- HOME

- Compliance

- Professional tax in Odisha: Slab, registration, and payment steps

Professional tax in Odisha: Slab, registration, and payment steps

Professional tax is a form of tax imposed by the government on individuals who earn a salary or income from a profession or trade. It is levied by state governments, and the amount of tax to be paid varies from one state to another in India. The revenue generated from professional tax is utilised by the state government for various welfare and development activities. In the state of Odisha, the professional tax process is governed by the Odisha State Tax on Professions, Trades, Callings, and Employments Act, 2000.

This article provides a complete guide to understanding professional tax in Odisha. It covers who needs to pay, the rules and regulations, different payment methods, and helps you keep your business compliant with the act.

Professional tax rules in Odisha

As per the Odisha Professional Tax rules, individuals engaged in various professions, including salaried employees, self-employed professionals, and business owners, are liable to pay professional tax. The tax rates and slabs are determined by the Odisha government and vary based on the income earned.

For salaried employees, the tax is deducted by employers from the salaries and remitted to the state government on a monthly basis.

For self-employed individuals and business owners, the onus is on them to deduct the correct tax amounts and deposit it to the government. Non-compliance with the professional tax rules can result in penalties or legal consequences.

Applicability of professional tax in Odisha

The following individuals and entities are liable to pay professional tax in Odisha.

- Salaried individuals: Employees working in private companies, as well as those employed by the state or central government, such as ministers or members of the legislative assembly.

- Self-employed individuals: Freelancers and people involved in any kind of profession or trade, except for those who earn wages on a casual basis.

- Entities: Hindu Undivided Families, societies, clubs, or associations engaged in any profession.

- Businesses: Firms, companies, or corporate bodies operating within the state of Odisha.

- Employers: Individuals who are responsible for paying salaries to employees within an organization, including business owners, managers, and other stakeholders, must deduct the correct amount of tax from their employees' salaries and submit it on their behalf.

Odisha professional tax slab rates

For salaried individuals

| Yearly gross salary | Monthly tax amount |

| Up to ₹ 1,60,000 | Nil |

| From ₹ 1,60,001 to ₹ 3,00,000 | ₹ 125 |

| ₹ 3,00,001 and above | ₹ 200 and ₹ 300* |

*For employees who earn ₹ 3,00,001 and above, ₹ 200 will be deducted as professional tax for the first 11 months, and ₹ 300 for the last month.

For self-employed individuals and businesses

| Tax assess category | Yearly tax amount |

| Real estate agents, promoters, brokers, and commission agents | ₹ 1,000 |

| Dealers whose gross turnover in the preceding year is: | |

| Nil |

| ₹ 500 |

| ₹ 1,000 |

| ₹ 1,500 |

| ₹ 2,500 |

| Legal practitioners within the municipal area of the state who have been in the service for: | |

| Nil |

| ₹ 250 |

| ₹ 500 |

| ₹ 1,000 |

| Medical practitioners within the municipal area of the state who have been in the service for: | |

| Nil |

| ₹ 1,000 |

| ₹ 1,500 |

| ₹ 2,500 |

| Chartered accountants, professional consultants, and tax consultants, who have been in their respective fields for: | |

| ₹ 1,000 |

| ₹ 1,500 |

| ₹ 2,500 |

Source: https://web.odishatax.gov.in/PT/ptact.pdf

Once you have determined the applicability and professional tax rates for your business and your employees, the next step is to getting registered under the act and ensuring timely payment of taxes.

Registering for professional tax in Odisha

All employers and self-employed individuals in Odisha who are required to pay professional tax must apply for a registration certificate within 30 days of becoming liable for the tax.

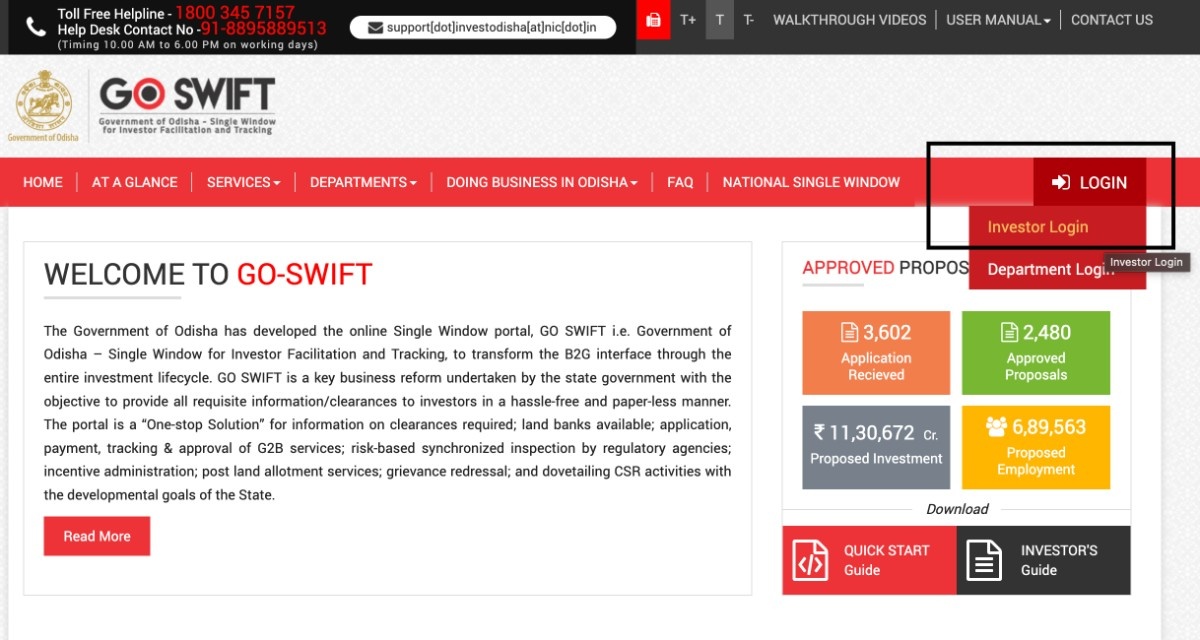

To register for professional tax, you can use the single-window portal called GO SWIFT, which is run by the Government of Odisha.

Step-by-step guide to registering for professional tax online in Odisha

To complete the registration process, you must first create an account on the official portal. Once you have created an account, log in to proceed with the professional tax registration. Here are the step-by-step instructions to guide you through the process.

Creating an account

- Visit the official portal, GO SWIFT, which is managed by the state government for professional tax registration.

- Click on the Investor Login button found under the Login option on the homepage. This will redirect you to the login page.

- Click on the New User Register Now button to create an account and generate unique login credentials.

- Provide the necessary details on the following page and complete the new account creation form.

- Choose a user ID and a strong password for your account and click Next.

- In the next step, verify your mobile number with an OTP. Complete the verification process and click the Submit button.

Registering for professional tax

- Once you have successfully created your account, revisit the Login page and log in using your credentials.

- Go to the Services section and select Registration for Profession Tax from the list of services.

- The New User Registration Form will appear on the screen. Fill in the required information on the registration form.

- Double-check the form for accuracy and click the Submit button to submit your application.

The assessing authority will review your application and send you the certificate of registration to the email address associated with your account.

For more information, take a look at the user guide on how to register, which has been released by the state government.

Odisha professional tax payment process

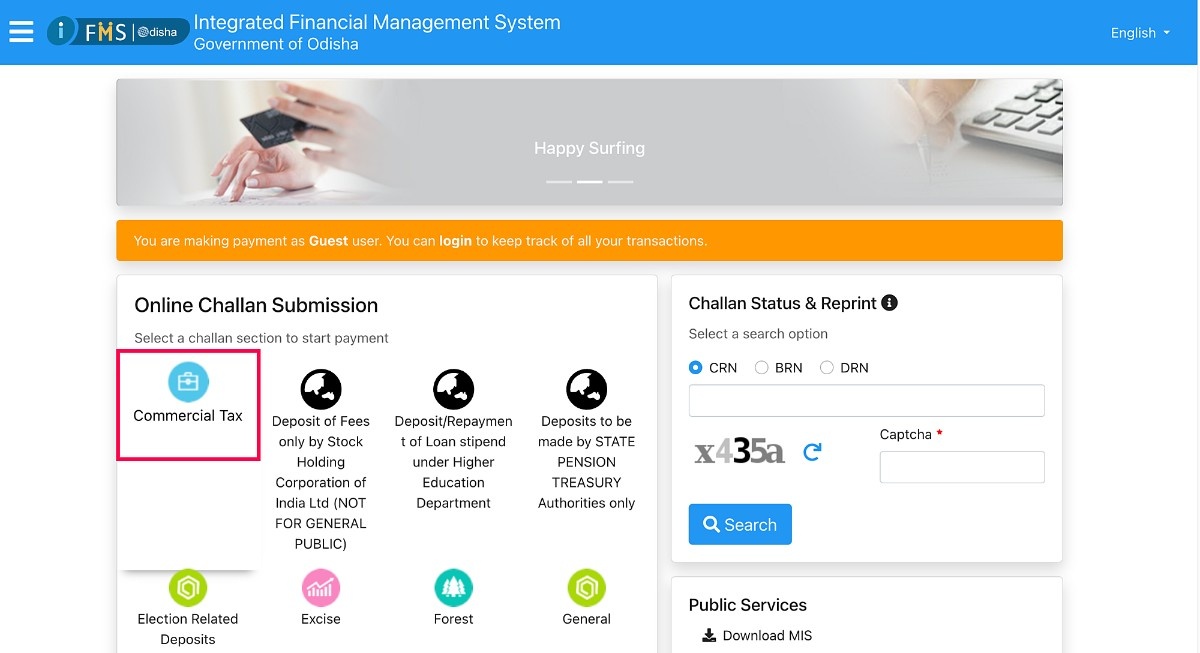

- Visit the official Odisha Treasury portal for professional tax payment.

- From the Online Challan Submission section, select Commercial Tax.

- On the subsequent E-challan page, choose Professional Tax from the list of Challan Purposes.

- Fill in the Dealer Details form with your name, registration number, and address.

- Scroll down and provide the payment details, including the payment period and mode of payment.

- Click Next. The system will automatically calculate the tax amount, verify it, and proceed with the payment.

- On the payment gateway page, enter the OTP verification code sent to your mobile number.

- After a successful payment, a return receipt will be generated. Download the receipt for future reference

Last date to pay professional tax in Odisha

All registered employers must pay the full amount of tax they owe to the Government Treasury every month. The payment deadline is the last day of the following month. For example, if an employer deducts professional tax from an employee's salary in May, the deducted amount should be deposited to the government before the end of June.

| Professional tax deduction cycle for employees | |

| Professional tax deducted month | Last date to pay professional tax |

| January | 28th or 29th of February |

| February | 31st of March |

| March | 30th of April |

| April | 31st of May |

| May | 30th of June |

| June | 31st of July |

| July | 31st of August |

| August | 30th of September |

| September | 31st of October |

| October | 30th of November |

| November | 31st of December |

| December | 31st of January of the following year |

Penalty for late payment and other offences

If individuals or employers fail to comply with the provisions of the Odisha Professional Tax Act, various penalties can be imposed.

| Offence | Penalty |

| Failure to pay professional tax within the given time | A penalty of a minimum of 25% but not exceeding 50% of the tax due |

| Failure to register or enrol under the act |

|

| Failure to follow the rules of the act |

|

The penalties mentioned above are in addition to any applicable interest charges.

Compliance forms and challans for professional tax in Odisha

| Form | Description |

| Form 1 | Application for registration |

| Form 2 | Application for enrolment |

| Form 3 | Certificate to be furnished by a person to his employer |

| Form 4 | Certificate to be furnished by a person who is simultaneously engaged in employment of more than one employer |

| Form 5 | Tax payment return (by the employer) |

| Form 6 | Schedule of deduction |

References

- https://web.odishatax.gov.in/PT/ptact.pdf

- https://web.odishatax.gov.in/PT/ptaxrule.htm

- https://investodisha.gov.in/goswift/Document/UserManual/Manual_10_2017_10_31_07_04_18_PM__%20.pdf

- https://web.odishatax.gov.in/portal/Shared/Guidlines.aspx

- https://www.odishatreasury.gov.in/echallan/index