- HOME

- Compliance

- Assam professional tax: Tax slab, payment, registration, and more

Assam professional tax: Tax slab, payment, registration, and more

In Assam, all employees and individuals engaged in any profession are subject to the Assam Tax on Professions, Trades, Callings, and Employment Act, 1947. This act establishes the framework for levying professional tax in the state. Applicable individuals and employers must ensure that this tax is paid to the state government before the deadline.

In this article, you will learn the key aspects of professional tax in Assam, including who needs to pay it, the rules for deduction, and the methods for payment. We will also provide guidance to help you remain compliant with the professional tax act in Assam.

Professional tax in Assam

The Assam state government requires that all individuals, including salaried employees and self-employed professionals such as lawyers, doctors, and chartered accountants, must pay professional tax if their income exceeds the specified threshold set by the state government.

The amount of professional tax owed by your employees is determined by their income slab, with the maximum payable tax being ₹2,500 per year.

Applicability of professional tax in Assam

The professional tax applies to the following individuals and entities who reside in Assam:

- Salaried individuals: Anyone earning a salary, including employees in both private and government sectors.

- Medical and legal professionals: Doctors, dentists, lawyers, and similar practitioners.

- Professional consultants: Such as tax consultants, chartered accountants, engineers, and similar experts.

- Real estate agents and contractors: Individuals like building contractors, real estate professionals, and brokers.

- Individuals in various professions: Those engaged in other trading, businesses, or professional services.

Registering your business for professional tax in Assam

Employers in the state must complete Form I for online registration of professional tax. To register, applicants should first sign up on the official website of the Assam Commissionerate of Taxes.

After filling in the registration details, you will need to upload the necessary documents. Once the upload is successful, an acknowledgement number will be generated, allowing you to track the status of your registration. Upon approval of your application by the designated accessing officer, you will receive an SMS notification. Finally, you can print your Registration Certificate using the ‘Track Status’ option under the e-Registration section.

For step-by-step information on how to sign up, take a look at the user manual released by the government of Assam.

Individuals who are not classified as employers or employees are required to obtain an enrolment certificate from the assessing authority. This certificate serves a similar purpose to the registration certificate that employers must acquire. To obtain the enrolment certificate, individuals need to submit Form II to the relevant state authority.

In the Certificate of Enrolment or Registration Certificate, the state authority will indicate the amount of tax that each certificate holder is required to pay, along with the specified date and schedule for payment.

Documents required for professional tax registration

- Rent agreement or proof of ownership for your premises

- Partnership deed (if applicable)

- PAN card copy

- Articles and Memorandum of Association

- Bank account details (photocopy of passbook or cheque)

- Municipal trade licence

- Passport-size photograph of the business owner

Assam professional tax slab rates

In Assam, professional tax needs to be deducted on a monthly basis. Employers are responsible for determining the tax amount for salaried employees by taking into account their monthly salary and the relevant slab rates. The following table mentions the professional tax slab in Assam:

| Monthly salary (Effective from 15th October 2014) | Tax per month |

| Till ₹ 10,000 | Nil |

| Above ₹ 10,000 but below ₹ 15,000 | ₹ 150 |

| ₹ 15,000 or above but below ₹ 25,000 | ₹ 180 |

| ₹ 25,000 and above | ₹ 208 |

Professional tax rates for all categories of profession in Assam

The professional tax slab rates vary for individuals involved in various professions. The following section outlines the tax rates applicable to different class:

| Category of profession | Yearly tax rate |

| Legal, medical professionals, technical advisors, principal agents, and surveyors with an annual gross income: | |

| Nil |

| ₹ 1,800 |

| ₹ 2,160 |

| ₹ 2,500 |

| Dealers, including industry or mill owners with an annual gross turnover of all sales: | |

| Nil |

| ₹ 1,000 |

| ₹ 1,500 |

| ₹ 2,500 |

| Occupiers of factories as defined under the Factories Act: | |

| ₹ 350 |

| ₹ 2,000 |

| ₹ 2,500 |

| Employers of shops and establishments: | |

| Nil |

| ₹ 300 |

| ₹ 1,500 |

| ₹ 2,500 |

| Banking organisations as per the Banking Regulation Act, 1949 | ₹ 2,500 |

| Members of the stock exchange | ₹ 2,500 |

| Building contractors or brokers or estate agents | ₹ 2,500 |

| Directors of companies registered under the Companies Act | ₹ 2,500 |

| Owners of X-Ray clinics, nursing homes, hospitals, pathological testing laboratories, beauty parlours, interior decorators, and dry cleaners | ₹ 2,500 |

For additional information on tax rates for other professions, refer to the tax rate notification.

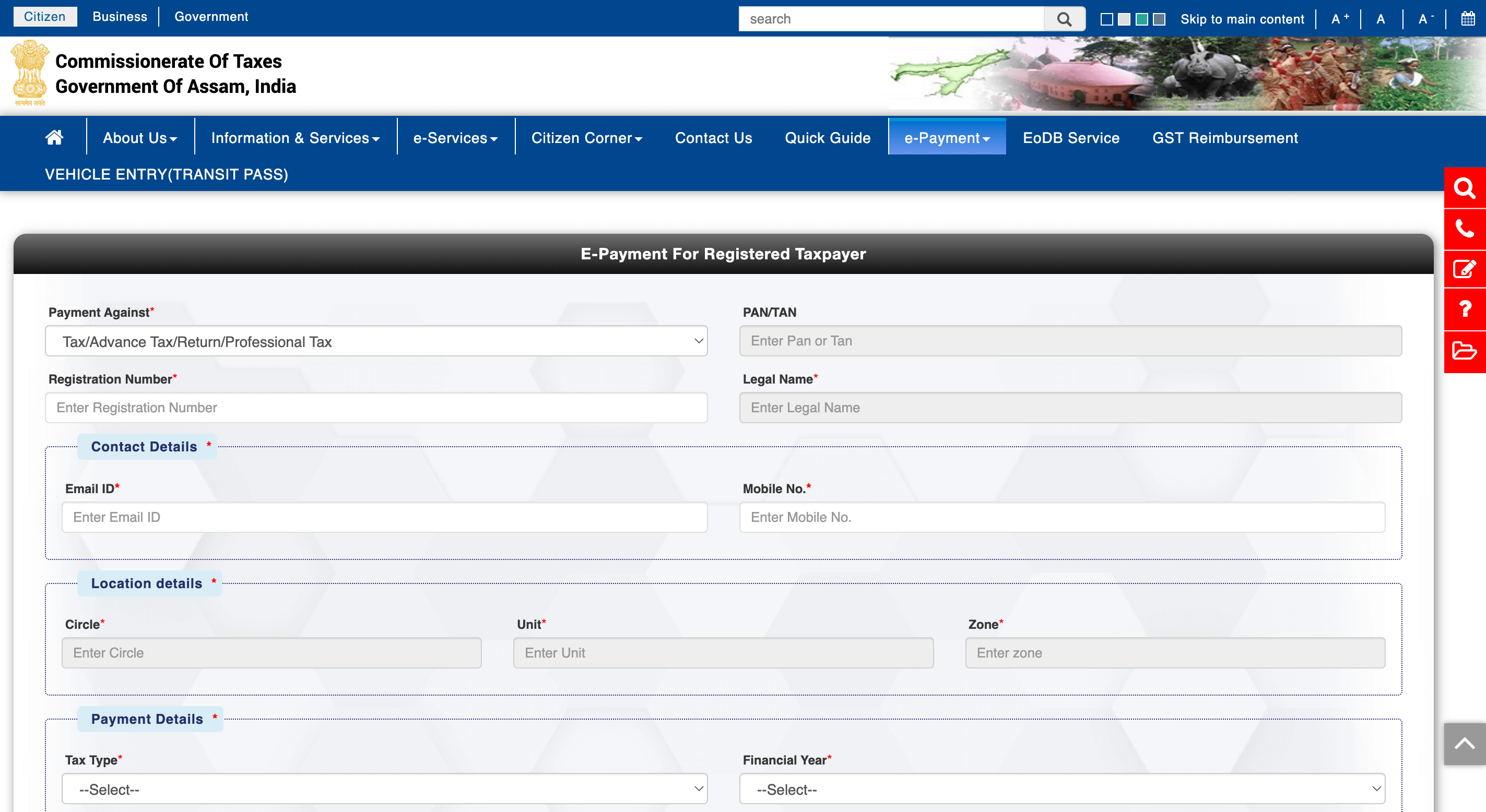

How to pay professional tax in Assam

- Go to the official website of the Assam Commissionerate of Taxes.

- Log in to your account using your ID and password.

- Find the 'e-services' section and click 'e-payment'. You’ll be taken to the ‘E-Payment for Registered Taxpayer’ page.

- Enter your registration number, contact, and location details. Choose the tax type as ‘Assam Professional Tax(APTCE)’ and select the financial year for which you’re paying the tax.

- Enter the challan amount and make the payment either through net banking, payment gateway, or authorised banks.

- After completing the professional tax payment, save the challan for any future references.

Due date to pay professional tax

Once you calculate the amount of tax your employee owes, you need to deduct the amount every month before processing salaries and pay the professional tax before the 28th of every month.

Assam professional tax late payment penalty

The Government of Assam imposes a 2% monthly penalty on late professional tax payments. If the tax remains unpaid, individuals can face a significant penalty, amounting to twice the total professional tax due in Assam.

Assam professional tax exemption

Certain individuals are exempt from professional tax payments under the Assam Professional Tax Act. These include:

- Members of the Armed Forces of India

- Individuals designated by the Assam Government in the public interest

- Any person receiving a cultural, literary, or sports pension, even if they are involved in another profession, trade, occupation or employment.

- Societies that provide education to individuals with physical or mental disabilities.

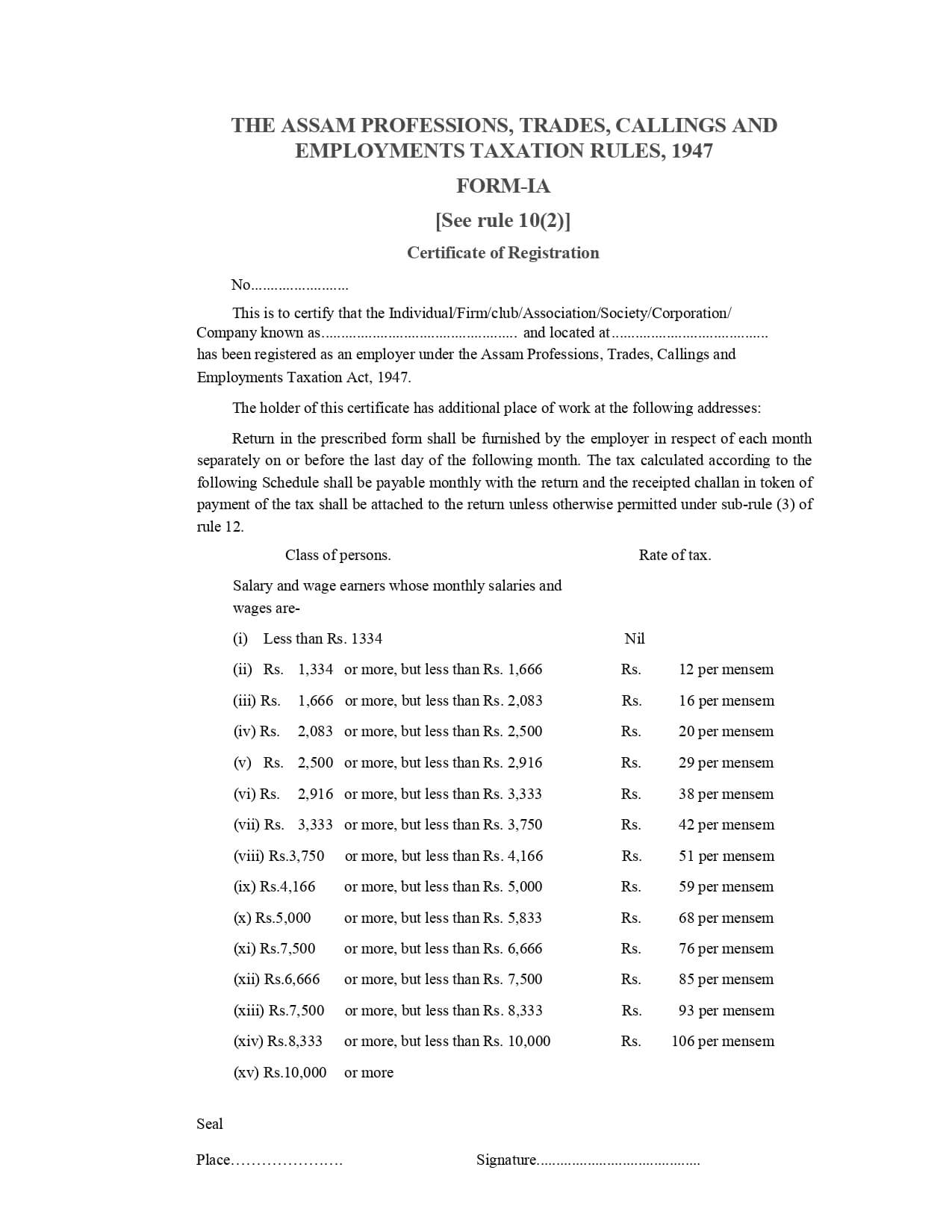

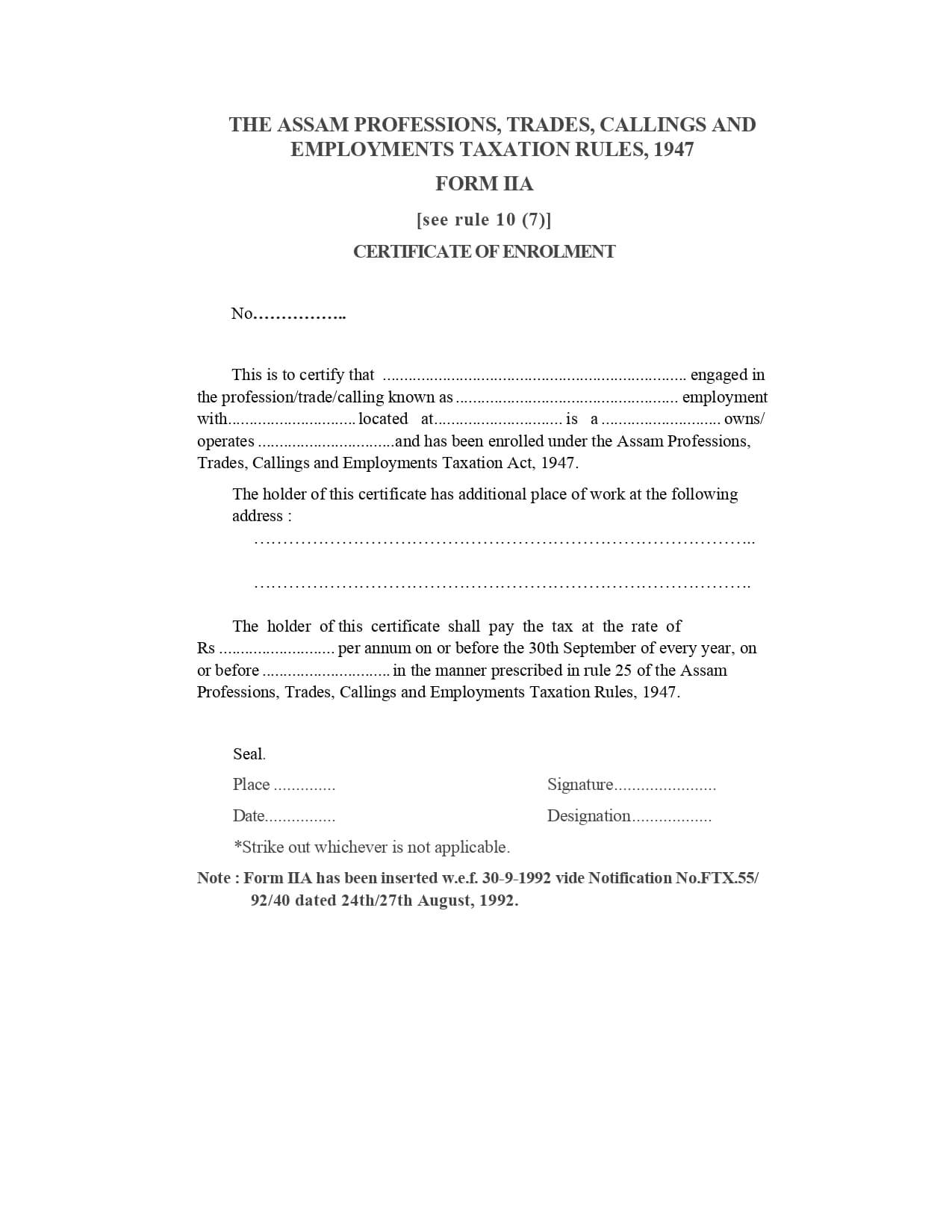

Compliance forms for Assam professional tax

| Form | Description |

| Form I | Application for the certificate of registration |

| Form IA | Certificate of registration |

| Form II | Application for the certificate of enrolment |

| Form IIA | Certificate of enrolment |

| Form II-B | Certificate to be furnished by a person to his employer |

| Form II-C | Certificate to be furnished by a person who is simultaneously in employment of more than one employer |

| Form III | Return |

| Form VII-C | Payment challan |

| Form VIII | Refund voucher |

| Form IX | Refund register |

Frequently asked questions

Is professional tax mandatory in Assam?

Yes, professional tax is mandatory in Assam. According to the state government, all individuals, whether salaried or self-employed, with certain income are required to pay professional tax.

When should I register my business for professional tax in Assam?

You should register your business for professional tax in Assam by filling out Form 1 within 30 days of becoming liable to pay the tax.

References