- HOME

- Compliance

- Professional tax in Tripura: Tax slab, payment, and due date

Professional tax in Tripura: Tax slab, payment, and due date

The Tripura Professions, Trades, Callings and Employments Taxation Act, 1997 governs professional tax (ptax) in the state. This tax applies to individuals engaged in any profession, trade, or calling, or holding employment in public or private sectors, as listed in the Schedule of the Act. Much like income tax is levied by the central government, professional tax is a mandatory state tax.

This guide explains the applicability, registration process, payment steps, slab rates, exemptions, and penalties related to professional tax in Tripura.

Professional tax in Tripura

Professional tax in Tripura is levied on individuals earning income through salary, business, or professional services. The maximum annual tax is ₹2,500, and it is deducted monthly as per the state’s tax slab rates.

Employers are responsible for deducting ptax from employees’ salaries and remitting it to the state government. Individuals liable to pay professional tax must register within 90 days of starting a business, trade, or profession.

Applicability of professional tax in Tripura

The ptax in Tripura applies to the following individuals and entities:

- Salaried and contract employees: All employees working in both private and government organisations are required to pay professional tax.

- Freelancers: Individuals offering services or skills to clients independently, without being attached to a specific employer.

- Self-employed individuals: Professionals like sole proprietors and independent practitioners who manage their own businesses and earn income.

- Employers: Businesses that employ workers are responsible for deducting and remitting the professional tax on behalf of their employees.

- Businesses: All organisations involved in commercial activities must comply with the professional tax rule, including registering under the act and filing payments.

Tripura professional tax registration process

Both self-employed professionals and business owners in Tripura must register with the state’s tax department within 30 days of commencing their service or business. Below are the documents you need to provide for professional tax registration in the state:

- PAN Card

- Passport-size photo

- Identity proof, such as Aadhaar

- Memorandum and Articles of Association (for companies)

- Lease agreement (for office premises)

- Certificate of registration under the Shops & Establishments Act

To register for professional tax offline in Tripura, visit the local Charge Office of the Profession Tax Officer and collect and fill Form 1 - Certificate of Registration (for employers) or Form III - Certificate of Enrolment (for self-employed). After filling out the form, submit it to the officer for review.

The officer will verify the application and issue a registration/enrolment certificate within 30 days.

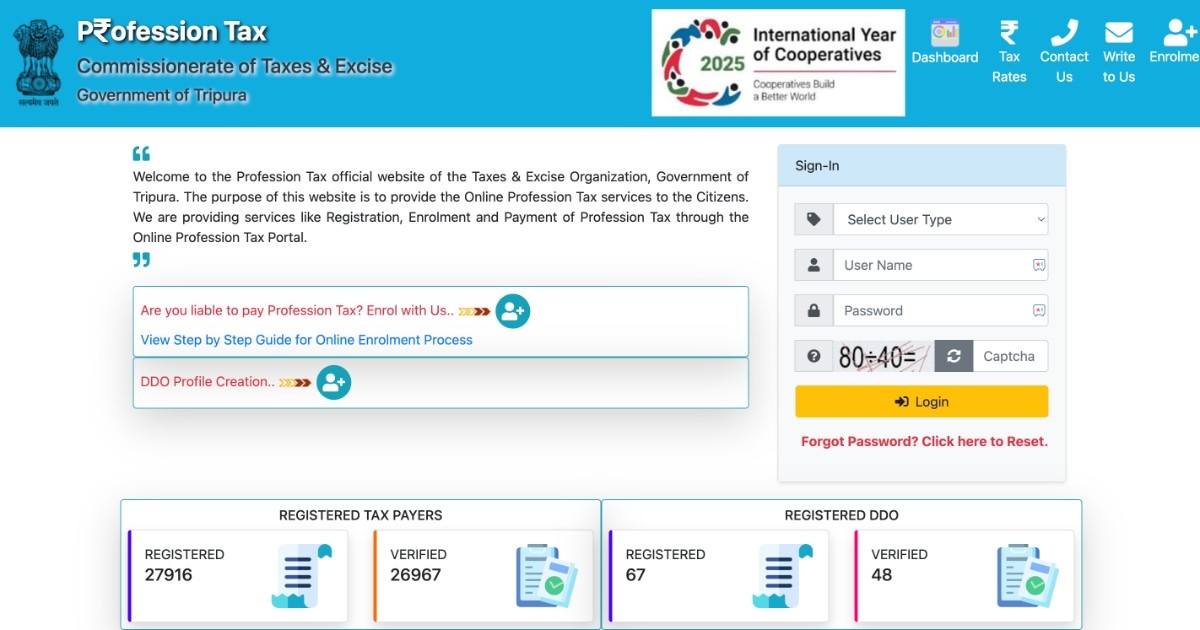

Professional tax online registration in Tripura

Here is a step-by-step guide you can follow to complete the registration online:

- Go to the Tripura Commissionerate of Taxes & Excise portal.

- Click on the ‘Enrolment’ button present on the right side of the homepage.

- On the next screen, select your entity type. If you’re a self-employed professional, register as an individual. If you run a business in the state, toggle to ‘others’.

- Provide basic details such as the establishment’s name, ID number, ID type, and phone number.

- Complete the captcha and press the ‘Enter’ button.

- You will receive an OTP on your registered mobile number and email ID. Enter the OTP to verify your profile.

- Select the profession, trade, calling, or employment that generates the highest income for you.

- Fill in establishment information, including name, jurisdiction, and address.

- Provide additional details such as commencement date, employee count, VAT/CST/GST number, and annual income.

- Review all the information before submitting the application. You can edit the details if needed.

- Submit the form.

- Upon submission, you’ll receive an application reference number via SMS and email.

Professional tax slab rates in Tripura (FY 2025-2026)

For salaried individuals, the monthly ptax deduction is as follows:

| Monthly gross salary | Monthly tax amount |

| Up to ₹ 7,500 | Nil |

| From ₹ 7,500 to ₹ 15,000 | ₹ 150 |

| ₹ 15,001 and above | ₹ 208 |

Professional tax rates for all categories of profession in Tripura

For self-employed individuals and professionals, tax rates vary depending on the profession and annual income as specified in the Act's Schedule. Refer to the table below for detailed rates:

| Category of profession | Tax rate per annum |

| Legal practitioners, chartered accountants, medical professionals, architects, brokers, auctioneers, engineers, plumbers, electricians, and tax consultants | ₹ 2,500 |

| Dealers as defined under the Tripura Value Added Tax Act, 2004, Central Sales Tax Act, 1956, Tripura State Goods and Services Tax Act, 2017 or Central Goods and Services Tax Act, 2017 whose annual gross sales turnover is: | |

| Nil |

| ₹ 2,500 |

| Directors of companies registered under the Companies Act, 1956 | ₹ 2,500 |

| Co-operative Societies registered under the Tripura Co-operative Societies Act, 1974 | ₹ 2,500 |

| Owners or lessees of petrol/diesel/gas filling stations and service stations, garages and workshops of automobiles | ₹ 2,500 |

| Occupiers of factories as defined in the Tripura Shops and Establishments Act, 2975 | ₹ 2,500 |

| Banking Companies as defined in the Banking Regulations Act, 1949 | ₹ 2,500 |

To learn about tax rates for other professions in Tripura, refer to the professional tax rate chart.

Tripura professional tax payment steps

Once the registration is complete, you can proceed with the Tripura professional tax payment by following the below steps:

- Visit the official Tripura Taxes & Excise website and log in as a registered taxpayer using your user ID and password.

- On the new page, click on ‘Pay Tax’ and select the financial year for which you’re making the payment.

- Enter your business details, such as the employee count and the total tax amount for the selected year.

- Add remarks, if any, and click ‘Proceed for payment’.

- Choose your preferred payment mode from the drop-down list and hit the ‘Continue’ button.

- A notification will pop up, with the GRN/Transaction ID for the payment. Note down the number for future reference and click ‘Ok’ to proceed.

- Select your bank, enter bank account details, and complete the payment by transacting the amount.

You will receive a confirmation message once the payment is successful.

Tripura professional tax due date

The due date for professional tax in Tripura varies based on your enrolment date.

- For individuals and employers enrolled on or before 31st August, the tax must be paid on or before 30th September of the same financial year.

- For those enrolled after 31st August, the tax must be paid within one month from the date of enrolment.

Professional tax late payment penalty in Tripura

Failing to pay professional tax on time or neglecting compliance requirements can lead to strict penalties and legal consequences under the Tripura professional tax rules. Here’s what you need to know:

| Offence | Penalty |

| Late payment of tax | 2% of the outstanding tax amount for every month or part thereof until full payment is made |

| Non-payment of tax | Up to 200% of the tax due, imposed after giving the defaulter a reasonable opportunity to be heard. |

| Not obtaining enrolment on time | Up to 200% of the payable tax amount |

| Failure to comply with the Act or rules, without reasonable cause | Imprisonment up to 6 months, or fine up to ₹5,000, or both imprisonment and fine |

Professional tax exemption in Tripura

In Tripura, certain individuals are exempt from paying professional tax. These include:

- Parents or guardians of disabled or mentally challenged children

- Senior citizens aged 65 years or older

- Individuals with a permanent disability or blindness of 40% or more

Compliance forms for Tripura professional tax

| Form | Description |

| Form I | Application for certificate of registration |

| Form II | Certificate of registration |

| Form III | Application for certificate of enrollment |

| Form V | Certificate to be furnished by a person to his employer |

| Form VI | Certificate to be furnished by a person who is simultaneously engaged in employment of more than one employer |

| Form VII | Returns |

| Form IX | Statement of recovery |

| Form XIII | Notice of demand for payment of tax interest penalty |

| Form XIX | Appeal/revision application against an order of assessment appeal/ penalty/ interest |

Key takeaways

Professional tax or ptax is mandatory in Tripura for individuals earning through employment or business. Employers must deduct and deposit the tax on behalf of employees. By adhering to registration procedures and payment deadlines and avoiding penalties, businesses can effectively meet their tax requirements.

Frequently asked questions

Is professional tax applicable in Tripura?

Yes, professional tax is applicable to both salaried and self-employed individuals in Tripura as per the Tripura Professions, Trades, Callings and Employments Taxation Act, 1997.

What are the basic requirements for online professional tax enrolment?

To apply for online professional tax enrolment, an individual must have a mobile number, email address, and PAN card. These are essential prerequisites for the application process.

References