- HOME

- Taxes & compliance

- Find answers to all your questions about VAT Returns in the UAE: FAQs

Find answers to all your questions about VAT Returns in the UAE: FAQs

How do I submit a VAT return?

Log in to the FTA e-services portal

- Go to the VAT tab to view your VAT returns.

- Open your VAT returns.

Fill in the appropriate details

Include the sales and purchase transactions with:

- The net amount excluding VAT.

- The VAT amount.

- The system will calculate the tax payable or repayable.

Review & Submit

- Review all the information in the VAT return and click Submit.

Settle the payable VAT (if any)

- You can view any payable VAT and pay it (before the deadline) in the My Payments tab.

How to connect Zoho Books to the EmaraTax portal?

To connect your Zoho Books organization with the EmaraTax portal:

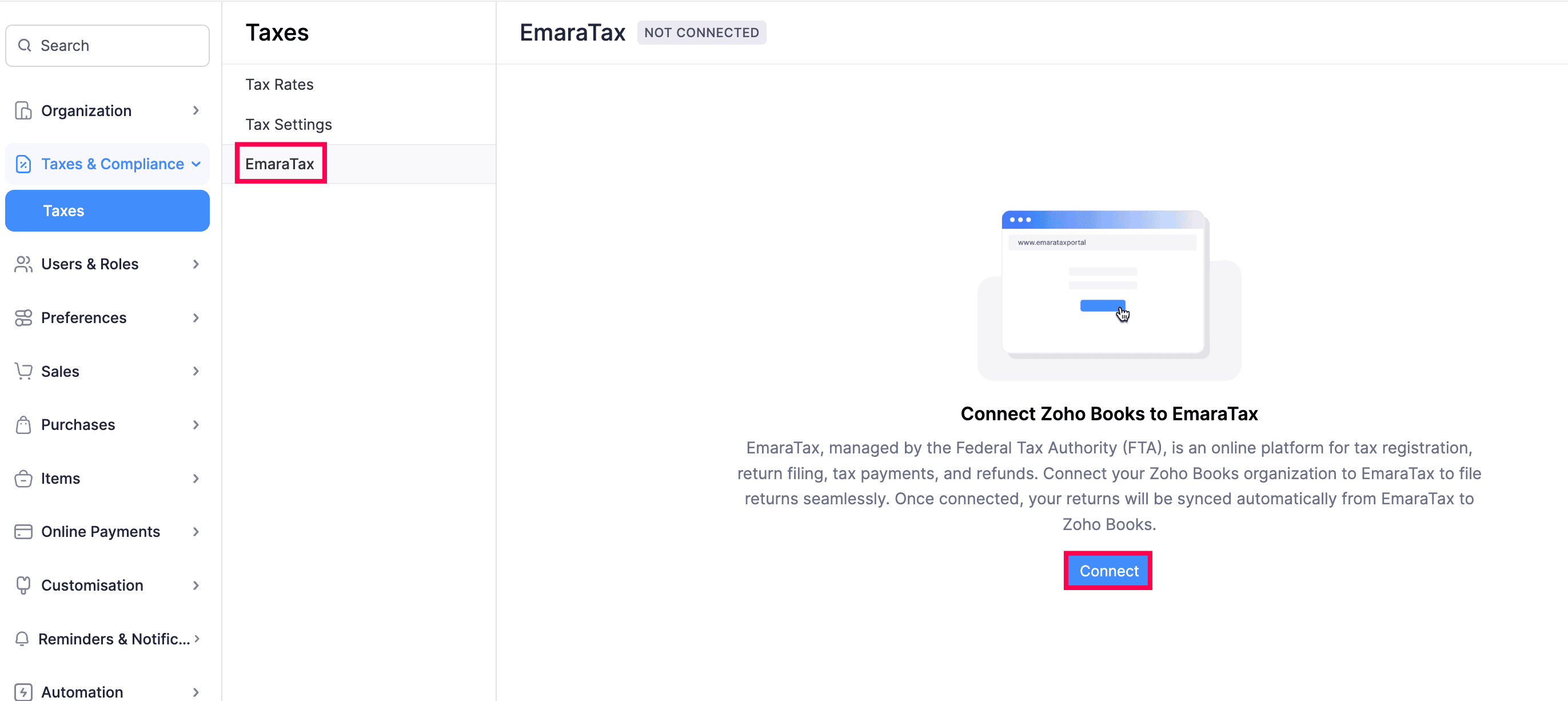

Go to Settings -> Taxes under Taxes & Compliance -> EmaraTax in the Taxes pane

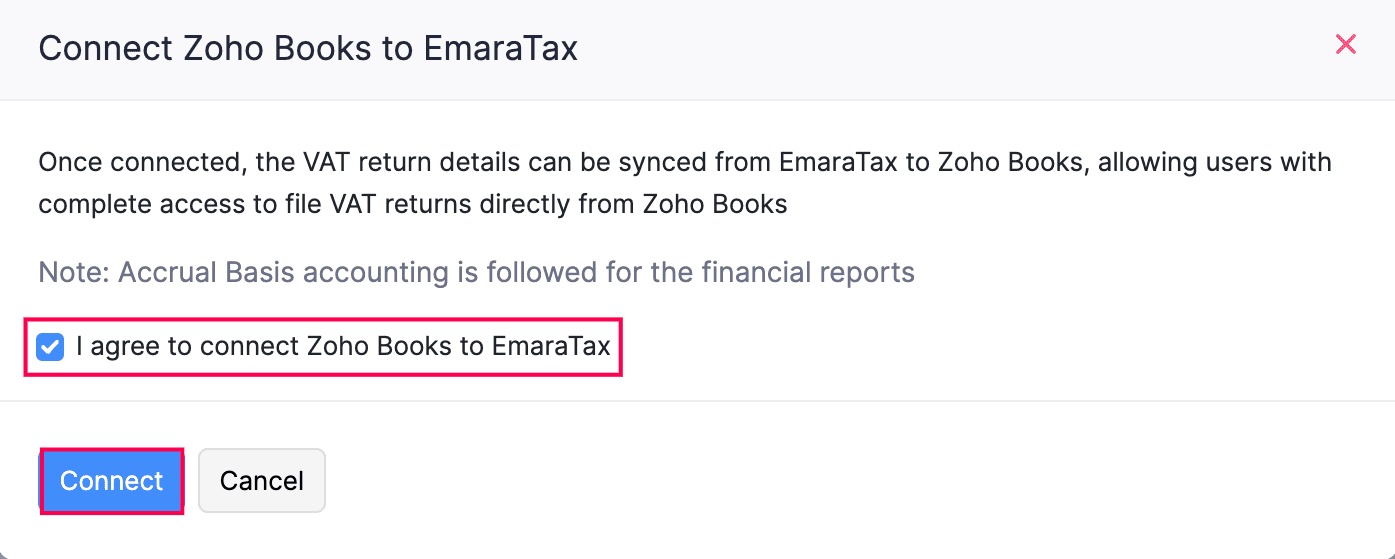

Once you click EmaraTax, the "Connect Zoho Books to EmaraTax" pop-up will open in the window. Read the terms, check the I agree to connect Zoho Books to EmaraTax option, and click Connect. You'll be redirected to the EmaraTax login page.

Enter your FTA credentials to log in. You will be reconnected to your Zoho Books organization which is now integrated with the EmaraTax portal.

How to fetch data from the EmaraTax portal?

Once you've connected, you can fetch the VAT details available in the EmaraTax portal and view them along with the VAT returns generated in Zoho Books. The following return types can be fetched from the portal into Zoho Books.

VAT return: A manually recorded VAT for a return period as assigned in the EmaraTax portal can be fetched to your Zoho Books account.

Voluntary disclosure: An amendment return known as a Voluntary Disclosure is expected to be submitted by the user in the EmaraTax portal if there is a mismatch of tax values over AED 10,000 for a previous VAT return. This can also be fetched into Zoho Books where the user can review the mismatch and file it along with the current VAT return directly from Zoho Books. If there's a mismatch of less than AED 10,000, you can include those in the next VAT return.

Where to view the VAT return fetched into Zoho Books?

Go to VAT on the left sidebar -> Select VAT returns

You will find the fetched VAT returns on the To-be-Filed tab.

Click on the VAT return you want to file.

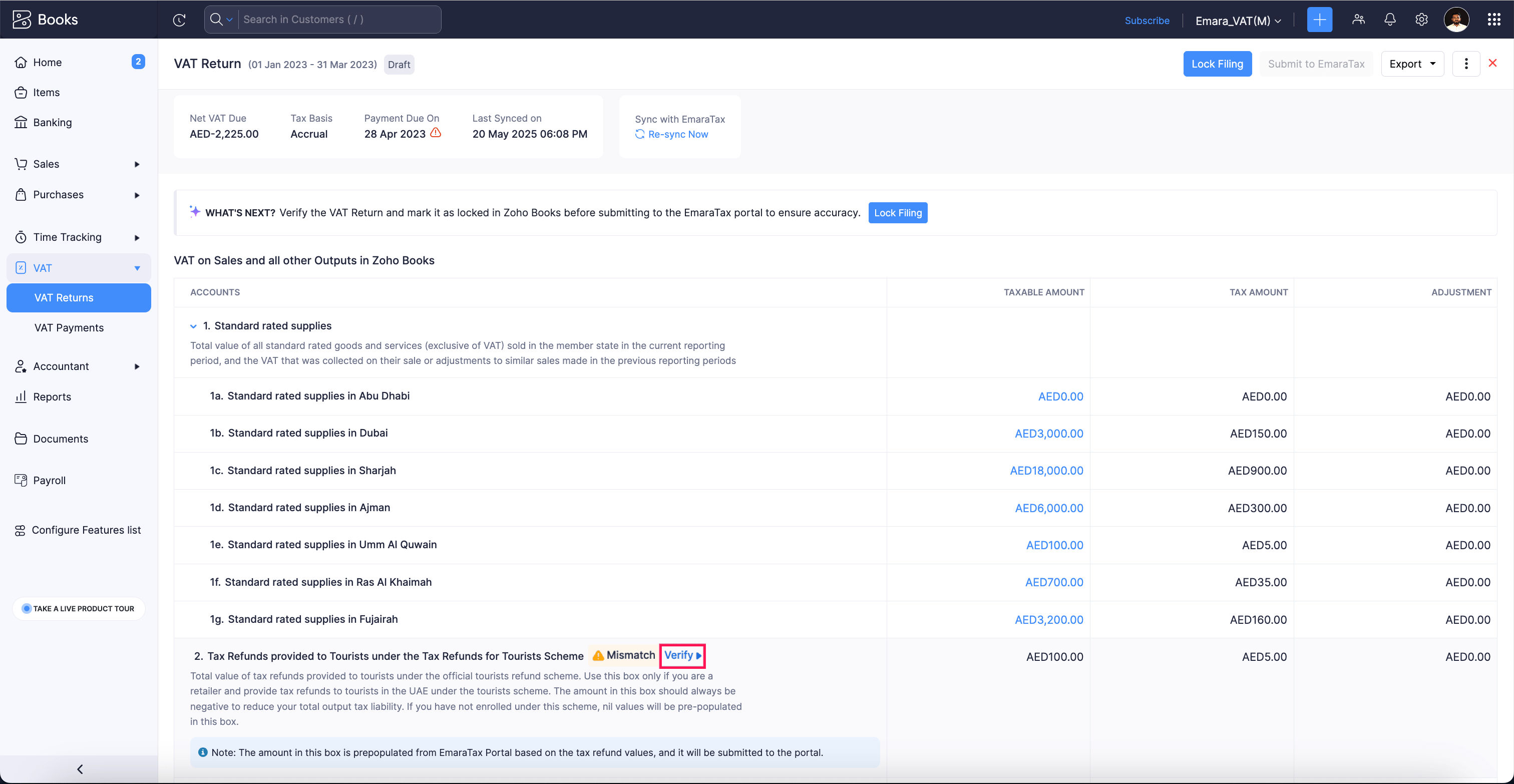

You can review the amount in the relevant VAT boxes. If there's a mismatch in the VAT returns generated by the portal and Zoho Books, you can verify it.

Click verify next to the required VAT box on the respective VAT return's details page.

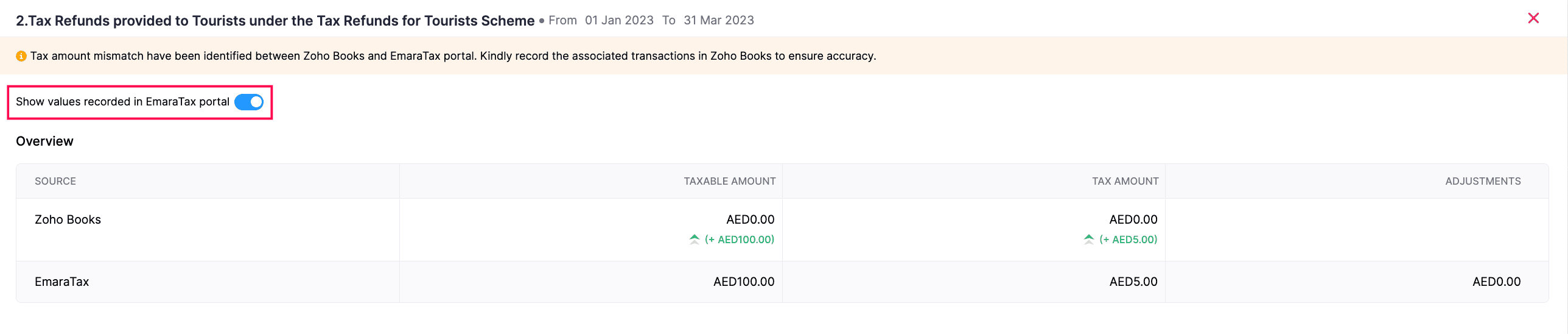

The next page shows the mismatch value in the Zoho books. You can find this in the Overview section.

To display the VAT value fetched from the portal, slide the toggle next to show values recorded in the EmaraTax portal.

You can find the list of transactions associated with the particular VAT box in the Transaction details section.

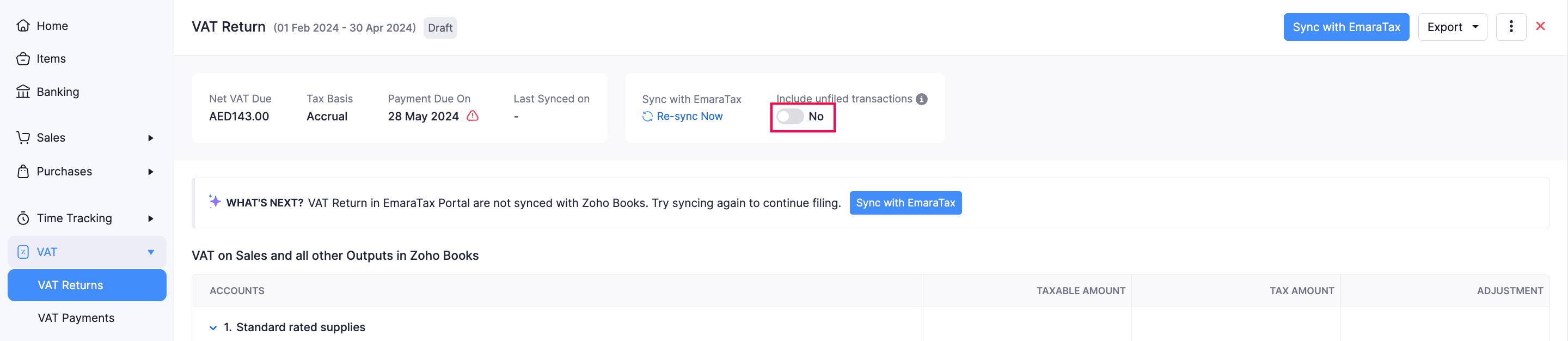

How to include unfiled transactions from the previous period?

To include them in your current VAT return and file them directly from Zoho Books,

Go to VAT on the left sidebar -> Select VAT Returns.

Select the required VAT return in the To-be-Filed tab.

Slide the toggle below to include the previous period's unfiled transactions.

Click OK to confirm in the pop-up that appears.

Note: Unfiled transactions from the previous return period will be included in the current VAT return.

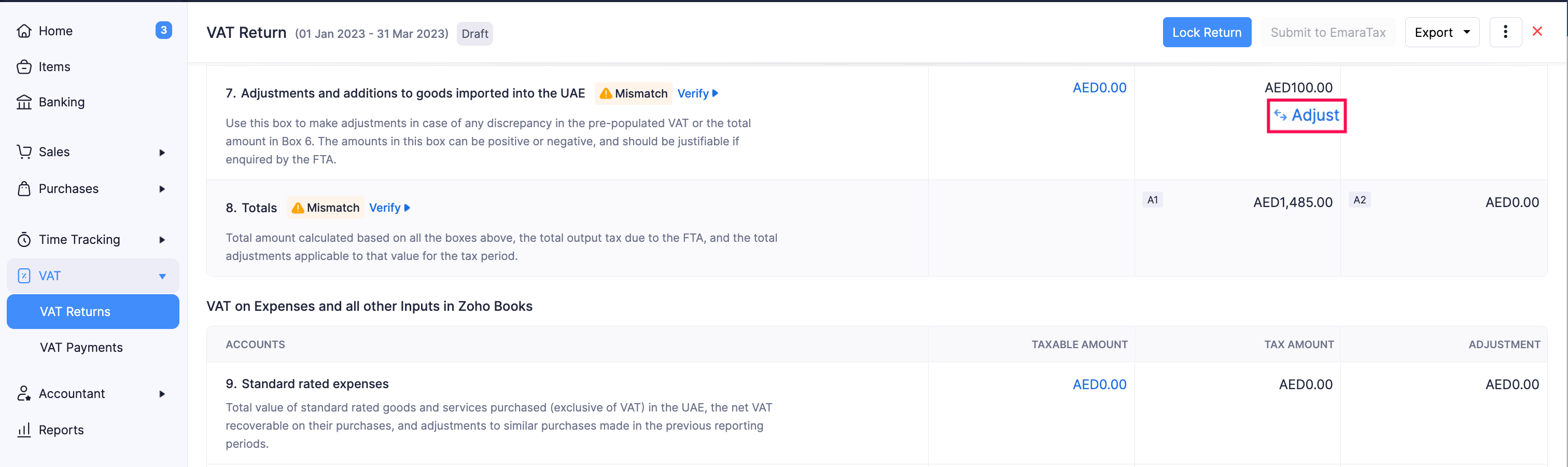

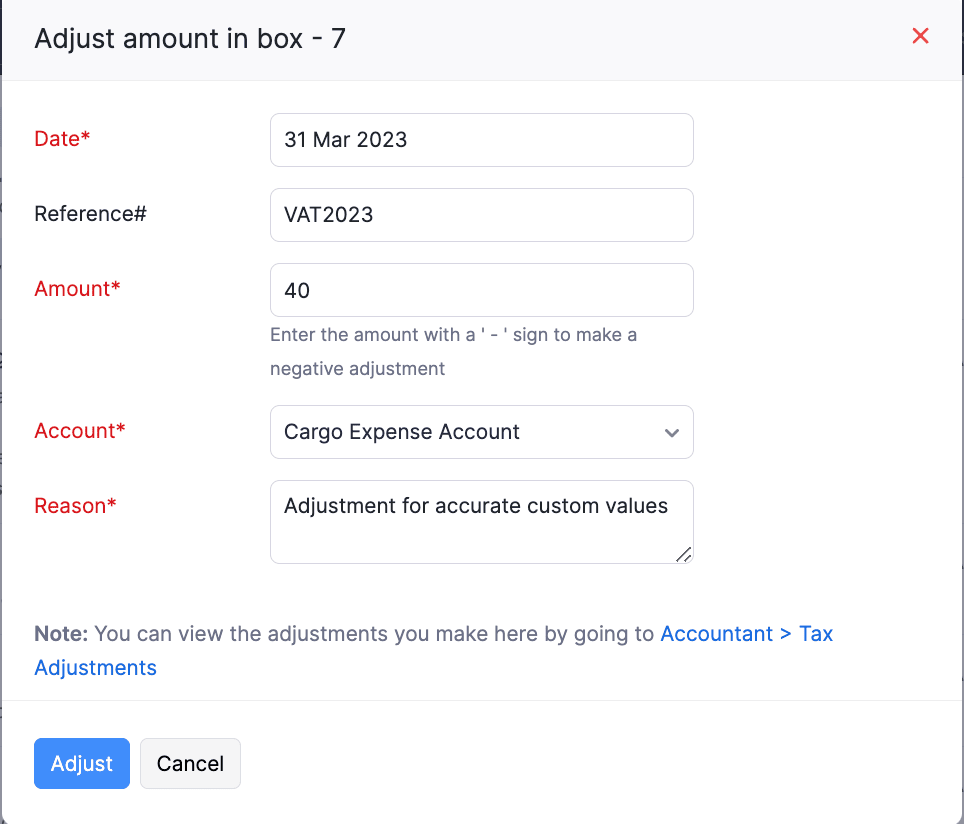

How to add adjustment amounts?

To add the adjustment amount:

Go to VAT on the left sidebar -> Select VAT Returns.

Select the required VAT return in the To-be-Filed tab.

Scroll down to Box 7. In the Tax Amount column, click Adjust below the amount displayed.

Fill in the following details in the pop-up that appears and click Adjust.

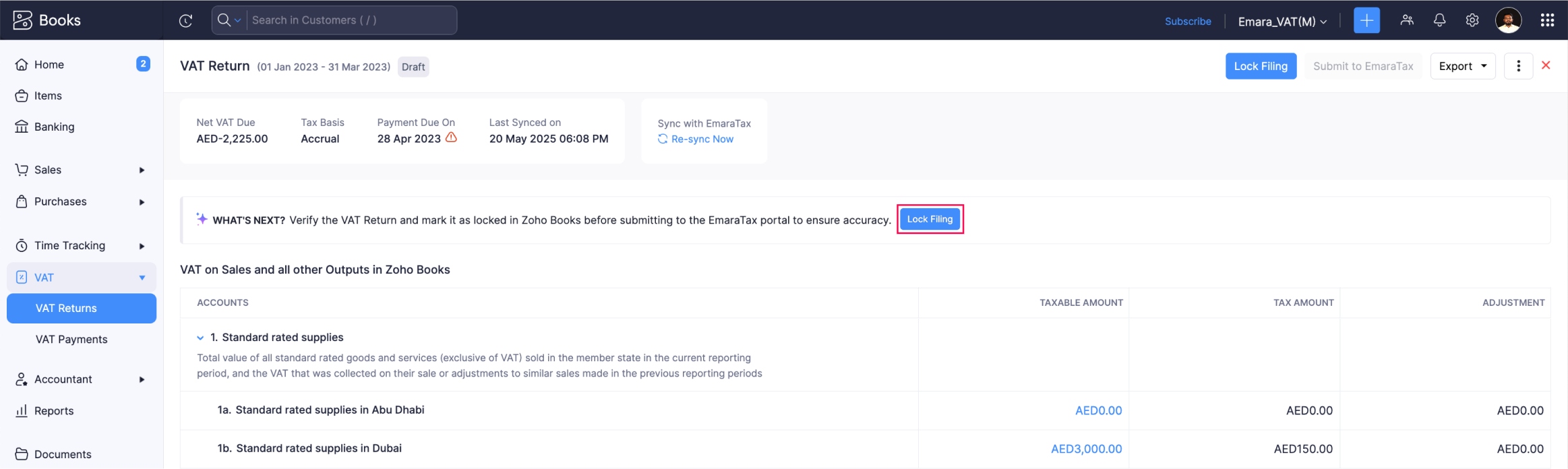

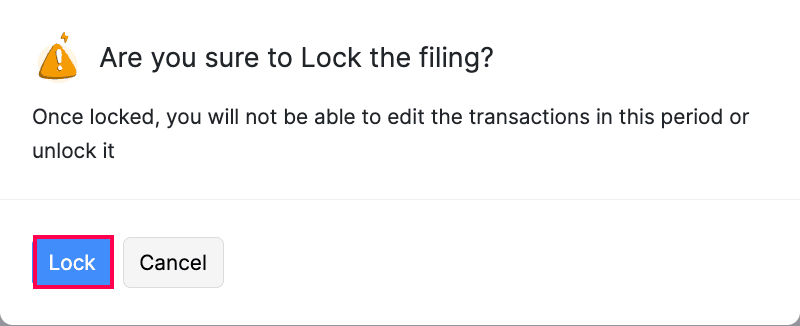

How to lock transactions?

To lock the reviewed amount in the VAT return for the tax period and prevent any further changes made to your final report, follow these steps:

Go to VAT on the left sidebar -> Select VAT Returns.

Select the required VAT return in the To-be-Filed tab.

At the top of the page, click Lock Filing.

Click Lock in the pop-up that appears to confirm.

Note: The transactions in the respective VAT return period will be locked. This cannot be edited or deleted later, and the VAT return will be marked as Locked.

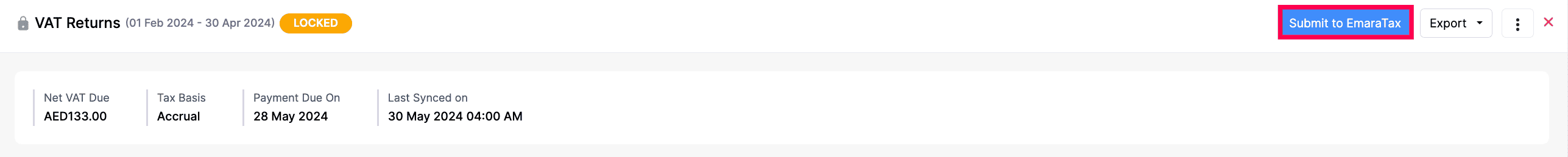

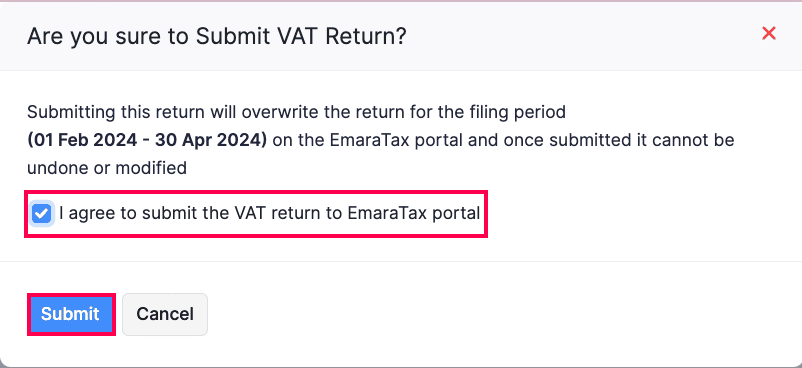

How to submit to the EmaraTax portal?

You can submit the VAT return that has been marked as locked. To submit the VAT return,

Go to VAT on the left sidebar -> Select VAT Returns.

Select the required VAT return in the To-be-Filed tab.

In the next page, click Submit to EmaraTax in the top-right corner.

Read the terms and check the I agree to submit the VAT return to EmaraTax portal option in the pop-up that appears.

Click Submit.

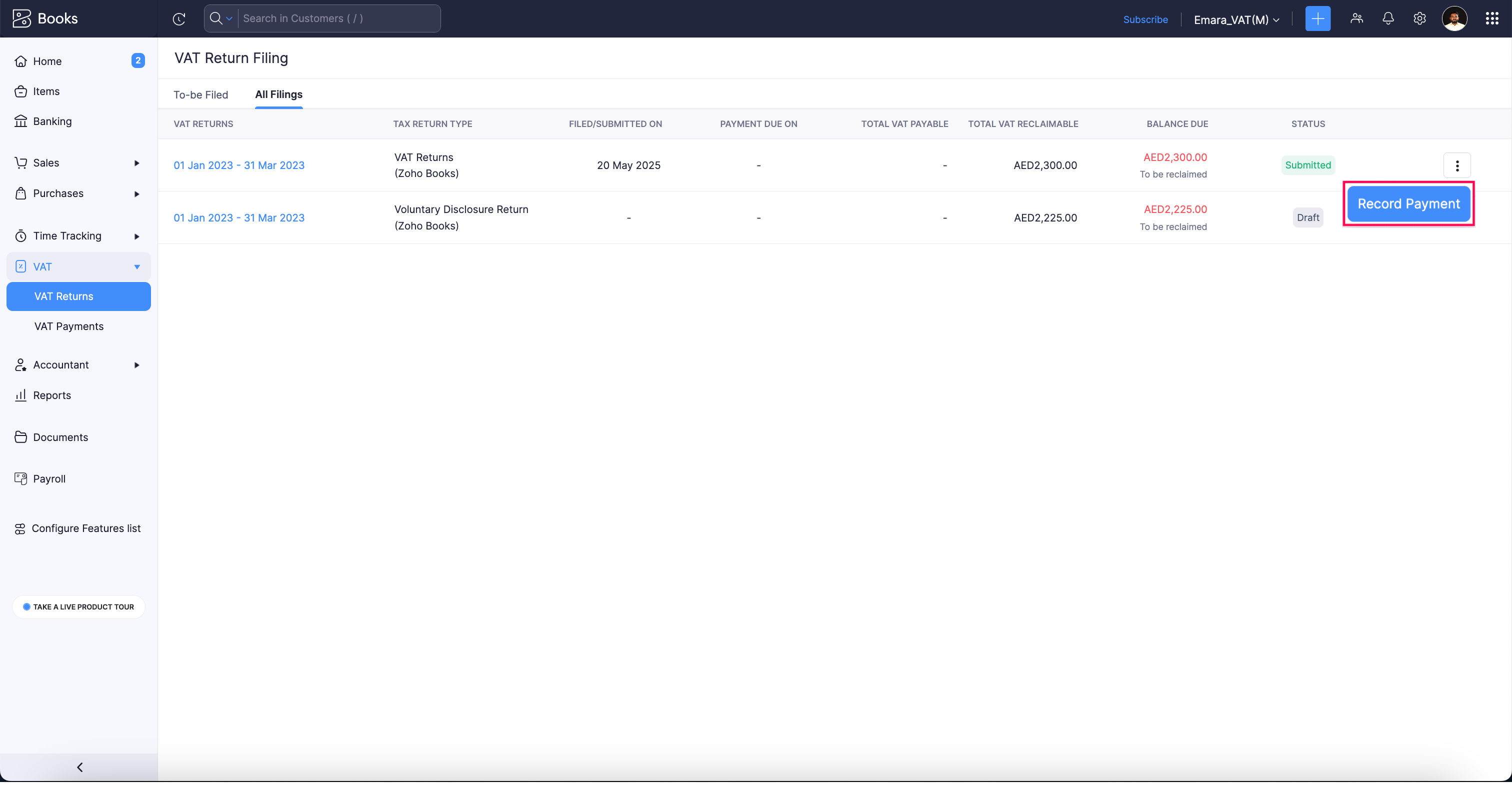

How to record payment?

Once the VAT return is filed in the EmaraTax portal, you can record the payment in Zoho Books. To do it,

Go to VAT on the left sidebar -> Select VAT Returns.

Navigate to the All Filings tab on the next page.

In the required VAT return, click more icon ->select Record Payment from the drop down.

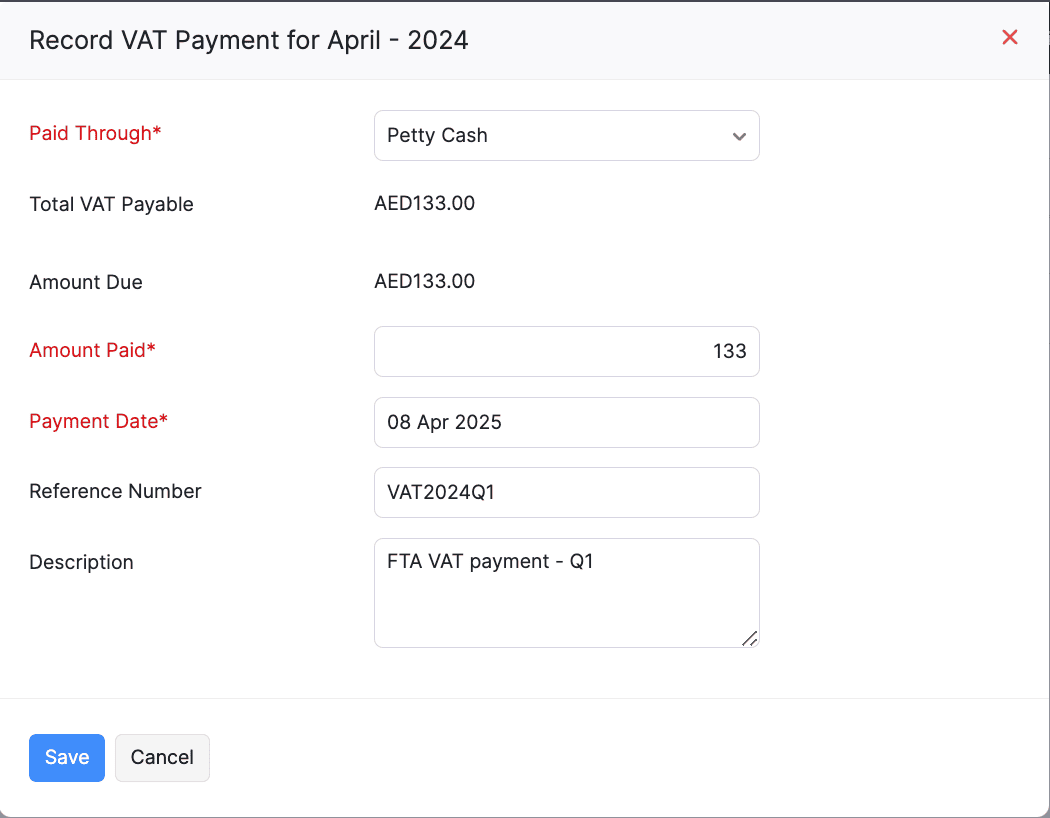

A pop-up appears, and you have to fill in the required fields. Then click Save.

The payment will be recorded for the respective VAT return.

Check out our help doc to learn more about the processes involved in filing VAT returns to EmaraTax in the Zoho Books.

How can I pay my VAT returns?

There are different ways to pay your VAT returns: through eServices, via bank transfer, or using eDebit

Pay via eServices (FAB Magnati):

This payment gateway accepts credit cards, debit cards, and prepaid cards. Payments made via the FAB Magnati gateway are subject to a fee of 0.68%.

Pay via Bank Transfer

Each taxable person is provided with a unique identification number called a GIBAN, which can be used to make a bank transfer. Just add your GIBAN as a beneficiary in online banking and transfer the VAT due.

Pay via eDebit

Payment through eDebit involves approvals, so it takes some time to settle the payment. This option works only for taxable persons who have access to retail or corporate online banking with one of the following banks:

- Citibank (Retail)

- Commercial Bank of Dubai (Corporate or Retail)

- Dubai Islamic Bank (Retail)

- Emirates NBD (Corporate or Retail)

- First Abu Dhabi Bank (Corporate or Retail)

- Noor Bank (Retail)

- Standard Chartered (Corporate or Retail)

Can foreign businesses claim VAT refunds?

Yes, foreign businesses are eligible for VAT refunds in the following circumstances:

The business owner is a resident in a GCC state that is not considered to be an implementing state;

or

A foreign entity that carries on business under the following conditions:

- It has no place of establishment or fixed establishment in the UAE or an implementing state;

- It is not a taxable person;

- It is registered as an establishment with a competent authority in the jurisdiction, in which it is established; and

- It is from a country that provides refunds of VAT to UAE entities in similar circumstances.

The period of VAT refund is 12 calendar months. Hence, the first application can only be made after the end of 2018.

The minimum amount of each tax claim that can be submitted under this scheme is AED 2,000.

What is the process to claim tax return for foreign businesses?

Foreign business which are eligible for tax refunds can claim VAT by following the steps below:

Download the form from the designated section on the FTA website.

Complete the Form:

- Fill in the required fields in the form.

- Print the form in PDF format and get the required signature and/or official stamp (handwritten forms are not accepted).

Submit the form along with the supporting documents:

- Email the soft copy of the PDF form (signed version) to specialrefunds@tax.gov.ae

- File types can be PDF, JPG, PNG or JPEG.

- The total file size must not exceed 5 MB.

You will receive an email notification immediately as soon as the refund form is submitted successfully.