How do I claim Input Tax Credit for the transaction fees charged by Razorpay?

Payment Gateways such as Razorpay collect Transaction Fees from its customers on payments received towards the invoices raised in Zoho Books. Razorpay also sends out a consolidated invoice of the charges and taxes applied on the transactions, which you can use to claim the Input Tax Credit while filing your GST returns.

Let’s take an example where you are a GST registered business owner and you collect payments from your customers via Razorpay. Say you raise an invoice for ₹10,000 and Razorpay charges you a transaction fees of ₹200 (2%) and 18% GST on the fees.

The amount received would be the balance after Razorpay deducts the transaction fees. If Zoho Books is integrated with Razorpay, the payment will be automatically recorded. If not, you’ll need to record the payment for your invoices manually. When Razorpay sends out the consolidated invoices, the total transaction fees can be recorded as an Expense.

To record an expense:

- Go to Purchases and select Expenses.

- Click the + New button to record a new expense.

- Select Bank Fees and Charges as the Expense Account.

Insight: When you enter bank charges in an invoice, they are tracked under the default account, Bank Fees and Charges. This same account is chosen when expenses is recorded.

- Enter the amount as specified in the invoice copy received in Razorpay.

- In the Paid Through field, choose your bank account. However, if you have integrated Razorpay with Zoho Books, select the Razorpay Clearing Account instead.

- Select Razorpay as your Vendor.

- Mark the expense as Tax Inclusive.

- Click Save.

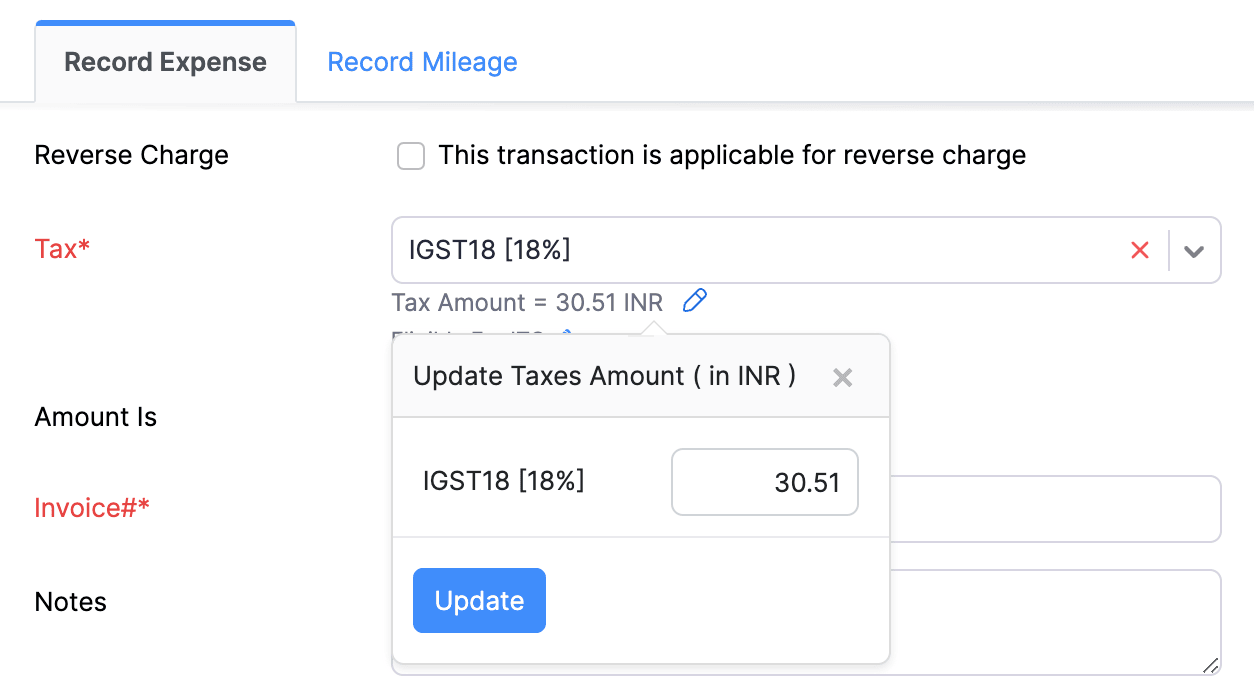

Note: 18% GST is charged on transaction fees, except for domestic card payments up to ₹2,000. In such cases, GST is not applicable. If the tax amount shown in Zoho Books differs from the actual GST charged, click the Edit icon to correct it.

Since the bank charges are recorded in both the invoice and the expense, it will cause double accounting. To address this, you’ll need to pass a journal entry.

To add a journal entry:

- Go to Accountant and select Manual Journals.

- Click the + New button to create a new journal.

- Fill in the required fields such as Date and Notes.

- Add the Journal entry as follows:

- Debit the respective Bank account through which you received the payment. If you have integrated Razorpay and Zoho Books, associate the Razorpay Clearing account instead of the bank account.

- Credit the Bank Fees and Charges account. Specify the amount as the expense amount.

- Click Save.

This journal entry ensures that your bank balance and expense reports remain accurate, allowing you to claim Input Tax Credit without recording the expense twice.

Yes

Yes