- HOME

- Compliance

- Professional tax in Tamil Nadu: Due date, tax slab, calculation, and more

Professional tax in Tamil Nadu: Due date, tax slab, calculation, and more

The Tamil Nadu Tax on Professions, Trades, Callings and Employments Act, 1992 mandates the payment of professional tax by individuals and businesses involved in any profession, trade, calling, or employment in the state. The tax is self-assessed and levied based on gross salary earned by employees or professionals on a half-yearly basis.

This guide covers the applicability, registration process, slab rates, payment methods, due dates, exemptions, and penalties under Tamil Nadu’s professional tax system.

Professional tax in Tamil Nadu

In Tamil Nadu, professional tax applies to salaried individuals and professionals such as doctors, lawyers, engineers, and teachers. It also applies to anyone earning income from a job, profession, or business within the state.

Employers are responsible for deducting professional tax from employees' salaries as part of TDS (Tax Deducted at Source) and remitting it to the government.

The tax is collected by village panchayats, town panchayats, municipalities, and city corporations, as per the Tamil Nadu Panchayats, Municipalities, and Municipal Corporation Rules, 1998.

Applicability of professional tax in Tamil Nadu

The following individuals and entities are liable to pay professional tax:

- Salaried employees: Their employers must deduct the professional tax from the employees’ salaries and pay it to the state government.

- Self-employed individuals

- Private establishments: Businesses, including those owned by Hindu Undivided Families (HUFs), proprietorships, and partnership firms are subject to professional tax.

- Other entities: Companies, corporations, societies, clubs, or associations are also liable to pay professional tax.

Tamil Nadu professional tax registration process

Employers and other individuals must register their establishment under the professional tax act within 30 days of their commencement of business in the state. Here’s how you can register online for professional tax in Tamil Nadu:

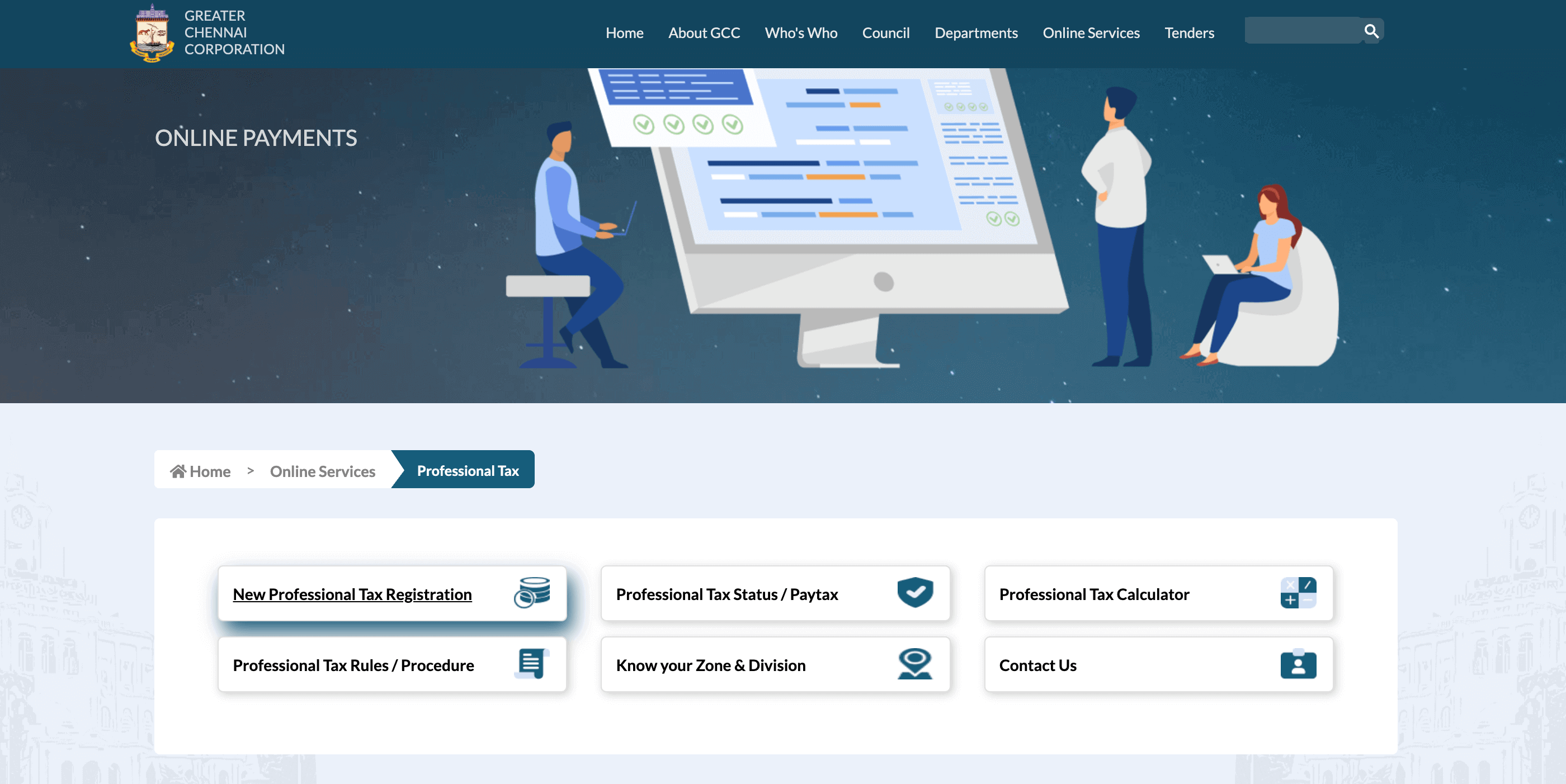

- Go to the official portal of Greater Chennai Corporation.

- Click on the "Online Services" tab and select "New Professional Tax Registration" to initiate the registration process.

- Create your unique username and password, and verify your mobile number and email. Once done, log in to the portal using your credentials.

- Fill out the self-assessment application form for professional tax registration, ensuring all details are accurate.

- Prepare and upload clear scanned copies of the following documents:

- Certificate from the Registrar of Companies.

- Memorandum of Articles (for Limited Companies).

- Proof of office location in Chennai (mandatory).

- Certificate from the Commercial Tax Department.

- PAN Card or bank account details.

- Detailed list of employers and employees (mandatory).

- Review all entered information and submit the application through the portal.

- After submission, an acknowledgement slip will be generated, containing your Profession Tax New Account Number (PTNAN). Save the PTNAN for future references.

Tamil Nadu professional tax slab rates

| Half-yearly income | Half-yearly tax amount |

| ₹ 21,000 | Nil |

| ₹ 21,001 to ₹ 30,000 | ₹ 100 |

| ₹ 30,001 to ₹ 45,000 | ₹ 235 |

| ₹ 45,001 to ₹ 60,000 | ₹ 510 |

| ₹ 60,001 to ₹ 75,000 | ₹ 760 |

| ₹ 75,001 and above | ₹ 1,095 |

These rates are fixed by local bodies based on Tamil Nadu state rules. Refer to the latest notification here.

Tamil Nadu professional tax payment process

Professional tax in Tamil Nadu can be paid through both offline and online modes. For offline payment, you can submit a cheque or demand draft at your local municipal office. To pay online, visit the official website and follow these steps:

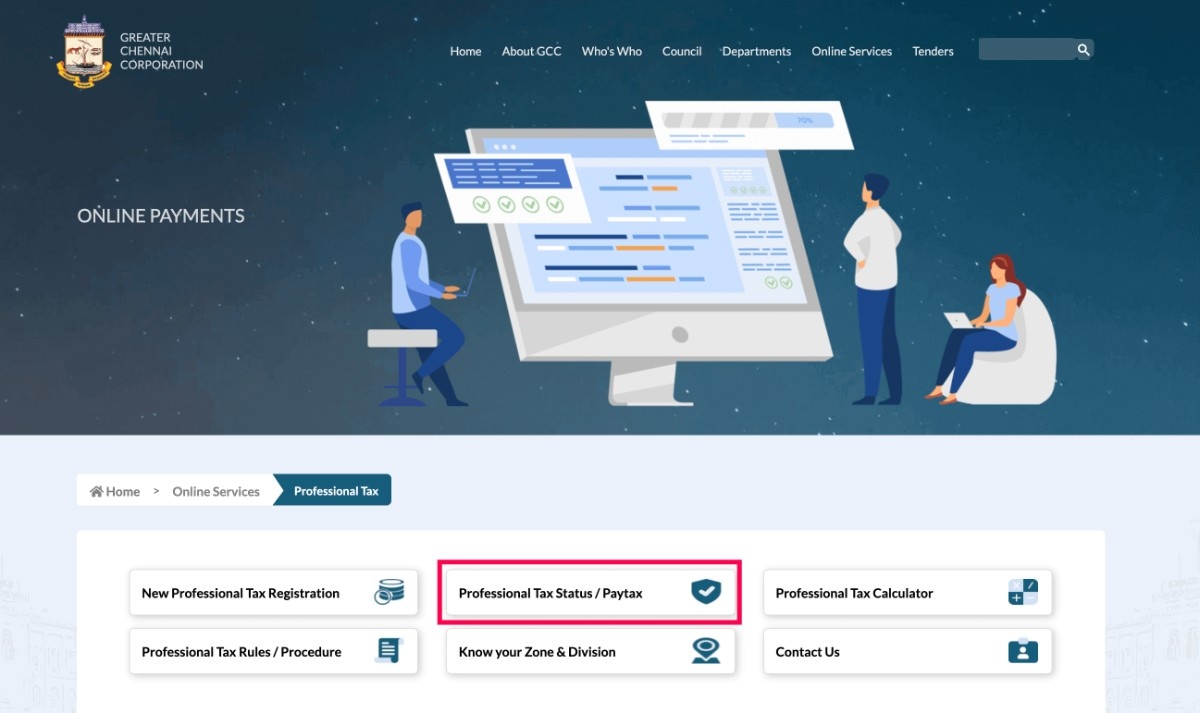

Step 1: Go to the Greater Chennai Corporation online payment website at: https://chennaicorporation.gov.in/gcc/online-payment/

Step 2: Tap on the "Professional Tax Status/Paytax" option present on the page.

Step 3: Log in to the account with your PTNAN.

Step 4: On the payment page, enter your business details, the number of employees in your organisation, and the amount of tax you’re paying

Step 5: Verify the tax details once and click "Pay Online" to proceed with payment.

Step 6: Upon successful transaction, a receipt will be generated. Download and save the professional tax receipt from the corporation’s website for your records.

Tamil Nadu professional tax due date

In Tamil Nadu, professional tax must be paid twice a year based on salary disbursement periods.

For salaries paid between April and September, the due date for remittance is September 30. For salaries paid between October and March, the tax must be remitted by March 31.

Professional tax late payment penalty in Tamil Nadu

| Violation | Penalty |

| Late payment of professional tax | 2% of the tax amount per month |

| Non-payment of professional tax | Additional 10% of the tax amount |

| Providing false or incorrect info | Three times the amount of tax due |

Professional tax exemption in Tamil Nadu

Here is a list of individuals who are exempted from paying professional tax in Tamil Nadu:

- Persons aged 65 years and above

- Parents/guardians of children with physical/mental disabilities

- Individuals with permanent physical disabilities

- Badli workers in the textile industry

- Women agents working under the Director of Small Savings or Mahila Pradhan Kshetriya Bachat Yojana

- Military personnel covered under the Air Force Act, Navy Act, or Army Act, including auxiliary and reserve forces

Compliance form for Tamil Nadu professional tax

Employers who are making the payment offline must fill out Form 1, (mentioning their name and address, profession or nature of business, income earned, and tax deposited) and submit it to the tax assessing authority.

Frequently asked questions

- What is the professional tax slab in Chennai?

The slab is based on half-yearly income. If your income exceeds ₹21,000, you’ll pay a minimum of ₹200 per year as professional tax.

- How to register for professional tax in Tamil Nadu?

Visit the Greater Chennai Corporation portal, create a new account, submit your business details to register for professional tax in the state.

- In which months is professional tax deducted in Tamil Nadu?

Professional tax is deducted in April and October, corresponding to the start of each half-year.