- HOME

- Compliance

- Jharkhand professional tax: Latest slab, registration, payment steps

Jharkhand professional tax: Latest slab, registration, payment steps

In India, most states impose professional tax on individuals engaged in various professions. Under the Jharkhand State Tax on Professions, Trades, Callings, and Employment Act, 2011, individuals earning in Jharkhand must pay professional tax. This includes salaried employees as well as self-employed professionals like doctors, CAs, and architects.

This guide covers everything you need to know about Jharkhand's professional tax, including its rules, who needs to pay, due dates, exemptions, and more.

Professional tax in Jharkhand

If you employ people or run a business in Jharkhand, you need to account for professional tax, which the state government charges on earnings. You must calculate and deposit this tax with the State Municipal Corporation based on your employees’ gross salary or your income level.

As an employer, you should also know that the amount paid toward professional tax by employees is exempt from income tax under Section 16 of the Income Tax Act. Keep this in mind while calculating your employees’ taxable income for a financial year.

Applicability of professional tax in Jharkhand

Professional tax applies to the following individuals and business entities in Jharkhand:

- Employees: Central, state government, and private sector employees in the state must pay professional tax.

- Self-employed individuals: Freelancers and independent professionals who provide services or skills without being affiliated with any organisation are required to pay this tax.

- Employers: Business owners who employ individuals are responsible for calculating professional tax, deducting the amount from their employees’ salaries, and paying the tax to the government.

- Companies: Owners of private and public limited companies, cooperative societies, and other establishments must also pay this tax.

Jharkhand professional tax registration process

Every employer and self-employed person must obtain a registration certificate within 60 days of them becoming liable to pay professional tax.

Here is a step-by-step procedure to register for professional tax in Jharkhand:

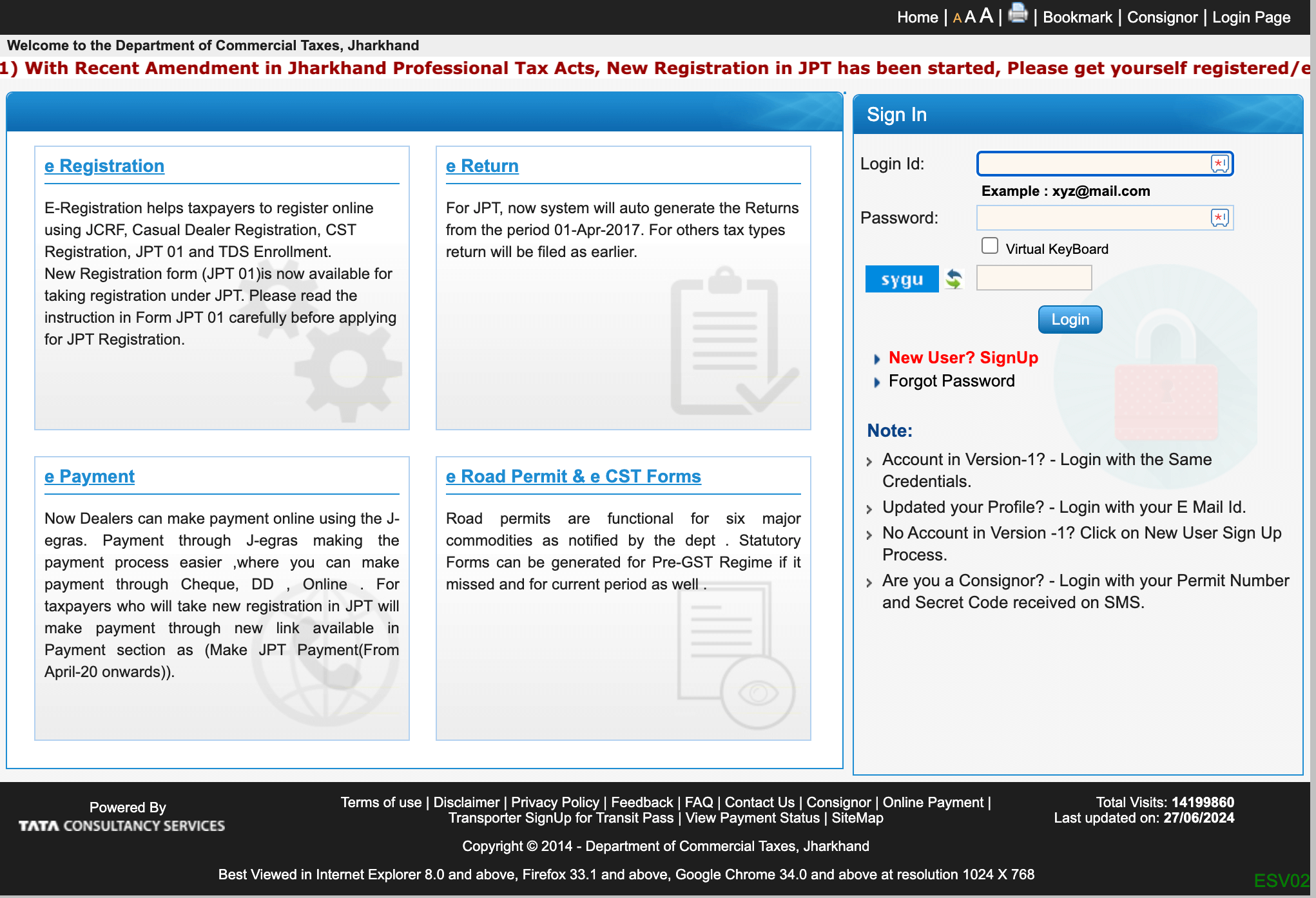

- Go to the official website of the Department of Commercial Taxes. Click on the ‘New User? Sign Up’ link.

- On the next screen, answer whether you have a Tax Identification Number (TIN) by selecting ‘Yes’ or ‘No’.

- If you select ‘No’, complete the form with all required information and submit it.

- If you select ‘Yes’, enter your TIN, fill in the necessary details and submit the form.

- After submission, a success page will notify you that a verification link has been sent to your email. Open your email and click on the verification link.

- Enter your email ID, mobile number, and verification code. Click on ‘Verify Code’ to confirm your mobile number.

- Once verified, you will receive your Login ID and password via email.

- Return to the official website and sign in using the credentials sent to your email.

- You’ll be asked to set a new password. Log in with the old password, create a new password, and click ‘Submit’to change it.

- After logging in with your new password, go to the home page and click on the ‘e-Registration’ link under ‘e-Services’.

- Choose the form type (JPT 101 or JPT 103) from the dropdown menu and click ‘Next’.

- Fill in the required information such as your name, nature of business, organisation address, then click ‘Submit.’

- Upon successful completion of the registration form, you’ll be directed to the ‘Upload Documents’ page. Upload identification documents, such as AADHAAR card and passport-size photos. The uploaded documents will be displayed in a table on the same page. Once done, click ‘Submit and Complete Registration Process.’

- You will receive an acknowledgment receipt confirming the process is complete.

Jharkhand professional tax slab rates

Registered employers must deduct professional tax annually from their employees’ salaries. The deduction amount depends on the individual’s salary.

| Yearly salary | Yearly tax amount |

| Till ₹ 3,00,000 | Nil |

| From ₹ 3,00,001 to ₹ 5,00,000 | ₹ 1,200 |

| From ₹ 5,00,001 to ₹ 8,00,000 | ₹ 1,800 |

| From ₹ 8,00,001 to ₹ 10,00,000 | ₹ 2,100 |

| Above ₹ 10,00,000 | ₹ 2,500 |

Professional tax rates for all categories of profession in Jharkhand

For individuals other than salaried employees, the tax amount varies based on their profession, years of experience, and income level. Refer to the table below to understand the tax rates applicable to different professions in Jharkhand.

| Category of profession | Tax per year |

| Legal practitioners such as solicitors, notaries public, professional and technical consultants, including tax consultants with total years of work experience: | |

| Nil |

| ₹ 1,000 |

| ₹ 2,500 |

| Chief agents, principal agents, insurance agents registered under the Insurance Act, 1938, whose annual income is not less than ₹40,000 | ₹ 2,500 |

| Dealers registered under the Jharkhand VAT Act, 2005, with annual turnover of: | |

| Nil |

| ₹ 1,000 |

| ₹ 1,500 |

| ₹ 2,000 |

| ₹ 2,500 |

| Employers of established as defined under the Shops and Establishments: | |

| Nil |

| ₹ 500 |

| ₹ 1,000 |

| ₹ 2,000 |

| ₹ 2,500 |

| Directors of companies registered under the Companies Act, 1956 | ₹ 2,500 |

| Occupiers of factories applicable under the Factories Act, of 1948 | ₹ 1,000 |

| Engineers, RCC consultants, architects and management consultants with total years of work experience: | |

| Nil |

| ₹ 2,500 |

| Chartered Accountants where the standing in profession is: | |

| Nil |

| ₹ 1,000 |

| ₹ 2,500 |

Learn more about tax rates specific to your profession in the Bare Act schedule.

Professional tax rates for all categories of profession in Jharkhand

For individuals other than salaried employees, the tax amount varies based on their profession, years of experience, and income level. Refer to the table below to understand the tax rates applicable to different professions in Jharkhand.

| Category of profession | Tax per year |

| Legal practitioners such as solicitors, notaries public, professional and technical consultants, including tax consultants with total years of work experience: | |

| Nil |

| ₹ 1,000 |

| ₹ 2,500 |

| Chief agents, principal agents, insurance agents registered under the Insurance Act, 1938, whose annual income is not less than ₹40,000 | ₹ 2,500 |

| Dealers registered under the Jharkhand VAT Act, 2005, with annual turnover of: | |

| Nil |

| ₹ 1,000 |

| ₹ 1,500 |

| ₹ 2,000 |

| ₹ 2,500 |

| Employers of established as defined under the Shops and Establishments: | |

| Nil |

| ₹ 500 |

| ₹ 1,000 |

| ₹ 2,000 |

| ₹ 2,500 |

| Directors of companies registered under the Companies Act, 1956 | ₹ 2,500 |

| Occupiers of factories applicable under the Factories Act, of 1948 | ₹ 1,000 |

| Engineers, RCC consultants, architects and management consultants with total years of work experience: | |

| Nil |

| ₹ 2,500 |

| Chartered Accountants where the standing in profession is: | |

| Nil |

| ₹ 1,000 |

| ₹ 2,500 |

Learn more about tax rates specific to your profession in the Bare Act schedule.

Jharkhand professional tax payment process

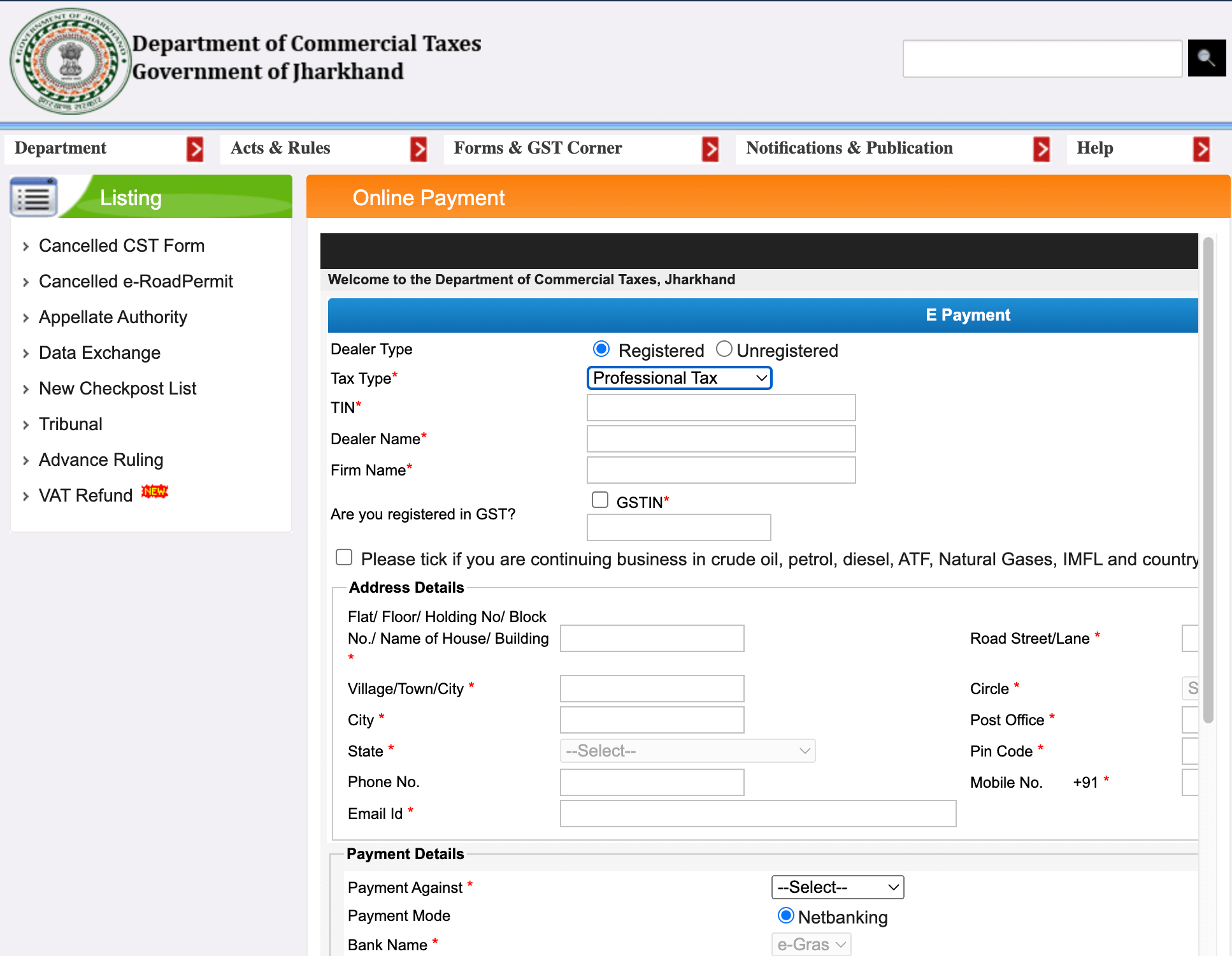

- Visit the state's official commercial taxes payment website. Choose ‘Registered’ under the Dealer Type and select ‘Professional Tax’ from the Tax Type dropdown.

- Fill in the required details such as your name, contact information, Tax Identification Number, and company details.

- In the next section, choose ‘Returns’ under Payment Against and select the period for which you’re paying the tax.

- Enter the liable tax amount, complete the CAPTCHA to verify your identity, and select net banking as your payment mode.

- You will be redirected to the e-GRAS website (Electronic-Government Receipt Accounting System). Choose your preferred payment gateway, enter your bank credentials, and press ‘Submit’.

- Upon successful payment, a return receipt will be generated. Save the receipt for future reference or verifications.

Due date to pay professional tax in Jharkhand

Every enrolled employer must pay their owed tax on a quarterly basis. The tax amount for that quarter should be deducted from employees’ salaries and deposited within 15 days of the end of each quarter. The due dates for payment are as follows:

| Quarter ending on | Due date for professional tax payment |

| 30th June | 15th May |

| 30th September | 16th August |

| 31st December | 15th November |

| 31st March | 15th February |

For self-employed individuals, the due date depends on when they complete registration for professional tax. If they register before 31st May, they need to make the tax payment by 30th June. However, if they register after 31st May, they must pay the tax within one month from the date of registration.

Professional tax late payment penalty in Jharkhand

In Jharkhand, it is crucial to ensure that professional tax is paid on time to avoid penalties. If you miss the deadline, authorities may charge a penalty ranging from ₹500 to ₹5,000. Additionally, you may incur a fine of ₹10 per day for each day of delay.

Professional tax exemption in Jharkhand

The following individuals are exempt from paying professional tax in the state:

- Senior citizens above 65 years of age

- Individuals with permanent physical disabilities

- Parents of individuals with physical or mental disabilities

- Employees working in the Union Home Ministry, Union Defense Ministry, or Border Security Force.

Compliance forms for Jharkhand professional tax

| Form | Description |

| JPT 101 | Application for a certificate of registration |

| JPT 102 | Certificate of registration |

| JPT 103 | Application for the certificate of enrolment |

| JPT 104 | Certificate of enrolment |

| JPT 105 | Certificate to be furnished by an employee to his employer |

| JPT 201 | Quarterly return for the employers |

| JPT 202 | Quarterly return for the holders of certificate of enrolment |

| JPT 203 | Annual return |

| JPT 204 | Payment of tax |

| JPT 205 | Form of challan for payment |

Frequently asked questions

What are the professional tax slab rates in Jharkhand?

The professional tax rate for employees in Jharkhand varies based on their income slab.

- Employees with salaries up to ₹ 3,00,000 - Exempt from paying professional tax

- ₹ 3,00,001 to ₹ 5,00,000 - Must pay ₹ 1,200 per year

- ₹ 5,00,001 to ₹ 8,00,000 - Must pay ₹ 1,800 per year

- ₹ 8,00,001 to ₹ 10,00,000 - Must pay ₹ 2,100 per year

- Above ₹ 10,00,000 - Must pay ₹ 2,500 per year

How can I register my business for professional tax in Jharkhand?

You can register your business for Jharkhand professional tax by visiting the official website of the Commercial Tax Department, Jharkhand.

What is the penalty for late payment of professional tax in Jharkhand?

In Jharkhand, failing to pay professional tax on time may result in a fine ranging from ₹ 500 to ₹ 5,000. Additionally, continuous non-compliance can lead to an extra penalty of ₹10 per day until the payment is made.