- HOME

- Compliance

- Professional tax in Karnataka: Payment, tax slab, registration

Professional tax in Karnataka: Payment, tax slab, registration

Individuals employed in any job or profession in Karnataka are subject to professional tax under the Karnataka Tax on Professions, Trades, Callings, and Employments Act, 1976. Those whose income exceeds the limit set by the state government must pay this tax. Professional tax is mandatory, similar to the income tax levied by the central government.

In this guide, you'll get an overview of the applicability, rules, deduction cycle, and payment methods for Karnataka's professional tax.

Professional tax in Karnataka

The state government of Karnataka collects professional tax based on an individual's gross salary or income. Whether the individual is employed by a private organisation or is self-employed, they are required to pay this tax. For salaried employees, it is the employer’s responsibility to deduct and remit the professional tax.

Meanwhile, self-employed professionals, like doctors, chartered accountants, and lawyers, are responsible for paying their professional tax directly to the local authorities.

Applicability of professional tax in Karnataka

- Individuals: Professional tax applies to all individuals engaged in any profession, trade, calling, or employment, whether in the government or private sectors.

- Salaried employees: For salaried individuals, their respective employers are required to deduct and remit professional tax from their employees' salaries.

- Self-employed professionals: Individuals, such as doctors, advocates, chartered accountants, etc., must pay the tax directly to the local authorities designated for tax collection.

- Business entities: Entities including Hindu Undivided Families (HUFs), companies and other corporate bodies, sole proprietorships, partnership firms, Limited Liability Partnerships (LLPs), corporations, societies, and associations.

Professional tax registration in Karnataka

All private companies in the state that employ at least one individual are required to obtain a Professional Tax Registration Certificate, while self-employed individuals must get a Professional Tax Enrolment Certificate within 30 days of starting their business or profession. Registration can be done via the state government’s official portal: e-Prerana or https://pt.kar.nic.in/.

Here’s a step-by-step guide for professional tax registration in Karnataka:

- Visit the e-Prerana portal.

- Click on the ‘Employer Login’ button on the homepage.

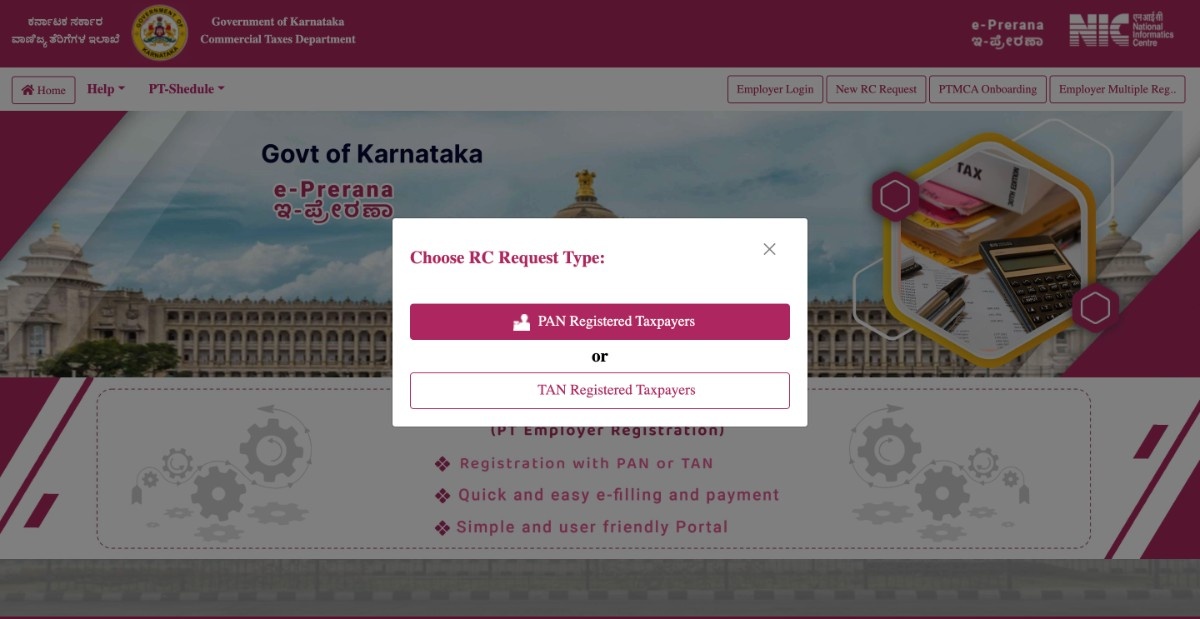

- On the next screen, choose your Registration Certificate (RC) request type. If your business has a TAN, select ‘TAN Registered Taxpayer.’ If you're a freelancer or engaged in any profession, select ‘PAN Registered Taxpayer.’

- Provide the necessary details such as business name, location, TAN/PAN, and upload the required documents. Then, click the ‘Submit’ option.

- After submission, you will receive a unique acknowledgment number.

- Your username and password will be sent to your registered mobile number. Be sure to save them, as they will be required for future logins to file monthly statements.

Upon successful verification of your application by the designated authority, you will receive your registration or enrolment certificate. Download and save the certificate for future reference.

Karnataka professional tax slab rates

For salaried employees in Karnataka, the professional tax rate depends on their monthly gross salary.

| Monthly salary | Tax per month |

| Up to Rs. 25,000 | Nil |

| From Rs. 25,000 and above | Rs. 200 |

Professional tax rates for all categories of profession in Karnataka

In Karnataka, professional tax rates vary based on the category of profession. The deduction cycle is typically yearly for most professions. Refer to the table below for the applicable slab rates for different categories of professions in the state.

| Category of profession | Yearly tax amount |

| Individuals registered under the Karnataka Goods and Services Act, 2017 | 2,500 |

| Legal practitioners, chartered accountants, tax consultants, insurance agents, real estate agents, medical practitioners, journalists | 2,500 |

| Educational institutions other than those run by the central government, state government, and local bodies | 2,500 |

| Employers of businesses covered under the Karnataka Shops and Commercial Establishments Act, 1961, with more than 5 employees. | 2,500 |

| Cooperative societies registered under the Karnataka Cooperative Societies Act and involved in any profession, trade, or business. | 2,500 |

| Owners of transport vehicles (except auto-rickshaws) under permits from the Motor Vehicles Act, 1988 | 2,500 |

| Individuals other than those mentioned above who are paying income tax to the central government | 2,500 |

Professional tax payment process in Karnataka

Registered employers can pay their taxes electronically through the e-Prerana portal. Here is a step-by-step guide to professional tax payment in Karnataka:

- Visit the e-Prerana portal and click on ‘Employer Login’.

- Log in using the credentials provided during registration.

- On the next page, choose ‘Return Entry’ under the e-Services tab.

- Select the return period type (monthly, quarterly, or yearly) and choose the relevant year.

- Enter the number of employees and their respective salary ranges. The system will automatically calculate the tax payable per employee and the total amount due.

- Review the data and click ‘Save Return’ to proceed with the payment.

- On the next screen, the PT-Demand details will appear. Verify the return details and click ‘Make e-Payment’.

- Choose your payment mode, fill in the necessary bank details, and complete the payment.

- Upon successful completion of payment, a unique PTR number and professional tax return will be generated.

- Download or print the professional tax return or FORM 5-A for future reference.

Due date to pay professional tax in Karnataka

- For employers with a Professional Tax Registration Certificate (PTRC), the due date to pay professional tax is the 20th of the following month. For example, if you deducted professional tax and paid salaries in May, you must pay the tax by June 20th.

- For self-employed individuals with a Professional Tax Enrollment Certificate (PTEC), the due date depends on when they enrolled. If enrolled before the start of the financial year, the tax must be paid by 31st of May. If enrolled after the year begins, the tax is due within one month of enrollment.

Professional tax late payment penalty in Karnataka

The Karnataka state government can impose a penalty of 1.25% monthly for delayed professional tax payments. The maximum penalty for late payment is capped at 50% of the total unpaid professional tax amount.

Professional tax exemption in Karnataka

Some categories of individuals are exempt from paying professional tax in Karnataka. They are:

- Self-employed individuals: Those who have not worked as an employee for more than 120 days in a financial year are exempt.

- Low-income salaried individuals: Employees with a gross monthly income below ₹25,000 do not have to pay professional tax.

- Senior citizens: Anyone above the age of 60 qualifies for an exemption from professional tax.

- Persons with disabilities: Individuals who are blind, deaf or mute, or have a permanent disability of 40% or more, are exempt.

- Armed Forces members: Personnel serving in the Army, Air Force, or Navy are not required to pay this tax.

- Foreign technicians: Expatriates working as technicians in Karnataka are also exempt from professional tax.

Compliance forms for Karnataka professional tax

| Form | Description |

| Form 1 | Application for registration |

| Form 1-A | Combined application form |

| Form 2 | Application for the certificate of enrolment |

| Form 3 | Certificate of registration |

| Form 4 | Certificate of enrolment |

| Form 4-A | Return to be furnished by an enrolled person/ employee |

| Form 5 | Return of tax payable by the employer |

| Form 5-A | Statement of tax payable by employer |

| Form 8 | Notice of demand for payment of tax/interest/penalty |

| Form 9 | Tax payment challan |

Frequently asked questions

How much is the professional tax in Bangalore?

In Bangalore, the professional tax is ₹ 200 per month for individuals with a monthly salary of ₹ 25,000 and above. If the monthly salary is below ₹ 25,000, no professional tax is payable.

What is the latest Karnataka professional tax exemption notification?

The latest professional tax exemption notification released in June 2023 exempts the following individuals from paying professional tax in the state.

- Owners of up to two transport vehicles (excluding auto rickshaws), operated by themselves or others under valid permits.

- Permit holders of up to two taxis or three-wheeler goods/passenger vehicles.

- Individuals with a permanent physical disability of 40% or more affecting both upper and lower limbs.

- Individuals with a single child who have undergone sterilisation.

- Ex-servicemen and others.

What are the professional tax rules in Karnataka?

As per the Karnataka professional tax act, the following rules apply in the state:

- Individuals with a monthly gross income of ₹25,000 or above are required to pay professional tax.

- All working professionals, regardless of their occupation, are liable to pay this tax if their income meets the specified threshold.

What is the professional tax return process in Karnataka?

Under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976, all registered employers holding a Professional Tax Registration Certificate must file an monthly returns online. This is done by submitting Form 5 through the official website of the Government of Karnataka's Commercial Taxes Department.

References