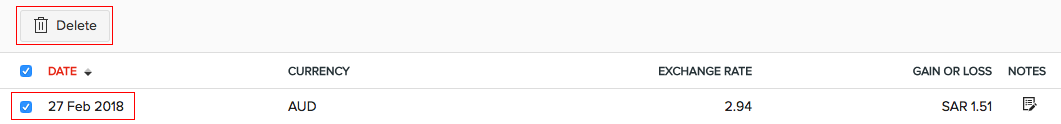

Deleting Currency Adjustments

You can delete the base currency adjustment you made anytime by selecting the entry from the Currency Adjustment window and clicking the Delete option.

Reports for Currency Adjustments

As soon as a currency adjustment is made, the particular account affected will be uploaded with new values in the Reports section as given below:

Business Overview

| Fields | Description |

|---|---|

| Profit and Loss | Non Operative Income/Expense (Exchange Gain or Loss) |

| Balance Sheet | Current Assets (Accounts Receivable) |

Accountant

| Fields | Description |

|---|---|

| Account Transactions | A entry with Base Currency Adjustment as Type will be created. |

| Journal Report | A new section will be created with the date and title as Base Currency Adjustment. |

| Trial Balance | Assets (Accounts Receivable) |

Currency

| Fields | Description |

|---|---|

| Realized Gain or Loss | Transaction Type: Base Currency Adjustment |

See Also:

Chart of Accounts

Transaction Locking

Manual Journals

Yes

Yes