- HOME

- Compliance

- Professional tax in West Bengal: Payment, tax slab, registration

Professional tax in West Bengal: Payment, tax slab, registration

The West Bengal State Tax on Professions, Trades, Callings & Employment Rules, 1979 empowers the state government to levy a professional tax on earning individuals across various professions. This includes salaried employees, self-employed individuals, and professionals who cross the income threshold for tax eligibility.

Employers must comply with these rules, as understanding the tax’s applicability, registration process, payment methods, and due dates is essential for staying compliant.

This guide provides a detailed overview of professional tax in West Bengal—who needs to pay, applicable tax rates, deadlines, exemptions, and more.

Professional tax in West Bengal

Professional tax in West Bengal is a state-level tax levied on individuals earning income through professions, trades, or employment. The purpose of this tax is to generate revenue for the state’s welfare and development activities.

It applies to both salaried individuals, where employers deduct and deposit the tax, and self-employed professionals who must pay it directly to the government. While the tax is calculated based on income slabs, the maximum amount that any individual can be charged in a financial year is capped at ₹2,500, as per Article 276 of the Indian Constitution.

Applicability of professional tax in West Bengal

The following individuals and entities are liable to pay professional tax in West Bengal:

- Employees: All salaried individuals employed in the private sector, public sector, or with the Central and State Governments (including railways) are liable to pay professional tax. The employer is responsible for deducting and remitting the tax to the government.

- Self-employed individuals: Professionals such as doctors, lawyers, chartered accountants, architects, and others engaged in any trade, profession, or calling within the state must pay the tax directly to the government, provided their income exceeds the threshold defined in the schedule.

- Entities: Hindu Undivided Families (HUFs), associations, clubs, firms, societies, and trusts engaged in any type of profession and earning income are also liable.

- Companies and co-operative societies: Every company, corporation, or co-operative society operating in West Bengal that engages in trade or business and earns income must register and pay professional tax as per the slab rates.

- Employers: Any person responsible for disbursing salaries, such as a manager or head of an organization, must deduct the correct professional tax from employees and remit it to the State Tax Authority within the prescribed due dates.

West Bengal professional tax registration process

To register for professional tax in West Bengal, follow these steps as outlined in the official user manual:

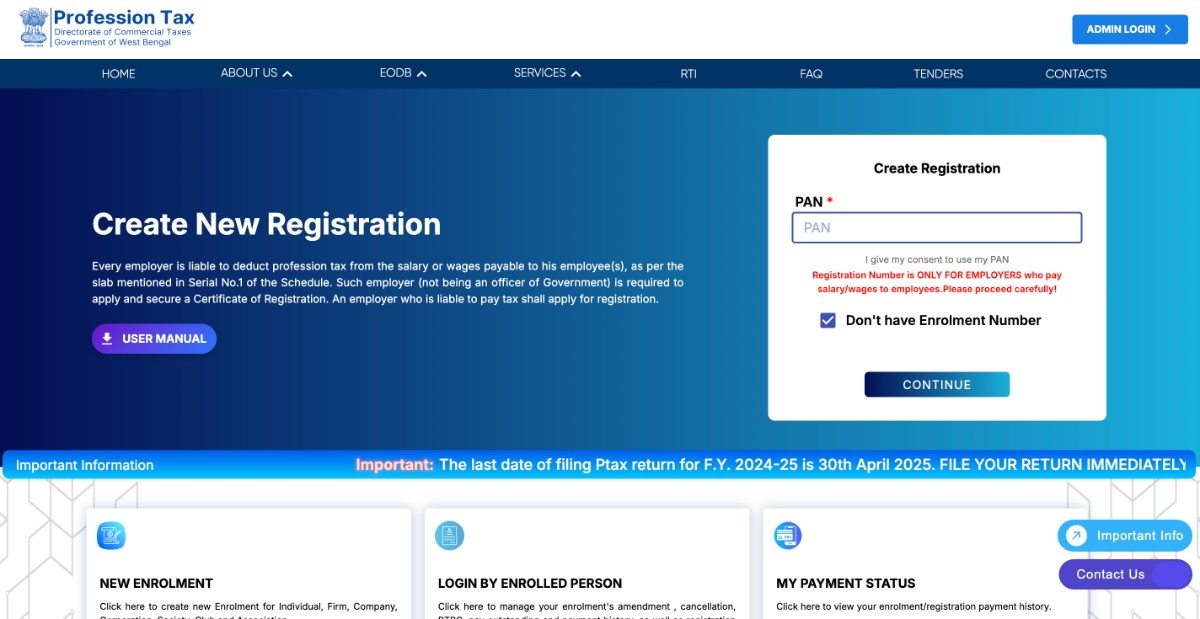

- Visit the official professional tax portal: https://professiontax.wb.gov.in/create-registration/registration-login.

- Enter your enrollment number to begin a new registration. If you don’t have one, you can use your PAN card number as an alternative.

- On the next screen, provide your contact details such as mobile number, email ID, and address.

- On the 'Additional Info' page, fill in your district, bank account details, and your role in the company under the ‘Status of Applicant’ field.

- Review all the information carefully and click the 'Submit' button. Once submitted, you will receive your registration number.

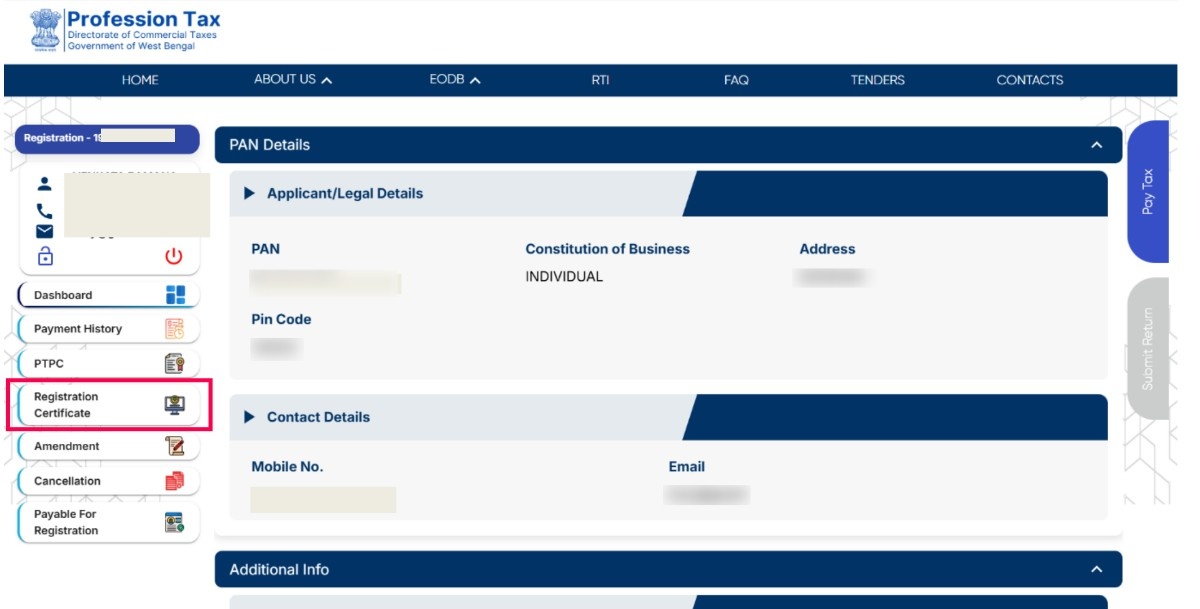

- To download your registration certificate, visit: https://professiontax.wb.gov.in/registration/new-registration-login. Enter your registration number and the CAPTCHA code shown on the screen.

- On the left-hand menu, click on ‘Registration Certificate’. Your certificate will be displayed on the screen, and you can download and save it to your computer.

Documents required for professional tax registration

For employers registering under professional tax, the following documents are necessary:

- Proof of the business commencement date

- Financial records

- Details of employees

- Employee salary details

- Proof of address

Professional tax slab rates in West Bengal

The below table illustrates the current professional tax rates for salaried employees in West Bengal:

| Monthly gross salary | Monthly tax amount |

| Till ₹ 10,000 | Nil |

| More than ₹ 10,000 till ₹ 15,000 | ₹ 110 |

| More than ₹ 15,000 till ₹ 25,000 | ₹ 130 |

| More than ₹ 25,000 till ₹ 40,000 | ₹ 150 |

| More than ₹ 40,000 | ₹ 200 |

Professional tax rates for all categories of profession in West Bengal

For self-employed individuals and businesses, the professional tax rates and payment eligibility may vary. Refer to the table below to understand the applicable tax amount based on your profession.

| Category of profession | Yearly tax amount |

| Legal practitioners, medical professionals, directors of companies, technical and professional consultants, members of Stock Exchanges, with an annual gross income: | |

| Nil |

| ₹ 480 |

| ₹ 540 |

| ₹ 600 |

| ₹ 1,080 |

| ₹ 1,320 |

| ₹ 1,560 |

| ₹ 2,000 |

| ₹ 2,500 |

| Companies registered under the Companies Act | ₹ 2,500 |

| Banking companies as defined in the Banking Regulation Act, 1949 | |

| Estate agents, promoters, brokers, or commission agents | |

| Dealers, shopkeepers, cooperative societies, cable operators, contractors of all descriptions, partnership firms, etc. whose annual gross sales turnover is: | |

| Nil |

| ₹ 600 |

| ₹ 1,200 |

| ₹ 2,500 |

For additional information on tax rates for other professions in West Bengal, refer to the official notification here.

West Bengal professional tax payment steps

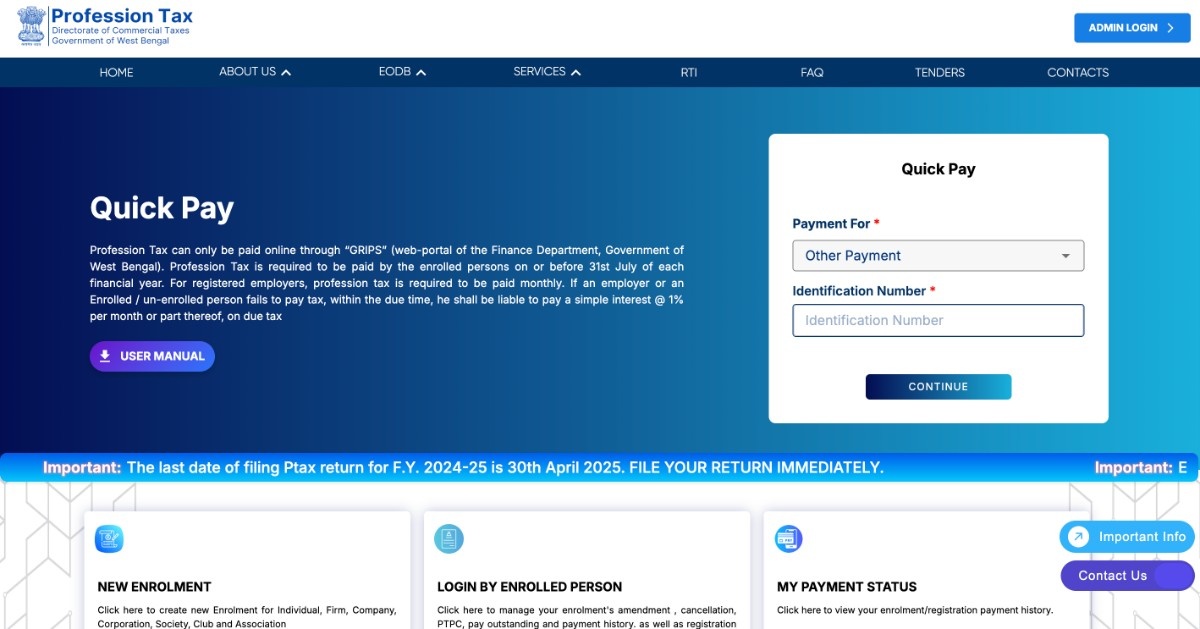

In West Bengal, professional tax can be paid online through the official government portal. Follow these steps to complete your payment:

- Visit the state’s Professional Tax Quick Pay website.

- Log in using your enrollment number, registration number, or Government ID.

- Once logged in, enter payment details, account, and amount information in the 'Tax Payable' section.

- Select the financial year or period for which you’re making the payment and click the 'Pay Now' button.

- Choose your preferred mode of payment and provide your bank details.

- After a successful transaction, a payment receipt will be generated. Download and save this receipt for your records.

West Bengal professional tax due date

The last date to pay professional tax for self-employed individuals and businesses is the 31st of July each financial year. For example, the tax for FY 2025-26 must be paid by July 31, 2025. However, employers who are required to deduct professional tax from their employees’ monthly salaries must deposit the tax within 15 days of the following month.

If the deadline is missed, a penalty will be imposed for late payment.

Professional tax late payment interest in West Bengal

In West Bengal, individuals and businesses incur a penalty of 1% per month if they fail to make professional tax payment before the deadline. To avoid these additional charges, it’s crucial to adhere to payment deadlines and comply with tax regulations promptly.

Professional tax exemption in West Bengal

The following individuals are exempt from paying professional tax:

- Personnel serving in the armed forces or Indian Navy stationed within West Bengal

- Members of the auxiliary forces or reservists employed in the state (provided they are receiving a salary and allowances)

- Any person with physical or mental disability, including blindness.

- Parents or guardians of children with physical or mental disability.

- Individuals who are aged 65 years and above.

Compliance forms for West Bengal professional tax

| Form | Description |

| Form I | Application for certificate of registration |

| Form IA | Certificate of registration |

| Form XIV | Appeal/revision application against an order of assessment/appeal/penalty/interest |

Key takeaways

Understanding and adhering to the professional tax regulations in West Bengal is crucial for both employers and individuals. By following the proper registration process and making timely payments, you can avoid penalties and ensure smooth financial management. Staying informed about the applicable tax rates, deadlines, and exemptions related to professional tax in West Bengal will help you effectively meet your tax obligations and maintain compliance.

Frequently asked questions

What is the professional tax for company directors in West Bengal?

The professional tax for company directors in West Bengal depends on the company's annual gross turnover. The minimum professional tax payable is ₹480 annually, and the maximum amount is ₹2,500 annually.

What happens if I didn't pay professional tax in previous years?

If you haven't paid professional tax in previous years, you are required to pay taxes for the current year and up to three past years (a total of four years). However, you will be charged interest on any delayed payments.

What documents are required for professional tax registration in West Bengal?

To register for professional tax in West Bengal, you only need your PAN card, mobile number, and email address. No additional documents like final accounts or books of accounts are required during the registration process.