- HOME

- Taxes & compliance

- eInvoicing in the UAE: All you need to know

eInvoicing in the UAE: All you need to know

In the rapidly growing UAE economy, managing invoices manually can be challenging and time-consuming. Inaccuracies, payment delays, fraud risks, and non-compliance can affect multiple business aspects, including finance, time, and growth opportunities.

Studies show that businesses face financial losses in their annual income due to invoice inaccuracies, and the cost per manual invoice can add to this. This can be burdensome for organizations that handle a high number of transactions.

To streamline the invoicing process, the United Arab Emirates (UAE) is set to implement eInvoicing. This is expected to be compulsory for B2B and B2G transactions by July 2026. This article dives into eInvoicing and its different aspects.

What is an eInvoice, and how is it different from a digital invoice?

An eInvoice refers to the creation, submission, and storage of invoices in a digitally structured format that complies with government standards. Comparatively, digital invoices are unstructured formats such as PDFs, text documents, images, scanned documents, and emails which are not eInvoices. Unstructured invoices are primarily designed for human review and may require manual entry. While eInvoices are a type of digital invoice, they are a structured format, making them faster and more accurate for machine interpretation to ensure a seamless exchange.

What is eInvoicing in the UAE?

eInvoicing in the UAE refers to the electronic transmission of invoices from a supplier to a buyer and reported electronically to the UAE Federal Tax Authority (FTA).

Key requirements for an eInvoice to be valid in the UAE are:

Structured formats: eInvoices must be in a quickly accessible digital format, such as XML or JSON.

Complies with government standard: eInvoices must be in a structured data format that adheres to the government's regulations. These standards are documented in a data dictionary released by the UAE’s Ministry of Finance, PINT AE to guide service providers to build compliant solutions for UAE’s eInvoicing and for businesses to assess their choice and processes. This document lays out the requirements for the processes involved in eInvoicing including generating, exchanging, processing, and reporting.

Real-time reporting: eInvoices must be transmitted to an Accredited Service Provider (ASP) in real time via the Peppol Network. Peppol (Pan European Public Procurement Online) is a global infrastructure that is used to securely transfer electronic documents, especially eInvoices, in the public sector.

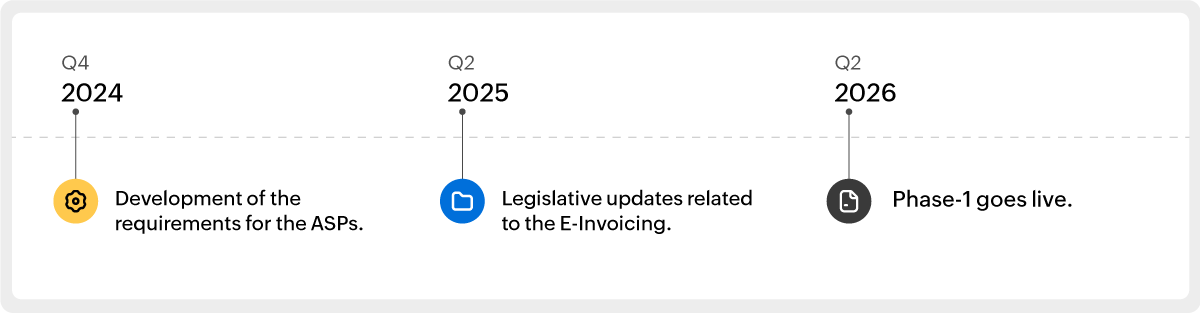

Timeline: eInvoicing in the UAE

Q4 2024: Development of the requirements and procedures for Accredited Service Providers (ASP).

Q2 2025: The government will implement new rules and regulations. Businesses will be notified of the legislative updates.

Q2 2026: Phase 1 of eInvoicing goes live for B2B and B2G eInvoicing.

What are the objectives of eInvoicing in the UAE?

Reduce human effort and the risk of errors in maintaining accuracy and compliance with the tax reporting process, concentrating on a digitally enabled fiscal year.

Reduce operational cost, cut processing time, and decrease paper waste to focus on sustainability.

Promote the development of the digital economy.

Identify and address both deliberate and unintentional VAT leakage, ensuring reduced errors and fraud.

Contribute to growth by creating a fully digitized and innovative economy.

Reduce the risk of fraud through encrypted transactions and secured data exchange.

Provide comprehensive information to policymakers on sectors that need government assistance by enabling real-time data access.

What is the scope of eInvoicing?

While the exact scope of eInvoicing is not defined by the UAE government, similar mandates in other GCC countries and inclusion of B2C transactions can be expected in the later phases. Businesses should keep themselves informed about upcoming updates. As of now, all B2B and B2G must implement eInvoicing by July 2026 as per the government mandate.

How does eInvoicing work?

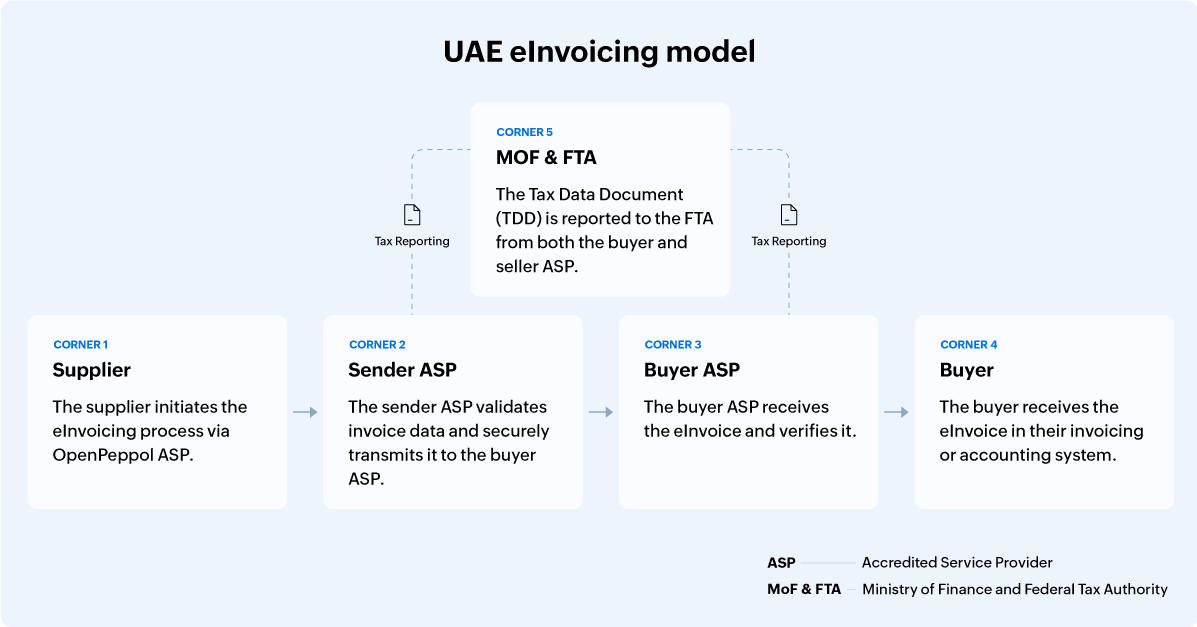

The UAE eInvoicing system, known as Decentralized Continuous Transaction Control and Exchange (DCTCE), adopts Peppol's "5-corner model," ensuring standard and secure exchanges of invoices between businesses.

Overview of eInvoicing model in the UAE

Supplier: Enters the data in their business software and starts the eInvoicing process through the OpenPeppol Accredited Service Provider (ASP).

Validate and transmit: The sending ASP validates the invoice and transmits it to the buyer ASP through the OpenPeppol directory facility securely.

Collect, validate, and deliver: The receiving ASP collects the data, validates it, and sends it to the buyer.

Receive: The customer receives this data in their business software.

Collect, validate, and store: Both UAE-accredited SPs can report the tax data document to the central platform managed by the FTA. The data will then be validated and processed.

What are the benefits of eInvoicing?

Implementing eInvoicing provides significant benefits for businesses, the government, and the economy.

Latest technology access: The eInvoicing regulation will empower small and medium businesses to adopt a standardized, streamlined, and compliant invoicing process, all at competitive costs.

Cost-reduction: It reduces paper usage and storage cost, significantly lowering overall invoicing costs up to 66%.

Improve cash flow: Automating invoice generation and exchange reduces errors, leading to faster payments and improved working capital management.

Financial visibility: With every detail available in a machine-readable format, businesses can make more informed decisions.

How to prepare your business for eInvoicing?

Understand: Review and familiarize yourself with the latest updates on the UAE's eInvoicing regulations.

Assess: Check your current invoicing process to ensure it is ready for eInvoicing. For instance, once an e-invoice is issued by an ASP, any discrepancies must be corrected using credit notes. In such a scenario, if your business uses manual invoicing, transitioning to the e-Invoicing format may require adjustments and proper resources to maintain an efficient, error-free workflow.

Choose a provider: Choose a software that supports the latest eInvoicing format.

Train: Educate your employees on the latest eInvoicing process for hassle-free implementation.

Factors businesses should keep in mind

While eInvoicing has a substantial amount of benefits for businesses, there are a few things that businesses should keep in mind.

Real-time transmission: Businesses need to invest in strong digital infrastructure to enable real-time data submission to ASP.

Integration: Businesses might have a hard time integrating invoicing software with their existing ERP platform, accounting software, and procurement tools. To ease this, they can opt for a cloud-based accounting platform that connects with multiple business applications.

How will Zoho Books be a part of this?

Zoho Books is a powerful cloud accounting platform in the UAE that is always committed to meeting customer requirements and effectively contributing to government mandates. Therefore, we are actively involved in securing the accreditation for the UAE's e-invoicing policies.

Conclusion:

Once eInvoicing becomes mandatory, businesses should stay alert for more updates related to it. Start preparing now by reviewing the regulations, upgrading your systems, and training your team for a stress-free transition.

Disclaimer: This blog is intended for informational purposes only and is not an official guidance. For the most accurate and up-to-date information on e-invoicing in the UAE, please refer to the official Ministry of Finance website: https://mof.gov.ae/einvoicing.