- HOME

- Compliance

- Manipur professional tax: Tax slab, payment, registration and more

Manipur professional tax: Tax slab, payment, registration and more

Professional tax is a direct tax levied on employees, professionals, and businesses in certain states in India. In Manipur, it is governed by the Manipur Professions, Trades, Callings, and Employments Act, 1981. The state’s tax department collects this tax from eligible individuals.

In this article, we’ll cover the applicability, tax rates, deduction cycle, and payment process for professional tax in Manipur.

Professional tax in Manipur

The Manipur state government mandates that all individuals earning an income of over ₹50,000 annually, including salaried employees and self-employed professionals such as lawyers, doctors, and chartered accountants, must pay professional tax. The tax amount payable by employees is based on the income slabs set by the state government. The maximum professional tax payable is ₹2,500 per year.

Employers are responsible for accurately calculating the tax amount for each employee, deducting it from their salaries, and depositing it with the state government. Self-employed individuals and business owners in the state must determine the tax applicable to them based on their income or turnover and ensure timely payment.

The collected tax contributes to the state government’s revenue and is typically used for infrastructure development projects in the state.

Applicability of professional tax in Manipur

The Manipur professional tax act applies to the following individuals and businesses in the state:

- Employees working in the private sector, state government, or central government with an annual salary of more than ₹50,000.

- Self-employed professionals, freelancers, and gig workers earning more than ₹50,000 annually.

- Firms, corporations, Hindu Undivided Families (HUFs), and cooperative societies engaged in any trade or profession.

Employers with at least one employee are required to calculate the professional tax at specified intervals and remit it to the government.

Manipur professional tax registration process

Every business owner and self-employed individual must obtain a registration certificate within 90 days of becoming liable to pay professional tax. The Manipur State Department of Taxes oversees this registration process.

Ensure you have the following documents ready before applying for registration:

- Memorandum of Association (MoA) or Articles of Association (AoA) (if applicable)

- PAN card

- Lease agreement (if operating from a rented premise)

- Passport-size photograph

- Address and identity proof

Step-by-step process for professional tax registration in Manipur

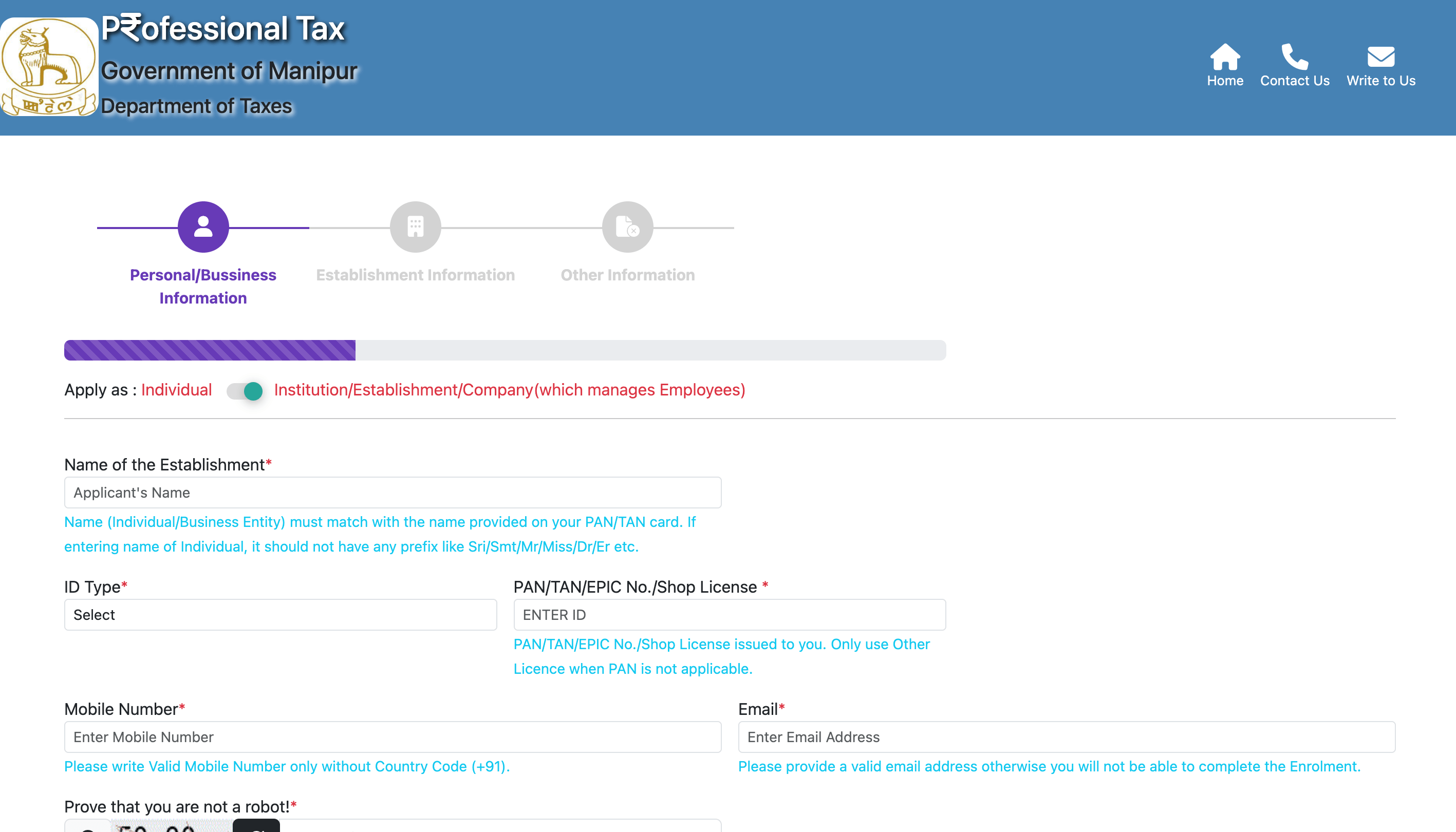

- Visit the official website of the Professional Tax Department of Manipur.

- Click on the "Enrolment" button on the right side of the screen.

- If registering as a company, select "Institution/Establishment/Company (which manages Employees)" as the type.

- Next, enter the name of the establishment, ID type, ID number, and phone number.

- Complete the captcha and click "Enter".

- You will receive an OTP on your registered mobile number and email ID.

- Select the profession, trade, calling, or employment category from which you earn the most.

- Provide establishment details, including the name, area of jurisdiction, and address.

- Enter additional details, such as: Commencement date, average number of employees, VAT, CST, or GST number (if applicable), state-level or district-level society (if applicable), annual gross income.

- Review all the information before final submission. Tick the declaration, complete the captcha, and click "Submit". If any corrections are needed, click "Edit".

- Enter the OTP received on your registered mobile number and click "Submit" again.

After submission, you will receive an application reference number via mobile and email, which can be used for future reference.

Manipur professional tax slab rates

In Manipur, professional tax is deducted monthly. Employers must calculate the tax liability for salaried employees based on their annual gross salary and applicable slab rates.

| Gross annual income | Yearly tax rate |

| Below ₹50,000 | Nil |

| More than ₹50,000 but less than ₹75,000 | ₹1,200 |

| More than ₹75,000 but less than ₹1,00,000 | ₹2,000 |

| More than ₹50,000 but less than ₹1,25,000 | ₹2,400 |

| Above ₹1,25,000 | ₹2,500 |

Professional tax rates for various profession in Manipur

The tax rates are different for different professions. Here are the applicable slab rates for various professions and businesses in Manipur.

| Tax assess category | Yearly tax amount |

| Legal practitioners, medical professionals, technical consultants, and insurance professionals who have been in the profession for: | |

| ₹ 1,600 |

| ₹ 2,000 |

| ₹ 2,500 |

| Companies registered under the Companies Act, 1956 | ₹ 2,500 |

| Firms registered under the Indian Partnership Act, 1932 | ₹ 2,500 |

| Directors of companies registered under the Companies Act, 1956 | ₹ 2,500 |

| Dealers registered under the Manipur VAT Act, 2004, whose total turnover is: | |

| Nil |

| 2% of annual gross turnover (subject to a maximum of ₹ 2,500) |

| Registered co-operative societies engaging in any profession, trade, or calling: | |

| ₹ 500 |

| ₹ 250 |

| ₹ 125 |

| Brokers, estate agents, or mercantile agents and owners of restaurants or hotels where food is served | ₹ 2,500 |

| Individuals or institutions conducting chit funds | ₹ 1,500 |

| Banking companies as defined in the Banking Regulations Act, 1949 | ₹ 2,500 |

| Owners or lessees of diesel or petrol filling stations and service stations, agents and distributors, including retail dealers of liquefied petroleum gas pumps. | ₹ 2,500 |

| Individuals or institutions conducting chit funds | ₹ 1,500 |

| Brokers, estate agents, or mercantile agents and mill owners of flour, rice, atta, or oil | ₹ 2,500 |

| Owners of private institutions, schools, or colleges and owners of private hospitals, nursing homes, or medical clinics | ₹ 2,500 |

For additional information on professional tax rates in Manipur, refer to the bare act available here.

Manipur professional tax payment process

Once your registration is complete, you need to determine your professional tax liability, and pay the tax amount to the Manipur government. Follow these steps to make the payment:

- Go to the official website of the Professional Tax Department of Manipur.

- Log in to your account as a registered taxpayer using your user ID, password, and captcha.

- On the dashboard, click on the Pay Tax option.

- Select the assessment year for which you are making the tax payment.

- The tax amount will be auto-filled based on your income slab.

- Choose your preferred payment mode from the available options and click Continue.

- A message will appear stating “Please note down GRN/Transaction ID for future reference”. Click Okay to proceed.

- Next, select your bank from the drop-down list and complete the payment.

Once the payment is successful, you will receive a confirmation message.

Due date to pay professional tax in Manipur

The due date for paying professional tax in Manipur depends on your enrollment date:

- If enrolled on or before August 31st, the professional tax must be paid by September 30th each year.

- If enrolled after August 31st, the tax must be paid within one month from the date of enrollment.

Manipur professional tax late payment penalty

Non-compliance with the professional tax rules in Manipur can result in the following penalties:

| Offence | Penalty |

| Late payment of professional tax | Interest at 2% per month or part thereof on the outstanding tax amount |

| Non-payment of professional tax or failure to obtain an enrolment certificate | Penalty up to 200% of the tax due after a hearing |

| Violation of provisions of the Professional Tax Act, 1981 | Imprisonment up to 6 months, or a fine up to ₹5,000, or both |

Professional tax exemption in Manipur

The following individuals are exempt from paying professional tax in Manipur:

- Senior citizens - Individuals above 65 years of age are exempt.

- Persons with disabilities - Those with 40% or more permanent physical disability or blindness are not required to pay professional tax.

- Guardians of disabled children - Parents or guardians of children with physical or mental disabilities are exempt.

- Foreign employees - Foreign nationals working for Indian companies are not liable to pay professional tax.

Compliance forms for Manipur professional tax

| Form | Description |

| Form I | Return of income |

| Form II | Notice |

| Form III | Assessment order sheet |

| Form IV | Assessment order |

| Form V | Return |

| Form VI | Notice of demand |

| Form VII | Assessment register |

Key takeaways

Managing professional tax in Manipur is crucial for legal compliance and avoiding financial penalties. Employers must ensure:

- Timely registration within 90 days of liability.

- Accurate tax deductions based on the prescribed slabs.

- On-time payments before the due date to prevent penalties.

By staying informed about tax slabs, deadlines, and exemptions, businesses can efficiently handle their professional tax obligations and avoid unnecessary complications.

Frequently asked questions

Is professional tax applicable in Manipur?

Yes, professional tax is applicable in Manipur. It is governed by The Manipur Professions, Trades, Callings, and Employments Act of 1981 and administered by the state government.

How to register for PT in Manipur?

You can register for professional tax by visiting the official website of the Professional Tax Department of Manipur and submitting the required details.

What is the maximum professional tax applicable in Manipur?

The maximum professional tax payable in Manipur is ₹2,500 per year.