- HOME

- Compliance

- Punjab professional tax: Tax slab, payment, registration and more

Punjab professional tax: Tax slab, payment, registration and more

In Punjab, professional tax serves as a key revenue source for the state government, funding public services and infrastructure developments. Employers are responsible for deducting professional tax from employees' salaries, while self-employed individuals and business owners must pay it directly.

This article outlines the professional tax rules in Punjab, including its tax slabs, registration, and payment processes.

Professional tax in Punjab

Professional tax is imposed by state governments in India under Article 276(2) of the Constitution. In Punjab, professional tax is governed by the Punjab State Development Tax Act. The tax, which came into effect on April 19, 2018, applies to all salaried individuals and professionals earning an income in the state.

Applicability of professional tax in Punjab

- Employees working in private companies located within the state.

- Employees of the central or state government.

- Government employees receiving a salary from Punjab State Revenue, even if their office is outside Punjab.

- Employees working in Punjab-controlled organizations, whether incorporated or not, operating within or outside Punjab.

- Employers responsible for disbursing employee salaries should deduct appropriate tax amounts from their employees’ salaries and deposit them on their behalf.

- Freelancers and self-employed professionals generating a specified revenue in the state.

Professional tax registration in Punjab

The act requires individuals and business owners to complete professional tax registration within 30 days from the day they commence their business or when the act starts applying to them.

Step-by-step registration process for Punjab professional tax

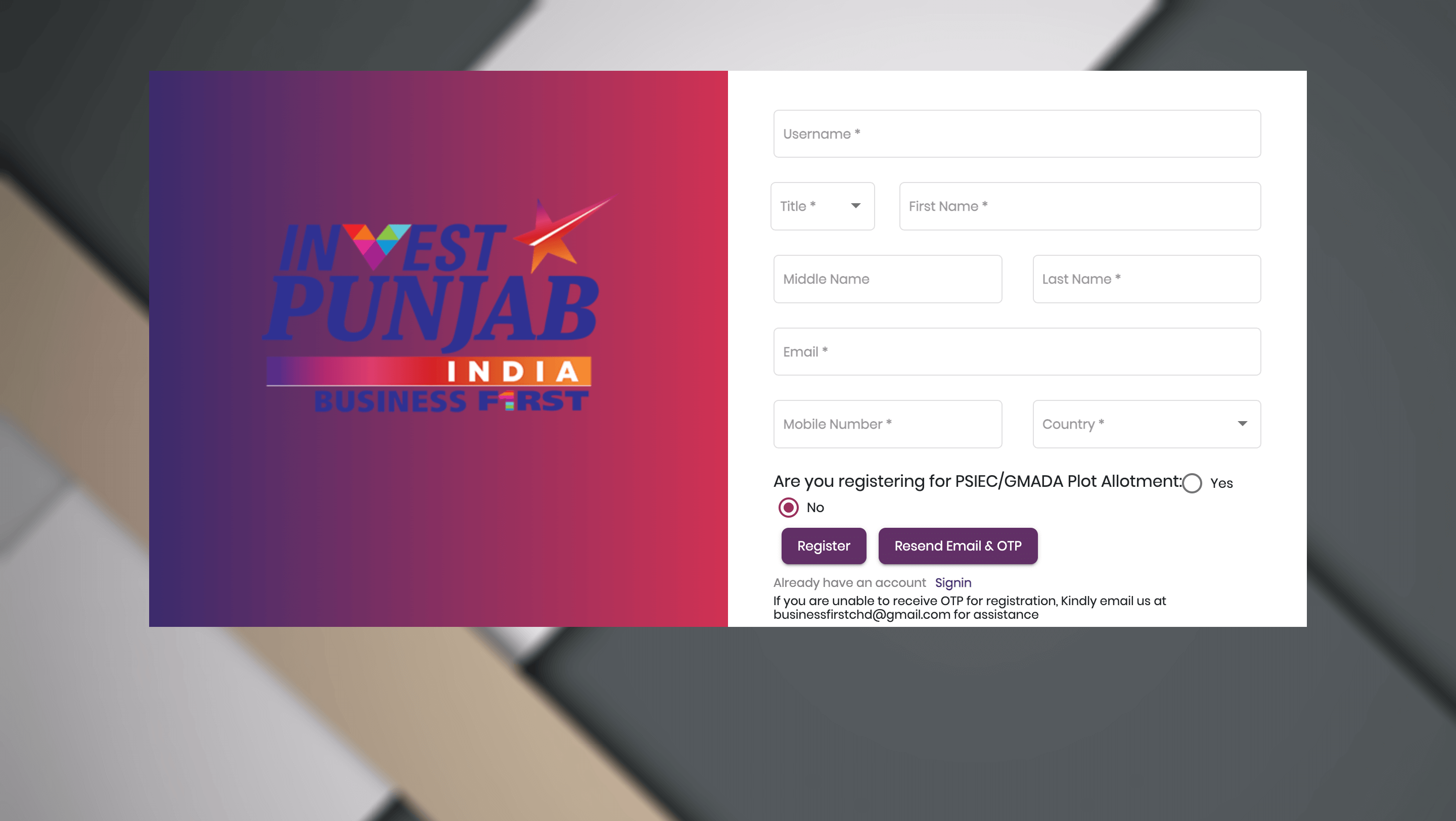

Visit the Single Window Portal and create an account on the portal by providing your username, name, email, country, and mobile number.

- Click Register to proceed.

- Verify your email and mobile number by clicking the confirmation link sent to your registered email and entering the OTP received on your phone.

- Set your password and complete the registration process.

- Now log in to the portal using your registered email and password.

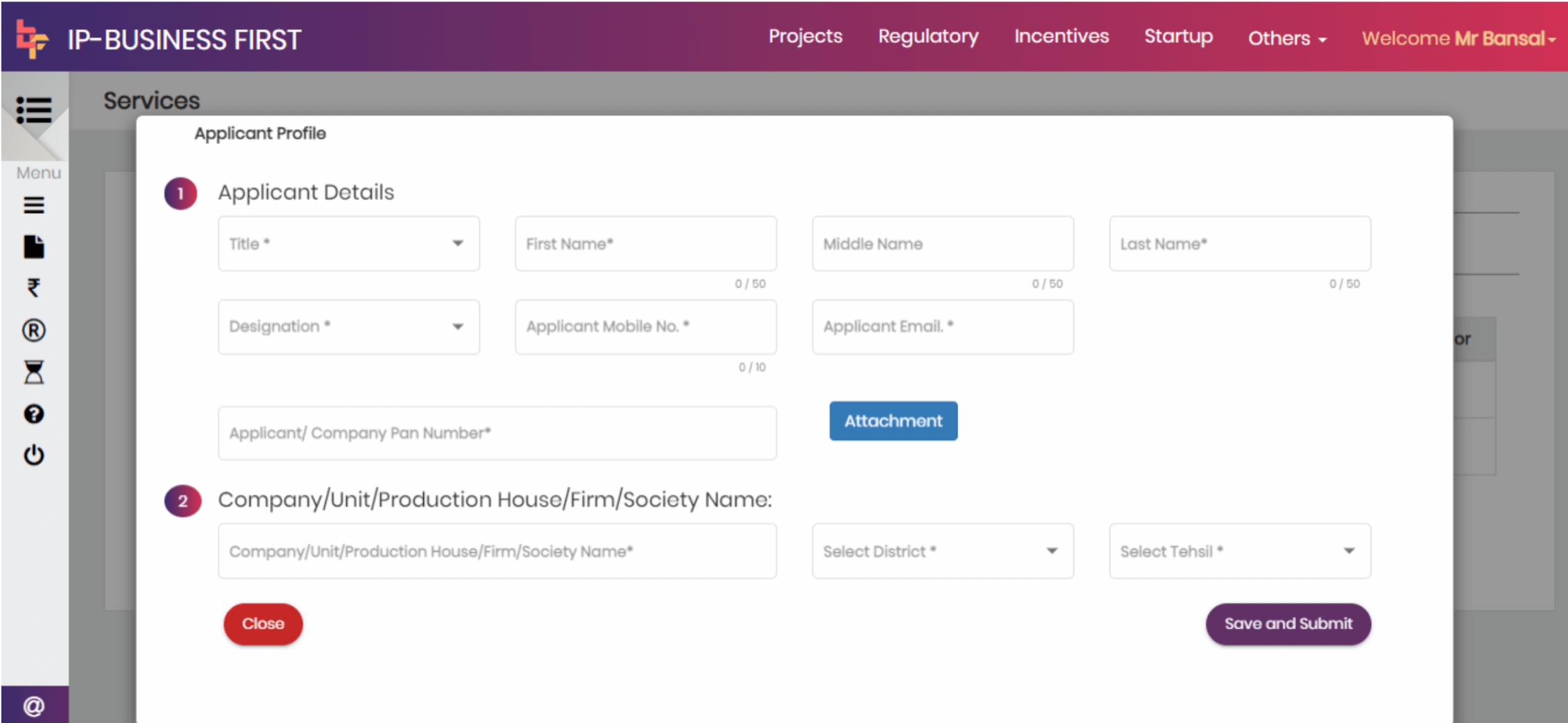

- Click “Apply for New Services” from the menu and select “New Service Profile”. You will be taken to the new user application tab.

Fill in the required details and submit the service profile.

- Once done, go to the “Dashboard”, click “Details”, and then select “Apply for New Clearance”.

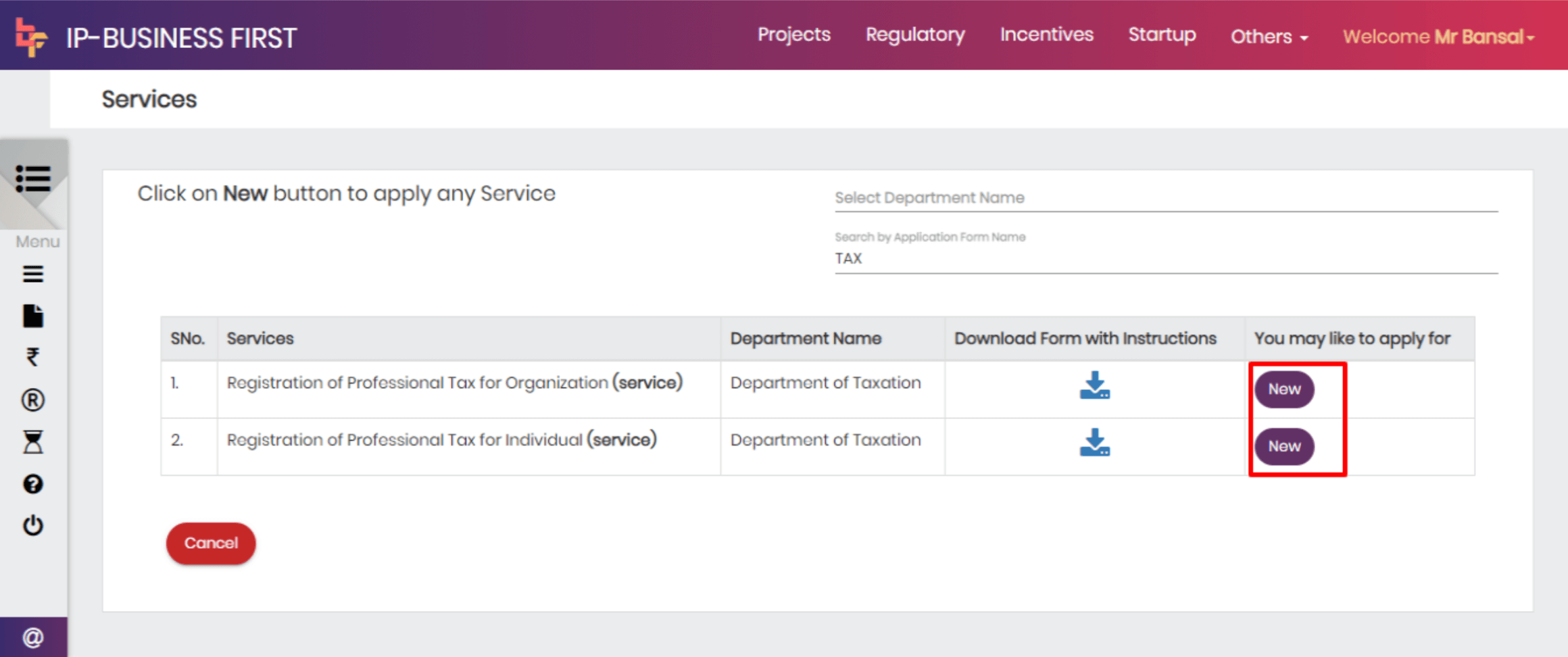

- Search for Professional Tax Registration, select either organisation or individual (based on the type of business you run), and click “New”.

- Fill in the application form, save the details, and click “Submit”.

- The tax assessing authority will review your form and process the Professional Tax Registration Certificate for your business.

Documents required for professional tax registration in Punjab

- Partnership deed, Memorandum of Association and Article of Association (MOA and AOA) or Certificate of Incorporation (based on the constitution of business) as proof of establishment

- Government-issued proof of residence of partners, proprietor or director such as passport, voter card, driving licence, Aadhar card and electricity bill

- Proof of place of business like property card, agreement of builder, leave and licence agreement, rent receipt and No-Objection Certificate (NOC)

- Lease agreement

- PAN card

- Cancelled cheque

Punjab professional tax slab rates

Professional tax rates in the state depend on how much you earn as part of your yearly gross salary.

| Yearly gross salary | Monthly tax amount |

| Less than ₹ 2,50,000 | Nil |

| ₹ 2,50,001 and above | ₹ 200 |

Punjab professional tax payment process

Taxpayers in Punjab can pay professional tax online or offline. Here’s how to pay online:

Online professional tax payment

- Visit the portal - Go to the official Punjab State Development Tax (PSDT) portal and log in with your credentials.

- Generate challan - Navigate to the “Challan” section and enter details like the month, year, and number of taxable employees.

- Request challan - Click on “Request Challan” and follow the on-screen instructions.

- Make payment - Choose a preferred payment mode (net banking, debit/credit card) and complete the transaction.

For offline payment of professional tax, employers need to fill the PSDT-8 (deposit challan) and submit it to the nearest tax assessing authority.

Due date for professional tax payment in Punjab

Professional tax must be deposited by the last day of the following month. For example, tax for April 2025 must be paid by 31st May 2025.

Punjab professional tax late payment penalty

If an employer fails to deduct and pay professional tax on time, they will be liable for the overdue tax amount, a penalty, and a simple interest of 2% per month on the overdue tax.

Offences and penalties for professional tax in Punjab

Failure to comply with professional tax regulations in Punjab can result in penalties. Below are the key offences and their corresponding penalties:

| Offence | Penalty |

| Failure to register the business under the Act | ₹ 50 per day of delay |

| Deliberately providing false information | ₹ 5,000 |

| Failure to file returns on time | ₹ 50 per day of delay |

| Failure to pay tax after receiving a demand notice | 50% of the outstanding tax amount as a penalty |

| Failure to maintain books of account | ₹ 50 per day of delay |

| Non-compliance with any provision of the Act or rules | ₹5,000 penalty; if the offence continues, an additional ₹50 per day until resolved |

Compliance forms for Punjab professional tax

| Form | Description |

| PSDT-1 | Application of enrollment by employer |

| PSDT-2 | Application of enrollment by assessee (other than a person earning salary or wages) |

| PSDT-6 | Annual return to be filed by the employer |

| PSDT-7 | Annual return to be filed by taxpayers - Enrollment |

| PSDT-8 | Pay in slip – to be sent to the Designated Officer |

| Form VII | Receipt for the amount of tax, interest, and penalty |

Frequently asked questions

What is the professional tax rate in Punjab?

The Punjab government levies a professional tax of ₹ 200 per month on individuals earning an annual income of ₹ 2,50,001 or above, as per the Punjab State Development Tax Act, 2018.

What is the due date for professional tax payment in Punjab?

Employers must deposit the deducted professional tax by the last day of the month following the month of deduction. If you deduct professional tax in the month of May, you must remit the deducted amount before 30th of June.

References