- HOME

- Compliance

- Chhattisgarh professional tax: Applicability, tax rates, and more

Chhattisgarh professional tax: Applicability, tax rates, and more

Professional tax is a form of tax levied by state governments in India on individuals who earn a regular income through various professions, trades, or employments. The collected professional tax serves as a source of revenue for the state and is utilized to develop the state's infrastructure. In Chhattisgarh, the professional tax is governed by the Chhattisgarh Professional Tax Act, 1995, also called Chhattisgarh Vritti Kar Adhiniyam, 1995.

In this article, we will explain the applicability, rules, deduction cycle, and payment methods of professional tax in Chhattisgarh in simple language to equip you with the necessary knowledge to ensure compliance with the act.

Professional tax in Chhattisgarh

The Chhattisgarh Professional Tax Act mandates that every employee and individuals involved in any type of work in Chhattisgarh pay a portion of their income as professional tax to the state government. This tax is calculated based on an individual's income with the maximum amount payable being ₹2,500 per year.

It is the duty of employers to calculate the tax liability of their employees by considering the appropriate slab rates. They should then deduct the corresponding amount from the employees' salaries and submit it to the Commercial Taxes Department of the state.

If you are self-employed, it is your responsibility to calculate the amount of tax you owe and make sure you pay it to the government within the specified timeframe.

Applicability of professional tax in Chhattisgarh

The Chhattisgarh Professional Tax Act applies to the following individuals and entities from the state.

- Salaried employees: All employees working in an organization, whether in the private or government sector.

- Self-employed individuals: Freelancers and other individuals engaged in any type of employment, trade, calling, or profession.

- Hindu Undivided Families (HUF): Family consisting of all persons lineally descended from a common ancestor, including wives and unmarried daughters.

- Businesses: Firm, company, corporation, or other corporate body operating in the state.

- Employers: The individuals responsible for disbursing employee salaries within an organization, such as business owners, managers, or other stakeholders, have the obligation to deduct the appropriate tax amounts from their employees' salaries and remit them on their behalf.

Registering your business for professional tax in Chhattisgarh

The act mandates that the individuals mentioned below must acquire a registration certificate from the Chhattisgarh Commercial Tax Department within 30 days of the commencement of their establishment or business.

- Every employer, other than the officers working for the central or state government or for the railways department.

- Every self-employed individual involved in any type of trade or profession other than agriculture.

- Every individual simultaneously employed by more than one employer.

Registration for professional tax can be done both offline and online. To process it offline, you need to download Form 1: Application for registration for employers, or Form 3: Application for registration for self-employed individuals, and submit it to the professional tax assessing authority of your division.

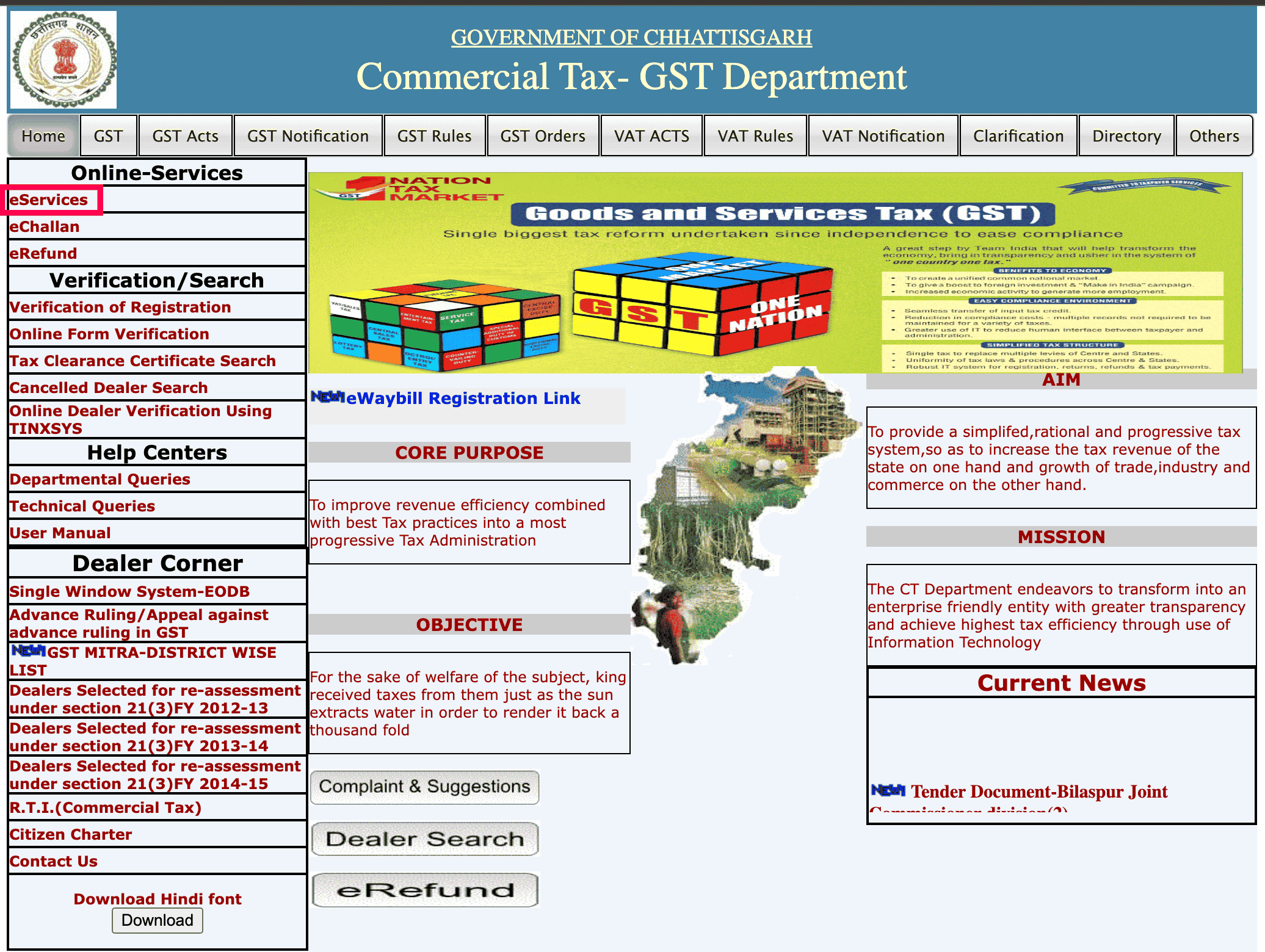

Additionally, you can apply for professional tax registration online using Chhattisgarh's Commercial Tax website.

Here are the steps you need to follow.

Go to the official website of the state government's commercial tax department and click on eServices located under the Online-Services tab on the homepage.

- Next, the e-services page will open. Select the New User (eRegistration and eServices) option on the left-hand side of the page.

- Fill in all the required information and upload the necessary documents on the online registration page.

- Once you have completed the form, click Submit.

- Upon successful completion of the registration form, you will receive an acknowledgement receipt through SMS and email.

- The assessing authority will review your registration and notify you with your unique Tax Identification Number (TIN).

Chhattisgarh professional tax slab rates

In the state of Chhattisgarh, professional tax needs to be deducted monthly. In the case of salaried employees, it is the employer's responsibility to calculate the tax liability based on the employee's monthly salary and the applicable slab rates.

| Yearly gross salary | Monthly tax amount |

| Up to ₹ 1,00,000 | Nil |

| From ₹ 1,00,001 to ₹ 1,50,000 | ₹ 130 |

| From ₹ 1,50,001 to ₹ 2,00,000 | ₹ 150 |

| From ₹ 2,00,001 to ₹ 2,50,000 | ₹ 200 |

| Above ₹ 2,50,001 | ₹ 208 and ₹ 212* |

*Salaries over ₹ 2,50,001 will be subject to a yearly deduction of ₹ 212 in the last month of the deduction cycle.

Professional tax rates for certain categories of profession in Chhattisgarh

The deduction cycle for certain professions in Chhattisgarh occurs annually. To find the slab rates applicable to your business, refer to the table provided below.

| Tax assess category | Yearly tax amount |

| Legal practitioners, medical practitioners, professional consultants, chartered accountants, insurance agents, real estate agents, contractors: | |

| Nil |

| ₹ 1,000 |

| ₹ 1,500 |

| ₹ 2,500 |

| Directors of companies registered under the Companies Act, 1956 | ₹ 2,500 |

| Employers of theaters and petrol/diesel/gas pumps with service stations. | ₹ 2,500 |

| Firms and Hindu Undivided Families operating in a place: | |

| Nil |

| ₹ 1,000 |

| ₹ 1,500 |

| Factories as defined in the Factories Act, 1948: | |

| ₹ 1,500 |

| ₹ 2,500 |

| Employers of residential hotels: | |

| ₹ 1,000 |

| ₹ 1,500 |

| ₹ 2,500 |

| Banking companies as defined in the Banking Regulation Act, 1949 | ₹ 2,500 |

| State level co-operative societies | ₹ 1,000 |

| District level co-operative societies | ₹ 800 |

| Co-operative sugar factories and sugar mills | ₹ 2,500 |

Source: https://www.datocms-assets.com/40521/1615539050-chhattisgarh-professional-tax-act-1995.pdf

How to pay professional tax in Chhattisgarh

After calculating the professional tax liability of your employees, it is necessary to deduct the designated amount from their salaries and remit it promptly to the government.

You can make professional tax payments online by filing an e-challan on the Chhattisgarh Commercial Tax website.

*E-challan is a standard form prescribed for various payments made to the Chhattisgarh government, including professional tax, VAT, luxury tax, and more. Here are the steps involved in making payments through the e-challan.

- Visit the official e-challan website and enter your log in credentials and captcha to log into your account.

- On the following page, select Commercial Tax from the list of departments and click Submit.

- Fill in all the mandatory details, which include your TIN, address of the establishment, assessment year, and similar information.

- From the Purpose type dropdown, choose Monthly tax and select the period for which you are paying professional tax. Once done, click Submit.

- An acknowledgment form will be displayed on the following page. Verify all the details you entered and click Confirm.

- Now, process the professional tax payment through any of the banks authorized by the state government.

- Upon successful completion of the payment, an e-challan receipt will be displayed on screen. Download the receipt for any future reference.

Source: https://comtax.cg.nic.in/pages/WorkOrder_16Feb2015To15Feb2016.pdf

Last date to pay professional tax

The due date to pay professional tax in Chhattisgarh is determined by the date of your registration under the Act.

| Date of registration | Last day to pay professional tax |

| On or before the 31st of August | On or before the 30th of September |

| After the 31st of August | Within 30 days from the date of registration |

Late payment penalty

The professional tax assessing authority can impose a penalty on those who fail to pay taxes within the specified date. The penalty is calculated at a rate of 2% per month of the tax amount due, with a maximum limit of two-thirds of the tax amount due.

Compliance forms for Chhattisgarh professional tax

References:

- https://www.datocms-assets.com/40521/1615539050-chhattisgarh-professional-tax-act-1995.pdf

- https://comtax.cg.nic.in/forms/vtform.pdf

- https://comtax.cg.nic.in/pages/WorkOrder_16Feb2015To15Feb2016.pdf

- https://echallan.cg.nic.in/abtEChallan.jsp